- Find an office

-

File Your Taxes

Find a Location

Find a Location -

Resolve Tax Issues

Resolve Tax Issues

Resolve Tax IssuesResolve Tax Issues

-

Tax Resources

See all Tax Help

See all Tax HelpTax Tools

Tax Tips & Resources

- Where's My Refund

- Refund Advance

- Hiring Local Jobs!

- Tax Services

- Promotions & Coupons

- Careers

- Search

- Contact Us

- Feedback

-

Log in | Sign up

Log in | Sign up

JH Accounts

|

|

Oh no! We may not fully support the browser or device software you are using ! To experience our site in the best way possible, please update your browser or device software, or move over to another browser. |

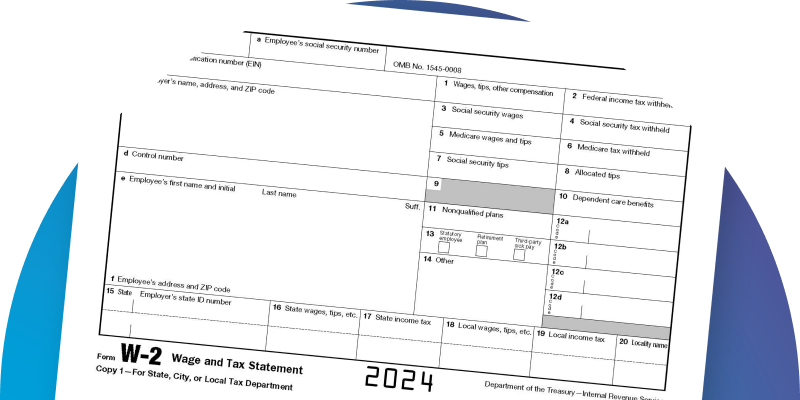

IRS FORMS: W-2

IRS Form W-2: What is an IRS W-2 form?

If you’re an employee, you’ll need a W-2 to file your taxes, and to get your refund! In this guide, we’ll cover everything you need to know about IRS Form W-2, including who receives it, what each box means, and what to do if you don’t get yours on time.

Key takeaways

- The W-2, Wage and Tax Statement, is an IRS form that shows your earnings and the taxes withheld from your paycheck for the year.

- Employers are responsible for sending W-2s to all their employees, whether they are full-time, part-time, or seasonal workers.

- If you don’t receive a W-2 from your employer, there are many steps you can take to ensure you get the information you need to file your taxes on time.

- Boxes A-F on your W-2 form contain your personal information and your employer's details.

- Boxes 1-2 provide key financial information.

- Boxes 3-4 focus on Social Security information.

- Boxes 5-6 cover Medicare taxes.

- Boxes 7-8 deal with any tips you’ve earned.

- Box 9 is not currently used.

- Box 10 shows any benefits you received for dependent care assistance.

- Box 11 reports the amounts you've received from a nonqualified deferred compensation plan or a non-government 457(b) plan.

- Box 12 can include various types of compensation or benefits.

- Box 13 has three checkboxes that indicate if you’re a statutory employee, an active participant in an employer-sponsored retirement plan, or you received third-party sick pay.

- Box 14 is for other information your employer wants to provide.

- Boxes 15-20 focus on state and local tax information.

What is the W-2 form?

IRS Form W-2 is a document that employers send to their employees and the IRS at the end of each year. It shows your earnings and the taxes withheld from your paycheck. If you’ve ever wondered how much money you made last year and how much went to taxes, your W-2 has the answers.

Think of the W-2 as a summary of your annual pay. It includes details like your total wages, tips, and other compensation, along with the amounts taken out for federal, state, and other taxes. The W-2 form is crucial because it helps you fill out your tax return. It tells you, and the IRS, how much you earned and how much was already paid in taxes throughout the year.

Employers must provide W-2 forms to their employees by the end of January each year. This gives you plenty of time to file your tax return before the April deadline. If you worked more than one job during the year, you'll get a W-2 from each employer. Keep track of these forms to ensure you report all your income correctly on your tax return.

Who receives a W-2 form?

