- Find an office

-

File Your Taxes

Find a Location

Find a Location -

Resolve Tax Issues

Resolve Tax Issues

Resolve Tax IssuesResolve Tax Issues

-

Tax Resources

See all Tax Help

See all Tax HelpTax Tools

Tax Tips & Resources

- Where's My Refund

- Refund Advance

- Hiring Local Jobs!

- Tax Services

- Promotions & Coupons

- Careers

- Search

- Contact Us

- Feedback

-

Log in | Sign up

Log in | Sign up

JH Accounts

|

|

Oh no! We may not fully support the browser or device software you are using ! To experience our site in the best way possible, please update your browser or device software, or move over to another browser. |

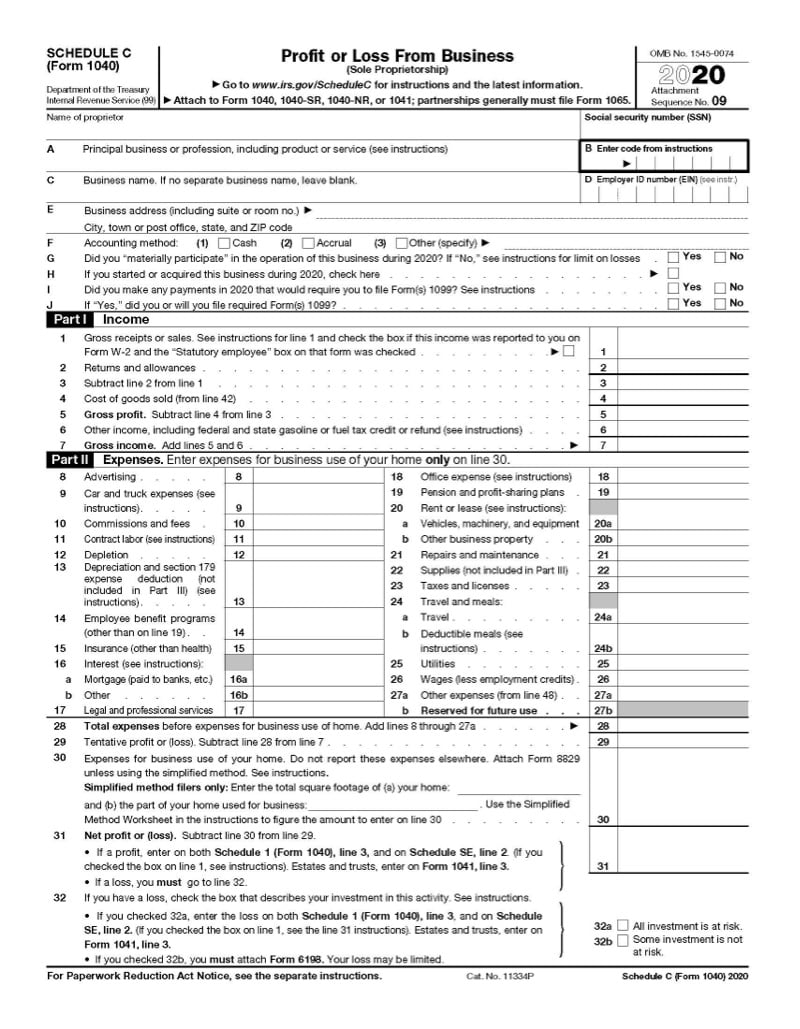

IRS FORMS: SCHEDULE C

Reporting Small Business Income, Self-Employment, and Side Hustles on Schedule C

Self-employed or own a small business? Read on to see why you must file an IRS Schedule C to report on your income and expenses.

What is Schedule C?

Schedule C is the form used to report income and expenses from self-employment. This can encompass owning a digital or brick-and-mortar small business, freelancing, contracting, and gig work such as ride-share driving.

If you receive a Form 1099-MISC, 1099-NEC, and/or 1099-K, you are likely to have to report it on Schedule C along with other income that is not reported on another tax form. Such payments would include cash received for goods or services. It is important to substantiate both income and expenses when filing Schedule C, such as having bank or credit card statements to back up receipts and any other relevant records.

The net result of Schedule C is then carried to Schedule SE to determine your self-employment tax. Half of what you pay in self-employment (SE) tax is deducted as an adjustment of income and not part of itemized deductions.”.

Do I need to have an established LLC or other business entity to file Schedule C?

While it may helpful to separate your business financial activity from your personal finances, you are not required to formalize your business as an LLC or other type of corporate entity. If you earn at least $400 from any source for the year you must file a tax return that includes Schedule C, even if this is your only income for the year. If your income for the year is $400 or less in self-employment income, you must still file a tax return with a Schedule C but there will be no self-employment taxes. If you have other income and need to file a tax return, you must include all income $1 or more on a Schedule C.

Do I need to file more than one Schedule C?

If you have more than one trade or business where each activity is significantly different in nature, each one would require their own Schedule C. For example, if you are building a freelance writing career but driving for Uber as you grow your client base, these two activities would have their own Schedule C's.

If your spouse engages in the same line of work as you, they will need to file their own Schedule C if their income and deductions are separate from yours. If both of you operate an unincorporated business together, you may be eligible for qualified joint venture (QJV) treatment and you might be able to split your income and expenses into two Schedules C with your joint tax return.

Because trust, guarantees, convenience & money all matter

-

TRUSTED GUARANTEES.

Be 100% certain about your money & your taxes, year after year.

-

NATIONAL PRESENCE. LOCAL HEART.

We’re in your neighborhood & inside your favorite Walmart store.

-

40+ YEARS. 65+ MILLION RETURNS.

The kind of trusted expertise that comes with a lifetime of experience.