- Find an office

-

File Your Taxes

Find a Location

Find a Location -

Resolve Tax Issues

Resolve Tax Issues

Resolve Tax IssuesResolve Tax Issues

-

Tax Resources

See all Tax Help

See all Tax HelpTax Tools

Tax Tips & Resources

- Where's My Refund

- Refund Advance

- Hiring Local Jobs!

- Tax Services

- Promotions & Coupons

- Careers

- Search

- Contact Us

- Feedback

-

Log in | Sign up

Log in | Sign up

JH Accounts

|

|

Oh no! We may not fully support the browser or device software you are using ! To experience our site in the best way possible, please update your browser or device software, or move over to another browser. |

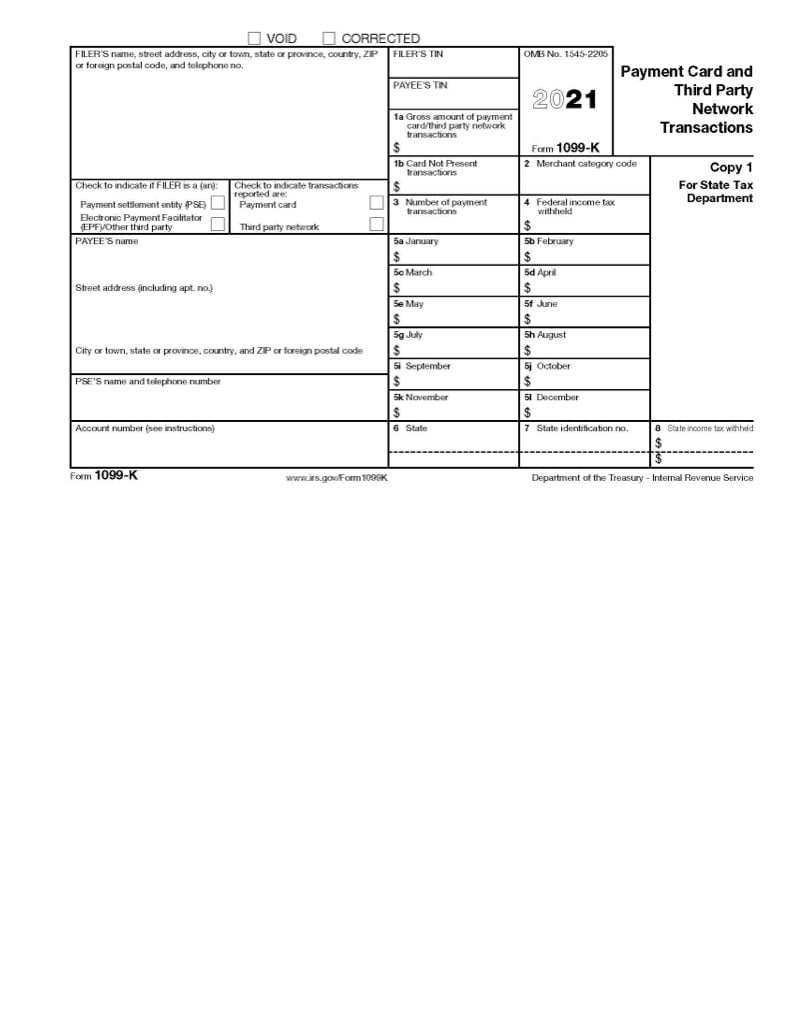

IRS FORMS: FORM 1099-K

Understanding Your Form 1099-K

You received an IRS Form 1099-K? Congratulations. It usually means you have earned income for a small business or side gig you’re running. It can also complicate your taxes. Read on to learn why people receive this form, what it is used for, and what to do with it.

What is Form 1099-K?

A Form 1099-K is an IRS form that reports income you received through a payment app like PayPal, Venmo, and Zelle, or an online marketplace like Etsy or eBay. You may also receive a 1099-K for payments you receive through payment cards such as credit cards, debit cards, and gift cards.

Ride-share drivers, delivery drivers, and other gig workers may also receive Forms 1099-K from the companies they work with.

The organizations that issue 1099-K forms are officially called payment settlement entities (PSEs), electronic payment facilitators (EPFs), and third-party merchant networks. All of them process payments between one organization or person and another. They send one copy of a 1099-K to the taxpayer (for example, you) and another to the IRS. Additional copies go to the relevant state tax agencies.

People sometimes refer to a 1099-K by its full name: Form 1099-K, Payment Card and Third Party Network Transactions.

Who gets Form 1099-K?