All employees, whether full-time, part-time, or seasonal workers, will receive a W-2 form from their employers. Basically, if you get a regular paycheck with taxes taken out, you should expect a W-2 form at the end of the year.

Keep in mind that your W-2 is different from a 1099 form, which is what companies send to independent contractors and freelancers. The difference is that independent contractors don’t have taxes withheld from their payments, which means that they handle their own tax payments directly to the IRS.

Even if you only worked at a job for a few days, as long as you were classified as an employee, you should receive a W-2. It’s important to make sure your employer has your correct address to ensure you get your W-2 on time.

What happens if I don't receive a W-2?

If you don’t receive your W-2 by early February, don’t panic. There are steps you can take to ensure you get the information you need to file your taxes.

- Many companies provide electronic versions of the W-2 through their payroll services. Log in to your payroll account and see if you can download your W-2 directly.

- Employers are required to send out W-2 forms by January 31st. If it’s still early February, give it a little more time. Mail delays can happen, especially if there’s bad weather.

- Reach out to your employer. Confirm they have your correct address on file and ask when they sent out W-2s. Sometimes, it might just be a mailing delay.

- If mid-February comes and you still haven’t received your W-2, it’s time to contact the IRS. Have your details ready, including your employer's name, address, phone number, your dates of employment, and an estimate of your earnings and taxes withheld (you can use your last pay stub for this). The IRS will contact your employer to request the missing form.

- If you still don’t get your W-2 in time to file your tax return, you can use Form 4852, Substitute for Form W-2. This form allows you to estimate your earnings and withholdings so you can file on time. It’s not ideal, but it’s a valid option to avoid late-filing penalties. Keep in mind that if you receive your W-2 later with different information, you might need to amend your tax return.

Employers sometimes make mistakes, or documents get lost in the mail, but following these steps will help you get the necessary information to file your taxes accurately and on time.

How to read Form W-2

Reading your W-2 form might seem complicated at first glance, but it’s fairly straightforward once you understand what each box represents. The form is divided into several sections, each with specific information about your earnings and taxes. Let’s break it down box by box.

Boxes A-F Form W-2

Boxes A-F on your W-2 form contain your personal information and your employer's details.

- Box A: Your Social Security number. Make sure this is correct.

- Box B: Your employer’s identification number (EIN).

- Box C: Your employer’s name, address, and ZIP code.

- Box D: A control number, which is used by your employer to track your W-2 form.

- Box E: Your full name. Ensure it is spelled correctly and matches your Social Security card.

- Box F: Your address. This is where the form was mailed, so it should be your current address.

Boxes 1-2 Form W-2

Boxes 1-2 provide key financial information.

- Box 1: Your total taxable wages, which includes tips, and other compensation, like your salary and any bonuses or commissions.

- Box 2: Any federal income tax your employer withheld from your pay. This is the amount already paid to the IRS on your behalf.

Boxes 3-4 Form W-2

Boxes 3-4 focus on Social Security information.

- Box 3: Your total wages that are subject to Social Security tax. This amount might be lower than your total wages because there’s a wage base limit.

- Box 4: All Social Security tax your employer withheld from your pay.

Boxes 5-6 Form W-2

Boxes 5-6 cover Medicare taxes.

- Box 5: Your total wages that are subject to Medicare tax.

- Box 6: The total Medicare tax your employer withheld from your pay.

Boxes 7-8 Form W-2

Boxes 7-8 deal with tips.

- Box 7: Any tips you’ve reported that are subject to Social Security tax.

- Box 8: Any allocated tips (tips your employer assigns to you based on your sales, if you didn’t report enough tips yourself).

Box 9 Form W-2

Box 9 is not currently used. It was used in the past for a tax credit related to employee stock options, but it’s now left blank.

Box 10 Form W-2

Box 10 shows any benefits you received for dependent care assistance, like contributions to a dependent care flexible spending account.

Box 11 Form W-2

Box 11 reports the amounts distributed to you from a nonqualified deferred compensation plan or a non-government 457(b) plan. This box helps determine if any amounts reported in Box 1 were already taxed in a previous year.

