- Find an office

-

File Your Taxes

Find a Location

Find a Location -

Resolve Tax Issues

Resolve Tax Issues

Resolve Tax IssuesResolve Tax Issues

-

Tax Resources

See all Tax Help

See all Tax HelpTax Tools

Tax Tips & Resources

- Where's My Refund

- Refund Advance

- Hiring Local Jobs!

- Tax Services

- Promotions & Coupons

- Careers

- Search

- Contact Us

- Feedback

-

Log in | Sign up

Log in | Sign up

JH Accounts

|

|

Oh no! We may not fully support the browser or device software you are using ! To experience our site in the best way possible, please update your browser or device software, or move over to another browser. |

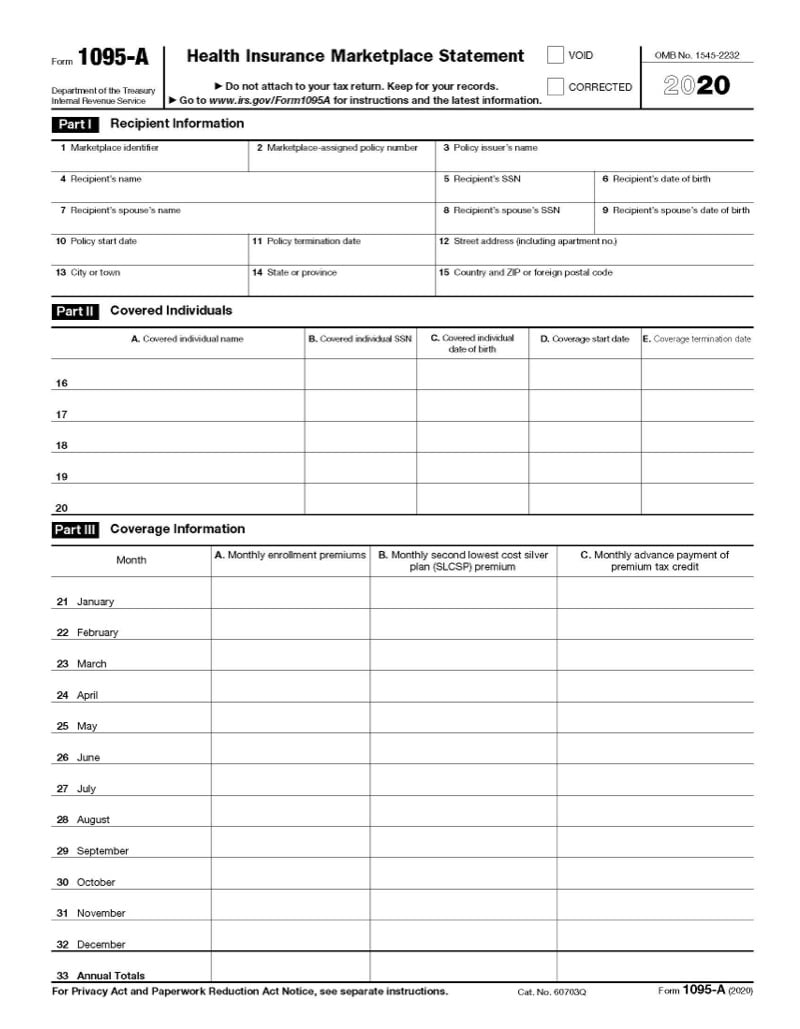

IRS FORMS: 1095-A

What is IRS Form 1095-A?

If you or your family receive medical coverage through the Health Insurance Marketplace, you will receive a Form 1095-A, Health Insurance Marketplace Statement, at the end of the year in time to file your taxes (usually around mid-January, for that previous year). Form 1095-A only reports medical insurance, not dental and vision plans. Keep reading to understand more.

What’s the purpose of IRS Form 1095-A?

The purpose of this form is to provide information about how long you’ve been covered by the health plan, and how much Advance Premium Tax Credit (APTC) you received to assist you in paying the premiums.

- APTC is an advance of the premium tax credit used to lower your out-of-pocket monthly health insurance payments, or “premiums.”

The amount of APTC is based on the household size and income and is paid directly to the insurance provider by the marketplace.

Form 1095-A reconciles the APTC you received with the actual premium tax credit (PTC) amount you are eligible for that year. If you didn’t use all of your APTC, you’ll get the rest as part of your refund. If your APTC is more than the actual premium you paid for your insurance, you’ll need to pay the balance. It can come out of your refund, or you’ll need to pay the IRS.

Additionally, you use the premium you paid, found on your Form 1095-A to determine your self-employed health insurance deduction or itemized medical deductions on Schedule A of your tax return.

What’s the breakdown of information found on your 1095-A?

As we’ve discussed, Form 1095-A is a Health Insurance Marketplace statement that lists the coverage you had for that year. The form contains the following information.

- Names of covered members of your household for that year

- Dates of coverage

- Total monthly premium for your plan

- Monthly amount of APTC paid to the insurance company

This is the primary breakdown of the form’s purpose, and it’s intended to help you file your taxes accurately. You can find more information on the back side of the form.

How important is Form 1095-A for filing your taxes?

It’s always very important to have all your financial and tax documents handy when you’re ready to file your taxes, so that you complete the most accurate return on time. An accurate tax return helps you get your tax refund in a timely manner, but also helps you avoid IRS penalties.

When it’s time to file your taxes, your Health Insurance Marketplace will send your Form 1095-A, not the IRS or the health insurance provider. You should receive a form for every insurance policy you or your family had during that tax year. If you have not received this form, be sure to log into your marketplace account and if it isn’t in the account, contact your Marketplace Help Center for help.