Anybody who receives income through a payment card, payment app, or online marketplace might receive a 1099-K. This can include:

- Freelancers and independent contractors

- Gig workers

- Solopreneurs

- Babysitters and nannies

- Hair stylists

- Farmer’s market vendors

- And more

You must report all your annual income to the IRS. But third-party networks only need to file a 1099-K when your total payments for the year are $600 or more. In other words, if you receive $500 in payments through your online store, you must report the income, even if you don’t get a 1099-K.

There are no minimum 1099-K filing requirements for income you receive via credit card, debit card, or gift card. If you receive any income through one of these cards, you should receive a Form 1099-K.

1099-K changes for the 2023 reporting year

As payment-processing apps and gig work have grown more popular, the IRS has revisited some of the rules around 1099-K forms. The biggest change is that, starting in 2023, the reporting threshold for 1099-K income has dropped to $600 from $20,000.

This means that you will receive a 1099-K for income of $600 or more. That includes all individual payments you receive combined. It doesn’t matter if you get one $600 payment or six $100 payments.

What if I receive both personal payments and business income through the same app?

If you use payment apps for both personal and business reasons—splitting a lunch tab with a friend one day, accepting payment for a little handyman work the next—you should set up two separate accounts to send and receive money. If you don’t, you will be mixing taxable income and nontaxable reimbursements. That can make a mess of your 1099-K forms.

A Jackson Hewitt Tax Pro can help make sure you only report taxable income on your annual tax returns. Keeping accurate records of your income, and how you were paid, will make it easier to do your taxes correctly.

How do I report 1099-K forms on my tax return?

You must report all income you receive on your tax return. Exactly how you report income from a Form 1099-K depends on the type of income:

- Self-employed people (gig workers, freelancers, independent contractors, etc.) report 1099-K income on Schedule C (Form 1040).

- If your 1099-K income is connected to a partnership, it belongs on the Partnership return (IRS Form 1065). You should give your 1099-K to the party completing the partnership’s.

- Income from the sale of personal property is reported on Form 8949, and Schedule D when sold for a profit. You do not report personal property sold for a loss.

- Rental income should be reported on Schedule E or Schedule C, depending on your situation.

Choosing the right form and completing it correctly can be confusing. A Jackson Hewitt Tax Pro will help make sure you do it right.

What do the boxes on Form 1099-K mean?

Box 1a reports your gross receipts, which is all the money you were paid. It does not account for refunds, credits, processing fees, or other fees you paid to access your money.

Box 1b reports "card not present" (CNP) transactions. It means the payer did not swipe, scan, or tap the card in your presence, which is often the case when you earn income online. Box 1a and Box 1b will likely be the same if you process all your payments online. If you also sold goods or services in a store, conference booth, market stall, or other physical location, and accepted credit cards, Box 1b is likely to report a different figure than Box 1a.

Box 3 reports the number of transactions the third party issuing the 1099-K processed for the taxpayer for the year. This information does not affect your tax return. It may be helpful for your business records or analysis.

Box 4 reports any federal income tax that has been withheld. 1099 payments generally do not have federal income tax withheld, but you may be subject to backup withholding if you didn’t provide your tax identification number when you set up your payment-processing account with the organization issuing the 1099-K. Some states and localities mandate state income tax withholding on electronic processor and third-party card payments. This amount is reported in Box 8.

Boxes 5a through 5l break down the gross pay received per month.

What if I received other 1099-MISC or 1099-NEC Forms that report the same income as Form 1099-K?

Form 1099-K must be issued to all taxpayers who meet the $600 income threshold. And it is possible to have the same income reported on both Form 1099-K and a 1099-NEC.

For example, let’s say a business pays you $1,000 via PayPal for some landscaping work. PayPal will send you a 1099-K that includes that transaction. The business will also issue a 1099-NEC reporting the income they paid you. You end up with two separate forms for the same payment. You need to and only report the income once on your tax return.

A Jackson Hewitt Tax Pro can help make sure you do not double-report, or underreport, your income. We are available all year to answer your 1099-K income and reporting questions, and to make sure you file your taxes correctly and get your biggest possible refund.

Because trust, guarantees, convenience & money all matter

-

TRUSTED GUARANTEES.

Be 100% certain about your money & your taxes, year after year.

-

NATIONAL PRESENCE. LOCAL HEART.

We’re in your neighborhood & inside your favorite Walmart store.

-

40+ YEARS. 65+ MILLION RETURNS.

The kind of trusted expertise that comes with a lifetime of experience.