Box 12 Form W-2

Box 12 includes various types of compensation or benefits. Each item in this box is coded with a letter code to identify it.

- Code A: Social Security tax on tips you’ve earned that hasn’t been collected.

- Code B: Medicare tax on tips you’ve earned that hasn’t been collected.

- Code C: Taxable cost of group-term life insurance over $50,000.

- Code D: Contributions you’ve made to a 401(k) plan.

- Code E: Contributions you’ve made to a 403(b) plan.

- Code F: Contributions you’ve made to a SEP plan.

- Code G: Contributions you’ve made to a 457(b) plan.

- Code H: Contributions you’ve made to a 501(c)(18)(D) plan.

- Code J: Non-taxable sick pay you’ve earned.

- Code K: 20% excise tax on large golden parachute payments, which are exit packages for top executives that can be taxed extra if they're too high.

- Code L: Employee business expense reimbursements that are non-taxable.

- Code M: Social Security tax on group-term life insurance over $50,000 (for former employees) that hasn’t been collected.

- Code N: Medicare tax on group-term life insurance over $50,000 (for former employees) that hasn’t been collected.

- Code P: Moving expense reimbursements for Armed Forces members that are excludable.

- Code Q: Non-taxable combat pay.

- Code R: Employer contributions to an Archer MSA.

- Code S: Contributions you’ve made to a SIMPLE plan.

- Code T: Employer-provided adoption benefits.

- Code V: Income from exercising non-statutory stock options.

- Code W: Employer contributions to an HSA.

- Code Y: Deferrals made to a non-qualified deferred-compensation plan.

- Code Z: Income from a non-qualified deferred-compensation plan that fails Section 409A.

- Code AA: Roth contributions to a 401(k) plan.

- Code BB: Roth contributions to a 403(b) plan.

- Code DD: Cost of employer-sponsored health coverage.

- Code EE: Roth contributions to a governmental 457(b) plan.

- Code FF: Benefits under a qualified small employer health reimbursement arrangement.

- Code GG: Income from qualified equity grants.

- Code HH: Aggregate deferrals under Section 83(i) elections.

- Code II: Amount of Medicaid waiver payments not reported in Box 1.

Box 13 Form W-2

Box 13 has three checkboxes.

- Statutory employee: Checked if you’re a statutory employee. Statutory employees report their wages on Schedule C.

- Retirement plan: Checked if you were an active participant in an employer-sponsored retirement plan.

- Third-party sick pay: Checked if you received third-party sick pay.

Box 14 Form W-2

Box 14 is for other information your employer wants to provide, like union dues, educational assistance payments, or other deductions or benefits not reported elsewhere on the W-2.

Boxes 15-20 Form W-2

Boxes 15-20 focus on state and local tax information:

- Box 15: State and employer's state ID number.

- Box 16: State wages, tips, etc.

- Box 17: State income tax.

- Box 18: Local wages, tips, etc.

- Box 19: Local income tax.

- Box 20: Name of local tax authority.

File with Jackson Hewitt

Understanding your W-2 is an important step toward filing your return the right way. But the good news is that you don’t have to do it alone. Say goodbye to tax stress and get your biggest refund by filing with Jackson Hewitt.

Still have questions or concerns about your W-2? No problem! Jackson Hewitt Tax Pros are here to help you navigate the details of your W-2 and find the answers you need. Best of all, you don’t have to wait until it’s time to file to get help. We're open all year for advice, answers, tax planning, and more.

Read more articles from Jackson Hewitt

Get a Tax Pro

Our Tax Pros are ready to help you year-round. Find an office near you!

Still need tax help?

We’re here for you! Find a nearby location today.

Because trust, guarantees, convenience & money all matter

-

TRUSTED GUARANTEES.

Be 100% certain about your money & your taxes, year after year.

-

NATIONAL PRESENCE. LOCAL HEART.

We’re in your neighborhood & inside your favorite Walmart store.

-

40+ YEARS. 65+ MILLION RETURNS.

The kind of trusted expertise that comes with a lifetime of experience.