How do I use Form 1095-A to file my taxes, and do I need to send the form with my return?

You need Form 1095-A in order to calculate the actual amount of your Premium Tax Credit (PTC), and you’ll do this by completing Form 8962 Premium Tax Credit with that information. The IRS verifies the information on your Form 8962 by comparing it to information received from the marketplace and to other information you entered on your tax return.

- Premium Tax Credit is a refundable credit that helps eligible individuals and families cover the premiums for health insurance purchased through the Health Insurance Marketplace.

You won’t need to send your 1095-A in along with your completed tax return. If the IRS finds any errors in your return, it may send you a separate notice after you’ve filed, asking for more financial information, such as a copy of your Form 1095-A. The form is primarily for your records, to help you and your local Tax Professional accurately file your taxes. If the IRS eventually requests a review of your 1095-A, be sure to make a copy to send back, and keep the original for your records.

What if I’m expecting a Form 1095-A, but didn’t receive it?

You must contact your marketplace and confirm you should have a 1095-A. If you receive a Form 1095-A that appears inconsistent with your payment records, you should contact the marketplace to issue you a corrected form.

If you have coverage that is NOT provided by the marketplace, then you will not receive a Form 1095-A. Private health insurance is not generally eligible for the Advance Premium Tax Credit (APTC) and no advance payments are made.

Forms 1095-B and 1095-C are information forms reporting health insurance coverage. While these forms are not needed to file your tax return, you should keep them for your records.

While there’s no longer a federal individual mandate to have health insurance as of 2019, you may still qualify for insurance-related tax benefits like the medical expense deduction or highly beneficial self-employment health insurance deduction, if you are self-employed.

Additionally, if you live in California, the District of Columbia, Massachusetts, New Jersey, Rhode Island, or Vermont, these states have their own individual mandates, and you may need to prove you had coverage throughout the year.

What are the common mistakes when using Form 1095-A to file your taxes?

Here’s some of the most common 1095-A related errors found on tax returns, according to the IRS.

- Missing completed Form 8962 (Premium Tax Credit) along with your return, if it appears you’re required to adjust the advance payment received with the actual PTC amount you are due (or must repay) found on your 1095-A.

- You submitted Form 8962 but it’s incomplete or incorrect.

- Based on the income you reported on your return, it appears you’re not eligible for the tax credit.

- The premium you entered on your 8962 appears to be an annual amount, rather than the required monthly amount.

- The IRS has questions about some of the entries you submitted on your 8962 that may be better clarified by reviewing your Form 1095-A (this is when the IRS usually sends a separate notice asking for more financial information, in which case you could send them a copy of your 1095. (But keep the original copy for your records).

So, what is Health Insurance Marketplace coverage?

Health Insurance Marketplace is a federally sponsored government program to help people, families, and small businesses with the following:

- Compare the cost and coverage of health insurance plans;

- Enroll in a new, or change an existing insurance plan;

- Learn about tax credits for private insurance or health plans such as Medicaid or Children’s Health Insurance Program (CHIP); and,

- Get answers to questions about health care insurance.

To enroll in marketplace coverage, there are a few eligible requirements to make note of.

- You must live in the United States as your primary residence.

- You must be a U.S. citizen, or national; and

- You must be legally residing in the U.S.; and

- You cannot be in jail or prison; and

- You’re not currently covered by Medicare.

Each health plan is put into 4 different categories; Bronze, Silver, Gold, or Platinum.

The categories are based on how you and your plan provider plan to split the cost of coverage. They have nothing to do with the quality of your care.

Affordable Healthcare Act plan categories

|

Plan category |

Insurance company pays |

You pay |

|

Bronze |

60% |

40% |

|

Silver |

70% |

30% |

|

Gold |

80% |

20% |

|

Platinum |

90% |

10% |

There are a number of marketplace plans within each category designed to meet different needs.

- Exclusive Provider Organization (EPO): you must use medical services, doctors, hospitals, or specialists that are in the plan's own network.

- Health Maintenance Organization (HMO) limits coverage to only using the specific doctors who do business with the HMO unless in the case of an emergency.

- Point of Service (POS) is a type of plan where you’ll pay less for using doctors and hospitals that are in the plan’s same network. Requires a referral from your primary care doctor in order to see a specialist.

- Preferred Provider Organization (PPO) is a health plan similar to POS where you’ll pay less if you use the doctors and hospitals within the plan’s network, but you don’t need a referral to see a specialist.

The biggest takeaways from the main 4 marketplace plans listed above are whether your choices in doctors, hospitals and specialists are restricted, and whether you’ll have to pay a higher cost (category plan) to visit medical providers outside of your plan’s network. The HHS.gov website can connect you with the Marketplace for more information.

Remember to keep all your tax documents, including your Form 1095-A and any related financial information so that when it comes time to file your taxes, you’re best prepared to get your biggest possible refund.

Taxes can be hard and confusing. Which is why we decided to become Tax Pros. To help hardworking Americans just like you. So, don’t tax alone! Come to the pros you already know. We’re open all year and ready to help you file and forget it (until that big tax refund hits!).

Because trust, guarantees, convenience & money all matter

-

TRUSTED GUARANTEES.

Be 100% certain about your money & your taxes, year after year.

-

NATIONAL PRESENCE. LOCAL HEART.

We’re in your neighborhood & inside your favorite Walmart store.

-

40+ YEARS. 65+ MILLION RETURNS.

The kind of trusted expertise that comes with a lifetime of experience.