- Find an office

-

File Your Taxes

Find a Location

Find a Location -

Resolve Tax Issues

Resolve Tax Issues

Resolve Tax IssuesResolve Tax Issues

-

Tax Resources

See all Tax Help

See all Tax HelpTax Tools

Tax Tips & Resources

- Where's My Refund

- Refund Advance

- Hiring Local Jobs!

- Tax Services

- Promotions & Coupons

- Careers

- Search

- Contact Us

- Feedback

-

Log in | Sign up

Log in | Sign up

JH Accounts

|

|

Oh no! We may not fully support the browser or device software you are using ! To experience our site in the best way possible, please update your browser or device software, or move over to another browser. |

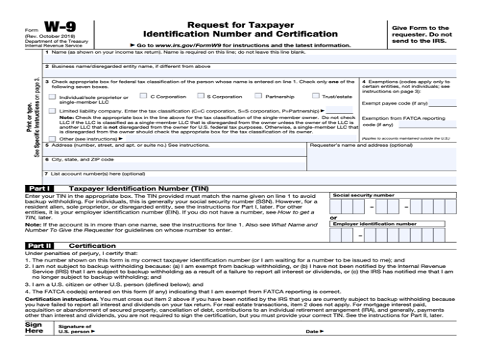

IRS FORMS

IRS Form W-9: Complete guide to taxpayer identification and reporting

If you’re a freelancer or have side hustles, you may have filled out a Form W-9 before, or you may be filling it out for the first time as an independent contractor. Officially speaking, the Form W-9 is the Request for Taxpayer Identification Number and Certification. We’ll delve into what this form is, how to complete it, why it is important, and more.

IRS Form W-9: Complete guide to taxpayer identification and reporting

Put simply, when a business or person hiring you requests that you complete Form W-9, it's because they need your name, address, and Social Security number (SSN) or Taxpayer Identification Number (TIN) for payroll and tax-reporting purposes.

Introduction to IRS Form W-9

The information provided on Form W-9 lets the company know what information to include in Form 1098 or Form 1099. Usually, the Form W-9 is used with independent contractors, but it can be necessary in other situations as well. We’ll go into more detail on that below.

Independent contractors fill out the W-9 to confirm their tax responsibilities and provide information to their employer(s). In turn, businesses use a contractor's W-9 to complete a 1099-NEC reporting the worker's income.

The form acts as an agreement that you, as a contractor or freelancer, are responsible for the taxes on your income. When you’re an employee, your employer withholds some of your income to cover federal income taxes and FICA taxes (which include Medicare and Social Security taxes). Employers do not withhold for contractors.

Examples of W-9 income

As mentioned above, you’d use Form W-9 to provide your correct SSN (SSN) or Individual Taxpayer Identification Number (ITIN) to the person who is required to file an information return with the IRS to report, for example:

- Income paid to you

- Real estate transactions

- Mortgage interest you paid

- Acquisition or abandonment of secured property

- Cancellation of debt

- Contributions you made to an IRA

Who is required to fill out Form W-9?

Broadly speaking, you must fill out Form W-9 if you are an independent contractor who performs work for a company or client for which you are not an employee. This includes freelance workers or gig employees under non-employment structures.

An individual or entity, who is required to file an information return with the IRS must obtain your correct TIN, which may be your SSN, ITIN, adoption taxpayer identification number (ATIN), or employer identification number (EIN), to report on an information return the amount paid to you, or other amount reportable on an information return.

Examples of information returns include, but are not limited to, the following.

- Form 1099-NEC (self-employment, contract work, gigs, or freelancing)

- Form 1099-DIV (dividends, including those from stocks or mutual funds)

- Form 1099-INT (interest earned or paid)

- Form 1099-MISC (various types of income, prizes, awards, or gross proceeds)

- Form 1099-B (stock or mutual fund sales and certain other transactions by brokers)

- Form 1099-S (proceeds from real estate transactions)

- Form 1099-K (merchant card and third-party network transactions)

- Form 1098 (home mortgage interest), 1098-E (student loan interest), 1098-T (tuition)

- Form 1099-C (canceled debt)

- Form 1099-A (acquisition or abandonment of secured property)

You can work with your tax professional on whether any of these apply to you, or if you have further questions.

Penalties for non-compliance or inaccurate information

If you don’t file the W-9, you may have to pay penalties. Same goes for the company, if it doesn’t collect your W-9.

The IRS charges penalties for inaccurate information, too.

If you don’t provide a correct tax number, you would be subject to a $50 fine for every instance of non-compliance with tax law and regulation. The IRS may waive this penalty if you can prove the non-compliance was not due to willful neglect.

Penalties for not filing a W-9, or filing late

|

Year Due |

Up to 30 Days Late |

31 Days Late Through August 1 |

After August 1 or Not Filed |

Intentional Disregard |

|

2024 |

$60 |

$120 |

$310 |

$630 |

Completing Form W-9: Step-by-step guide

Below we go through how to complete Form W-9 from a high level. If you have any questions, reach out to a tax professional to ask about your specific situation.

- Line 1 – Name. This should be your full, legal name. Make sure to accurately reflect if you have had any name changes due to marriage or divorce.

- Line 2 – Business name. Make sure to include an LLC if you have one, or if you’re Doing Business As (DBA) as an entity other than your own legal name.

- Line 3 – Federal tax classification.

- Line 4 – Exemptions.

- Lines 5 & 6 – Address, city, state, and ZIP code.

- Line 7 – Account number(s)

- Part I – TIN or SSN

- Part II – Certification.

You must sign the Form W-9. You will send the form to the client or company with whom or for whom you are doing work, not the IRS.

Questions on Form W-9? You can reach out to a Tax Pro near you to ask about the form and any other tax questions you may have. We are here for you year-round.

Because trust, guarantees, convenience & money all matter

-

TRUSTED GUARANTEES.

Be 100% certain about your money & your taxes, year after year.

-

NATIONAL PRESENCE. LOCAL HEART.

We’re in your neighborhood & inside your favorite Walmart store.

-

40+ YEARS. 65+ MILLION RETURNS.

The kind of trusted expertise that comes with a lifetime of experience.