- Find an office

-

File Your Taxes

Find a Location

Find a Location -

Resolve Tax Issues

Resolve Tax Issues

Resolve Tax IssuesResolve Tax Issues

-

Tax Resources

See all Tax Help

See all Tax HelpTax Tools

Tax Tips & Resources

- Where's My Refund

- Refund Advance

- Hiring Local Jobs!

- Tax Services

- Promotions & Coupons

- Careers

- Search

- Contact Us

- Feedback

-

Log in | Sign up

Log in | Sign up

JH Accounts

|

|

Oh no! We may not fully support the browser or device software you are using ! To experience our site in the best way possible, please update your browser or device software, or move over to another browser. |

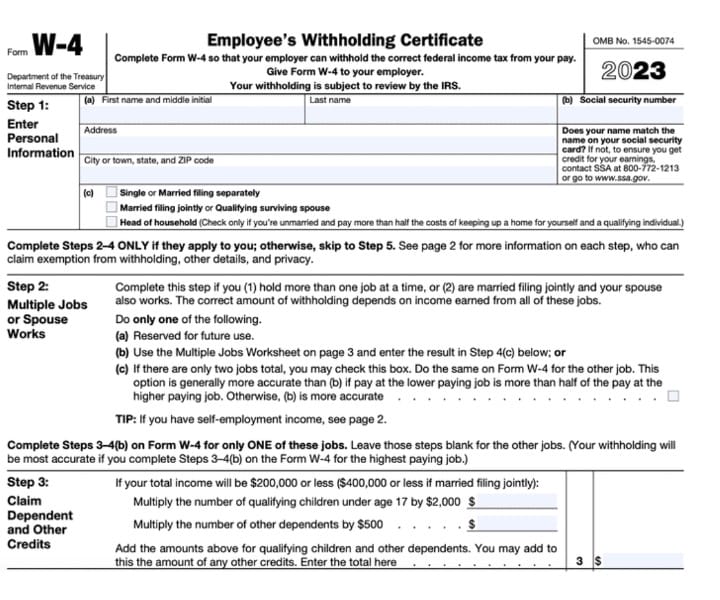

IRS FORMS: W-4

What Do You Do With a W-4 Tax Form?

Starting a new job and going through other major life events often mean that you’ll have to think about filling out or revising your withholdings. In 2020, the IRS made significant changes to Form W-4 to help individuals withhold federal income tax more accurately from their paychecks. Read on to learn when what the major changes are, and how paying the right amount in taxes as you go could be the difference between a tax refund or a tax bill when you file your federal and state returns.

What is IRS W-4 form?

The IRS W-4 form, also known as the Employee's Withholding Certificate, is a document provided by the Internal Revenue Service (IRS). It is used by employees to inform their employers about their federal income tax withholding preferences.

When starting a new job, you should complete a W-4 form. By filling out the form, you provide your employer with information that helps them determine the appropriate amount of federal income tax to withhold from your paycheck. The W-4 form consists of several sections that require you to provide details such as your name, address, Social Security number, filing status, and the number of allowances you wish to claim.

What are the most recent changes with Form W-4?

First, withholdings are the amount of local, state, and federal taxes taken out of your paycheck. You have to fill out a Form W-4 formally titled "Employee's Withholding Certificate.” Employers use the information provided on a W-4 to calculate how much tax to withhold from an employee's paycheck throughout the year.

The Tax Cuts and Jobs Act (TCJA) significantly changes how the federal income tax system works. The TCJA made several changes, including:

- Doing away with personal exemptions

- Increasing the standard deduction

- Making the Child Tax Credit open to more people

That said, these tax changes don't always work well with the previous version of Form W-4. The older version relied on calculating personal and dependent exemptions, along with any additional withholding amount desired, to figure out how much federal income tax to withhold from your paycheck. In general, the more exemptions you had, the less money you had taken from your paycheck. Exemptions are no longer used for calculating withholdings on Form W-4. This change is meant to increase the simplicity, and accuracy, of the form. Due to the changes in tax law, you cannot claim personal or dependency exemptions.

