- Find an office

-

File Your Taxes

Find a Location

Find a Location -

Resolve Tax Issues

Resolve Tax Issues

Resolve Tax IssuesResolve Tax Issues

-

Tax Resources

See all Tax Help

See all Tax HelpTax Tools

Tax Tips & Resources

- Where's My Refund

- Refund Advance

- Now Hiring!

- Promotions & Coupons

- Careers

- Search

- Contact Us

- Feedback

-

Log in | Sign up

Log in | Sign up

JH Accounts

|

|

Oh no! We may not fully support the browser or device software you are using ! To experience our site in the best way possible, please update your browser or device software, or move over to another browser. |

We can help resolve your tax issues. Call (855) 580-9375 today.

IRS Notices: Tax Debt

What is a CP14 notice?

Getting any notice from the IRS can cause confusion and stress. It’s good that a CP14 notice is intended to be more informational, and less scary, for taxpayers just like you. So, don’t panic, and allow us to better explain what these unfamiliar tax terms are, and how it can affect your taxes. Keep reading to understand what your CP14 notice means.

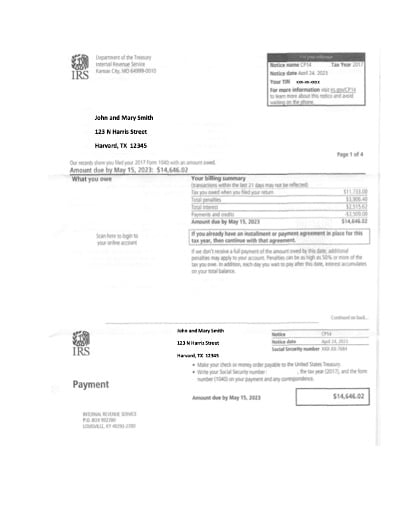

What is an IRS CP14 notice?

The IRS refers to this as a notice of Tax Due and Demand for Payment. This is the most-common notice sent to taxpayers, and it’s a formal letter letting you, the taxpayer, know that you owe the IRS $5 or more. The CP14 notice will state the amount owed, including interest and penalties, and will request the amount be paid in 21 days (three weeks).

Why did you receive an IRS CP14 notice?

Simply put, you received this notice because you owe taxes to the IRS. Always read a notice from the IRS in full.

Responding to the CP14 notice

Read the notice in full to gather as many details as possible. And if the CP14 notice is too confusing, we’re here for you. Your local Tax Pro can explain the notice and help you determine the best next steps to take.

If you can’t pay in full by the 21-day deadline, you have options, and just knowing that is a great start. The IRS offers payment plan options. If you need assistance, you can speak to a Tax Pro who can review your notice and help determine if you qualify for an IRS program, and help you set up your payment plan.

Payment options

A payment plan is an agreement with the IRS to pay the taxes you owe in an extended timeframe. The IRS offers four options.

- Pay Now

- Pay the tax amount owed in full today. Pay directly from a checking or savings account online, by phone, or in-person. Or pay by check, money order, or credit card (processing fees apply when paying with a credit card). There’s no setup fee to use this type of payment and no future penalties or interest, since you’re choosing to pay now and not later.

- Short-term Payment Plan

- Pay the tax amount owed in 180 days (about six months) or less. You can use the same methods of payment as Pay Now. There’s no setup fee to apply for this plan. Interest and penalties will continue to accrue until you pay the amount in full. If you don’t pay in full within the 180 days (about 6 months), you will be assessed the fee to set up a long-term payment plan.

- Long-term Payment Plan (installment agreement)

- Pay the amount owed in monthly installments. If you’re approved for this plan, you have two options to make payments.

- Direct Debit. This makes automatic monthly payments from your checking account, also known as Direct Debit Installment Agreement (DDIA).

- Monthly payments. With this option, you can make a monthly payment using your checking or savings accounts, money order, or credit/debit card (processing fees apply when paying by card). The setup fees range, depending on how you apply for this plan (online, phone, or in-person) and whether your income is low enough to have the fee waived. Interest and penalties will continue to accrue until you pay the amount owed is paid in full.

- Pay the amount owed in monthly installments. If you’re approved for this plan, you have two options to make payments.

- Change an Existing Payment Plan

- If you’re approved for one of the three plans outlined above, but want to switch to another, you can apply to a different plan, but there are setup fees. There are setup fees if you apply online, or by phone, mail, or in-person. If your income is low enough, there’s a small setup fee to apply by either of these same methods. In some cases, you could get your setup fee back if you qualify. Your local Tax Pro can help you understand if your income qualifies for “low” or not, and whether you meet the criteria.

Penalties and interest

Penalties and interest could add up if you do not pay taxes owed to the IRS on time. The IRS charges a late payment on unpaid taxes. This is usually a 0.5% interest charge on your unpaid balance each month, until you pay your tax bill in full.

It’s best to call the IRS phone number listed on your CP14 notice to make payment arrangements or pay in full. Alternatively, set up a payment plan and payment method online. Finally, you can also pay in full by mail with a check or money order. It is important to act before your 21-day deadline.

What if the IRS says you owe but you already paid?

If you’re able to call the number listed on your CP14 notice, you should do so as soon as possible. Grab your tax documents and paperwork (canceled checks or proof of tax payment, filed or amended tax return, etc.) and have these resources handy.

If calling the IRS doesn’t lead to the solution you were hoping for, speak with one of our Tax Pros. For all other tax-filing needs, we’re in your neighborhood and open all year to help you file your tax return or assist with any tax problem you’re facing.

CP14 notice example

If you received a CP14 notice, we can deal with the IRS for you.

Because trust, guarantees, convenience & money all matter

-

TRUSTED GUARANTEES.

Be 100% certain about your money & your taxes, year after year.

-

NATIONAL PRESENCE. LOCAL HEART.

We’re in your neighborhood & inside your favorite Walmart store.

-

40+ years. 60+ million returns.

The kind of trusted expertise that comes with a lifetime of experience.