- Find an office

-

File Your Taxes

Find a Location

Find a Location -

Resolve Tax Issues

Resolve Tax Issues

Resolve Tax IssuesResolve Tax Issues

-

Tax Resources

See all Tax Help

See all Tax HelpTax Tools

Tax Tips & Resources

- Where's My Refund

- Refund Advance

- Hiring Local Jobs!

- Tax Services

- Promotions & Coupons

- Careers

- Search

- Contact Us

- Feedback

-

Log in | Sign up

Log in | Sign up

JH Accounts

|

|

Oh no! We may not fully support the browser or device software you are using ! To experience our site in the best way possible, please update your browser or device software, or move over to another browser. |

We can help resolve your tax issues. Call (855) 580-9375 today.

IRS NOTICES: TAX DEBT

What is a CP14H notice?

IRS notices are letters sent to inform taxpayers of important tax information. Each one is different, but we can explain what the CP14H is about.

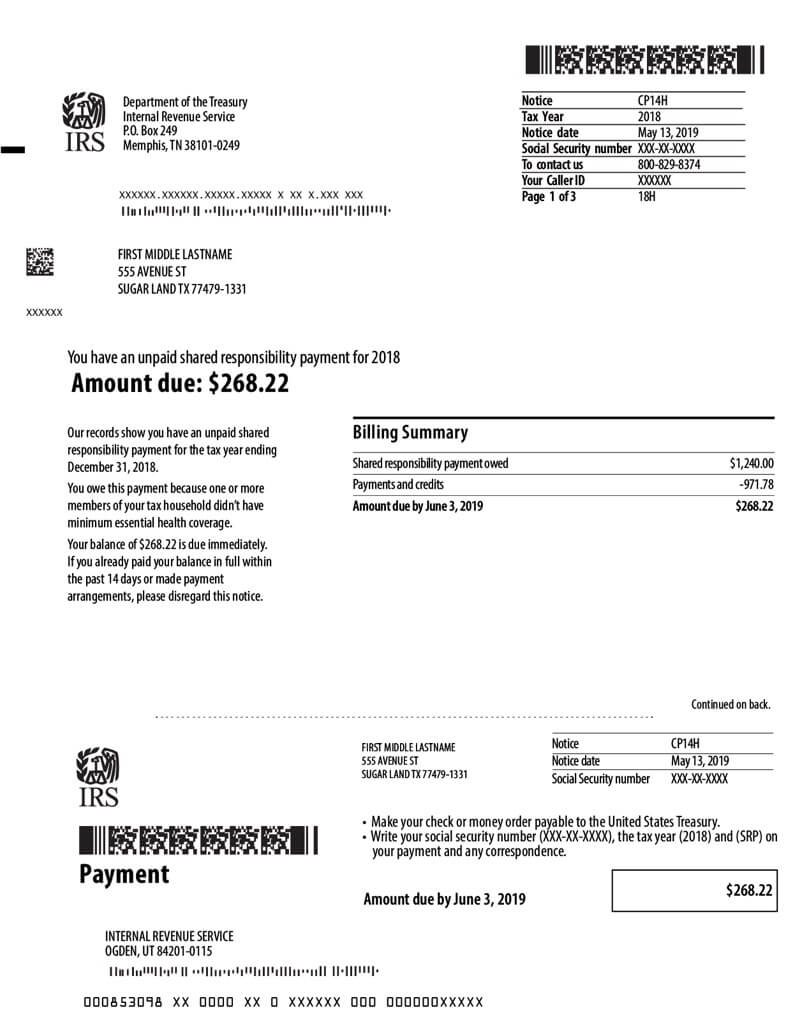

Understanding your CP14H notice

You have an unpaid shared responsibility payment. A shared responsibility payment is a penalty for not having minimum essential health coverage for you and any dependents before January 1, 2019. The notice gives details on the amount due, how to pay it, and the due date.

Type of Notice

Tax debt

Why you received the CP14H notice

You received a CP14H notice because you have an unpaid shared responsibility payment. This means you owe money to the IRS because you and/or your dependents did not have minimum essential health coverage in a year before January 1, 2019. The CP14H notice was sent to notify you that a payment is due and to request that payment.

Likely next steps

As always, read the notice carefully. Your notice will explain the due date, the amount due, and where to find payment options.

The IRS offers payment plans if you cannot pay the full amount you owe by the payment due date in the notice. Learn how to set up a payment plan here. If you are financially unable to pay at all, you can request an Offer in Compromise. The offer in compromise is a payment option that allows you to pay as much as you can and be forgiven the remaining balance due.

if you disagree with the IRS assessment, you need to contact the IRS at the toll-free number listed on the CP14H in the top right-hand corner or by mail within 60 days.

You can also contact a tax professional to learn more about your options.

CP14H Notice deadline

Your CP14H notice will have a deadline for payment listed in the notice.

If you miss the deadline

If you do not pay the balance by the deadline/due date, you will accrue interest and additional penalties on the unpaid amount. The IRS can also offset the unpaid amount against any tax refund that you may have in the future if the debt goes unpaid.

Because trust, guarantees, convenience & money all matter

-

TRUSTED GUARANTEES.

Be 100% certain about your money & your taxes, year after year.

-

NATIONAL PRESENCE. LOCAL HEART.

We’re in your neighborhood & inside your favorite Walmart store.

-

40+ YEARS. 65+ MILLION RETURNS.

The kind of trusted expertise that comes with a lifetime of experience.