What are federal withholdings and state withholdings?

The U.S. has a pay-as-you-go tax system, meaning you pay tax as you earn money. This is generally accomplished by withholding money from your paycheck for both federal and state tax obligations. State withholding is based on state-determined taxable income, while federal withholding is based on federal taxable income. State withholding rules vary by state (read more on that below), but the federal withholding rules are consistent throughout the U.S.

What is withholding tax?

Put simply, if you're an employee, your employer withholds federal income taxes and your share of Social Security and Medicare taxes from your paycheck and sends your withholdings to the IRS and your state tax authority in your name.

Federal income tax withholding on the W-4

Your employer will use information you provided on your IRS Form W-4 to determine how much to withhold in income taxes. The amount of your taxable income and how frequently you are paid also play a part in how much federal income tax withholding (FITW) and state income tax withholding (SITW) to withhold from each paycheck.

How to calculate federal income tax withholdings

If you earn more than usual during a pay period—such as receiving a bonus or working overtime—FITW and SITW will increase. If you earn less—by working fewer hours or increasing contributions to your retirement savings—FITW and SITW will decrease. It’s advisable to have sufficient FITW and SITW during the year to cover your expected income tax bills.

What does Fed Tax, FT or FWT mean on your paycheck?

Federal income tax might be abbreviated as Fed Tax, FT, FWT or other ways on your paystub. Withholdings are the amount that you put aside for your income taxes. Your employer sends the money to the IRS.

This means you’ll get a credit for this amount to apply to any taxes you owe, after determining credits. Or, if you withheld too much, you’ll get the extra back as a tax refund. According to the IRS, your FITW from your pay depends on:

- The filing status shown on your W-4 form,

- The number of dependent credits specified, and

- Other income and adjustments on Form W-4 you filed with your employer.

How will having multiple jobs affect the W-4?

Tax rates increase as income rises, and you can claim only one standard deduction on each tax return, regardless of the number of jobs. Withholding calculations are based on total income, so when you have multiple jobs, or a joint return where both you and your spouse work, you need to mark that on your Form W-4. This will help you have the correct withholding. Adjustments to your withholding may be needed to avoid owing additional tax, and potential penalties, when you file your tax return.

The old Form W-4 accounted for multiple jobs using detailed instructions and worksheets that many employees may have overlooked. It’s important to note that you use a Form W-4 for each job.

State withholding tax

As mentioned above, SITW can vary greatly, depending on where you live and work. If your state has an income tax, you will probably have state income taxes withheld from your paycheck. Your employer will use information provided on the state version of Form W-4 and your income to figure out how much to withhold.

If you owe taxes to more than one state (for instance, if you work in a different state from your resident state), you may want to ask that your employer withhold taxes for the state you live in and the state you work in. Another option is to make estimated payments to the state you live in to make up the difference.

You can reach out to your Jackson Hewitt Tax Pro about any questions that may come up about complicated multi-state situations to avoid errors or a larger-than-expected tax bill when you file your federal and state returns.

While you will likely have state tax withholdings on your paycheck, it depends on where you live. In fact, based on your location, you might:

- Live and work in a no-income-tax state and have no withholding.

- Have state withholding for more than one state—the state you live in and the state(s) you work in, or the states your work in, but not your home state.

- Have local withholding for your city or town.

How much is federal and state tax?

In 2023, the U.S. federal tax rates range from 10% to 37%. The U.S. has a progressive tax system, where portions of a person's taxable income can fall into different brackets to be taxed at different rates. These tax brackets are adjusted each year to account for inflation. This can help prevent a taxpayer from paying higher taxes as the cost-of-living increases.

Your state and local taxes vary by where you work and live. Always work with a Tax Pro to figure out what your tax rate is.

When should you think about changing your withholding?

