- Find an office

-

File Your Taxes

Find a Location

Find a Location -

Resolve Tax Issues

Resolve Tax Issues

Resolve Tax IssuesResolve Tax Issues

-

Tax Resources

See all Tax Help

See all Tax HelpTax Tools

Tax Tips & Resources

- Where's My Refund

- Refund Advance

- Hiring Local Jobs!

- Tax Services

- Promotions & Coupons

- Careers

- Search

- Contact Us

- Feedback

-

Log in | Sign up

Log in | Sign up

JH Accounts

|

|

Oh no! We may not fully support the browser or device software you are using ! To experience our site in the best way possible, please update your browser or device software, or move over to another browser. |

IRS FORMS: 8962

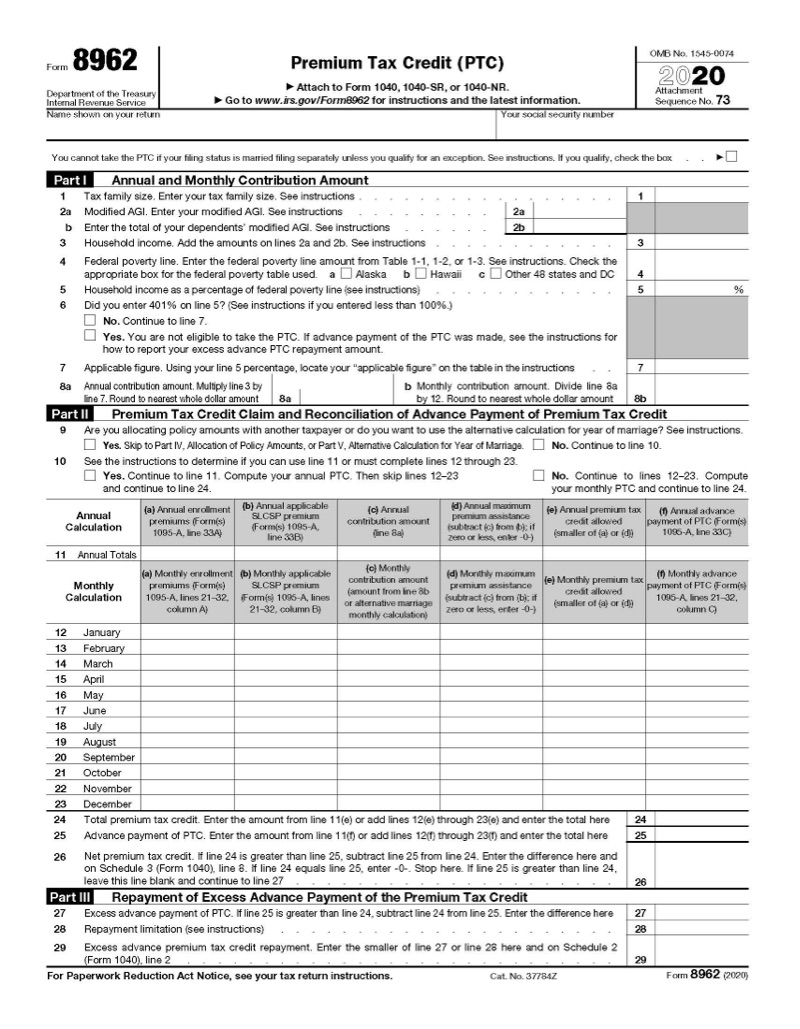

What You Need to Know About Form 8962: Premium Tax Credit for Health Insurance

If you are covered by a health insurance plan that you purchased on your own, then you may have received advance premium tax credit (APTC) to help cover the cost of your premiums.

Even if you did not receive APTC to assist you with making payments, you still need to file Form 8962 to reconcile your health costs and to receive any premium tax credit (PTC) for which you may be eligible. If you did receive APTC, you might have to repay some or all of it if your income exceeded a certain level based on the federal poverty level. This form reconciles the two different amounts.

Am I required to file Form 8962?

You must file Form 8962 if you obtained a marketplace health insurance plan for yourself or your family, and part, or all, of your premium was paid with subsidies at any time of the year.

The following types of health insurance do not qualify for the advance premium tax credit. If you receive health coverage through any of the following methods, you do not need to file Form 8962:

- Coverage through another family member’s insurance, such as a spouse or parent

- Employer-sponsored health insurance

- Insurance obtained outside of federal and state health insurance exchanges, such as a private broker or student health plans

- Government coverage such as Medicare, Medicaid, Tricare, and state health programs

In addition, you are not eligible for the advance premium tax credit if you can be claimed as another taxpayer’s dependent, or are married and filing separately, unless you are fleeing domestic violence or qualify for a spousal abandonment exception.

What if my circumstances changed through the year?

Career changes, marriage and divorce, and the birth of a child can affect your eligibility for the premium tax credit. Temporary and permanent relocations as well as a loss of income or a family member due to COVID-19, can also change your eligibility.

You cannot always predict life events and grieving is likely to cause you to not focus on tax issues when they occur. However, you should do your best to notify the health insurance marketplace through which your loved one had insurance so the insurance payments can be adjusted or halted accordingly.

How Can I Avoid APTC Repayment?

If you find out you owe money back for your health insurance, it is usually because the number of people in your household decreased, your income increased beyond what you estimated, or your marital status changed. When this happens, be sure you reach out to the and report the changes so your advance payments are adjusted accordingly.

Because trust, guarantees, convenience & money all matter

-

TRUSTED GUARANTEES.

Be 100% certain about your money & your taxes, year after year.

-

NATIONAL PRESENCE. LOCAL HEART.

We’re in your neighborhood & inside your favorite Walmart store.

-

40+ YEARS. 65+ MILLION RETURNS.

The kind of trusted expertise that comes with a lifetime of experience.