The IRS recommends thinking about reviewing and possibly changing your withholding:

- Early in the year

- When the tax law changes

- When you have major life changes, like:

- Lifestyle: Marriage, divorce, birth or adoption of a child, home purchase, retirement, or filing chapter 11 bankruptcy

- Wage income changes: You or your spouse start or stop working or start or stop a second job

- Taxable income not subject to withholding: You receive interest income, dividends, capital gains, self-employment income, or IRA (including certain Roth IRA) distributions

- Adjustments to income: You expect to claim IRA deductions, student loan interest deductions, or alimony expense

- Itemized deductions or tax credits: You expect to have medical expenses, taxes, interest expenses, gifts to charity, dependent care expenses, education credit, child tax credit, or earned income credit that are greater than the standard deduction

There are other situations not included here. If you think you may not be withholding enough federal tax, it may be time to adjust your withholding using Form W-4. It’s always a good idea to review your W-4 every two years. A Tax Pro can help you.

Why would I need to fill out a W-4?

As an employee, you cannot control your social security and Medicare tax deduction or any state mandatory fund contributions such as family leave and disability funds. However, you can control how much federal income tax is automatically withheld from each paycheck by completing your Form W-4. This form helps you estimate your annual income, deduct dependent related benefits, and request any additional dollar amounts to be withheld.

The tax withheld is based on your filing status, how often your employer pays you, the expected income from the job, and your other income and deductions. While a new job is the most common reason for filling out a Form W-4, the following situations are also likely to generate the need to submit a new W-4 at other times during your time with an employer:

- Marriage and divorce

- Having children

- Working multiple jobs

- Picking up a side hustle, or planning a transition to freelancing or becoming self-employed

- Major change in income

- Becoming a homeowner, or other situation resulting in increased deductions

How do I fill out a W-4 Form?

The W-4 form was updated due to tax reform and the elimination of personal and dependent exemptions. The withholding tables are now based on dollar amounts relative to filing status, income and tax credits.

If your tax situation is simple, you only need to enter your name, Social Security number, filing status, and signature in Step 5. Your withholding will be based on your standard deduction and tax rate with no additional adjustments. If your tax situation is more complex, you need to complete Steps 2-5.

First, you need to complete the multiple jobs worksheet in Step 2 if it applies to you. In Step 3, enter the number of dependents if your annual income is expected to be less than $200,000 ($400,000 if married filing jointly). In Step 5, enter your expected deductions, other income aside from your job, and additional voluntary withholding.

Are there variations of W-4 Forms?

Yes. While only a Form W-4 can be given to employers, there are other forms in this series: W-4P for retirement income and W-4V for governmental payments like Social Security benefits and unemployment. Withholding is voluntary for these types of income, but recommended since they are subject to income tax.

Additionally, there is a state W-4 equivalent form you should not overlook if you live in a state with income tax. For instance, New York residents must fill out an IT-2104 which has the same purpose as a Form W-4, except it's for state and city taxes. If you move to or leave the city but have stayed within the state, that could force you to change your state and local withholding, but your federal tax situation usually won’t change. If you only want to change one type of withholding, like state taxes, you do not need to file a new Federal Form W-4. The same is true of wanting to leave your state withholding as-is, you don't need to file a new state form and just need to submit a new Federal Form W-4.

Where do I get a W-4 Form?

You can download the Form W-4 for free from the official IRS website if your employer or payroll provider did not already give you one.

Questions? We are here to help you navigate the complexities of federal and state tax withholdings and how the most recent W-4 changes may affect you and your family. You can work with Jackson Hewitt Tax Pro to decide what the right next steps may be for your tax situation.

Because trust, guarantees, convenience & money all matter

-

TRUSTED GUARANTEES.

Be 100% certain about your money & your taxes, year after year.

-

NATIONAL PRESENCE. LOCAL HEART.

We’re in your neighborhood & inside your favorite Walmart store.

-

40+ YEARS. 65+ MILLION RETURNS.

The kind of trusted expertise that comes with a lifetime of experience.