- Find an office

-

File Your Taxes

Find a Location

Find a Location -

Resolve Tax Issues

Resolve Tax Issues

Resolve Tax IssuesResolve Tax Issues

-

Tax Resources

See all Tax Help

See all Tax HelpTax Tools

Tax Tips & Resources

- Where's My Refund

- Refund Advance

- Hiring Local Jobs!

- Tax Services

- Promotions & Coupons

- Careers

- Search

- Contact Us

- Feedback

-

Log in | Sign up

Log in | Sign up

JH Accounts

|

|

Oh no! We may not fully support the browser or device software you are using ! To experience our site in the best way possible, please update your browser or device software, or move over to another browser. |

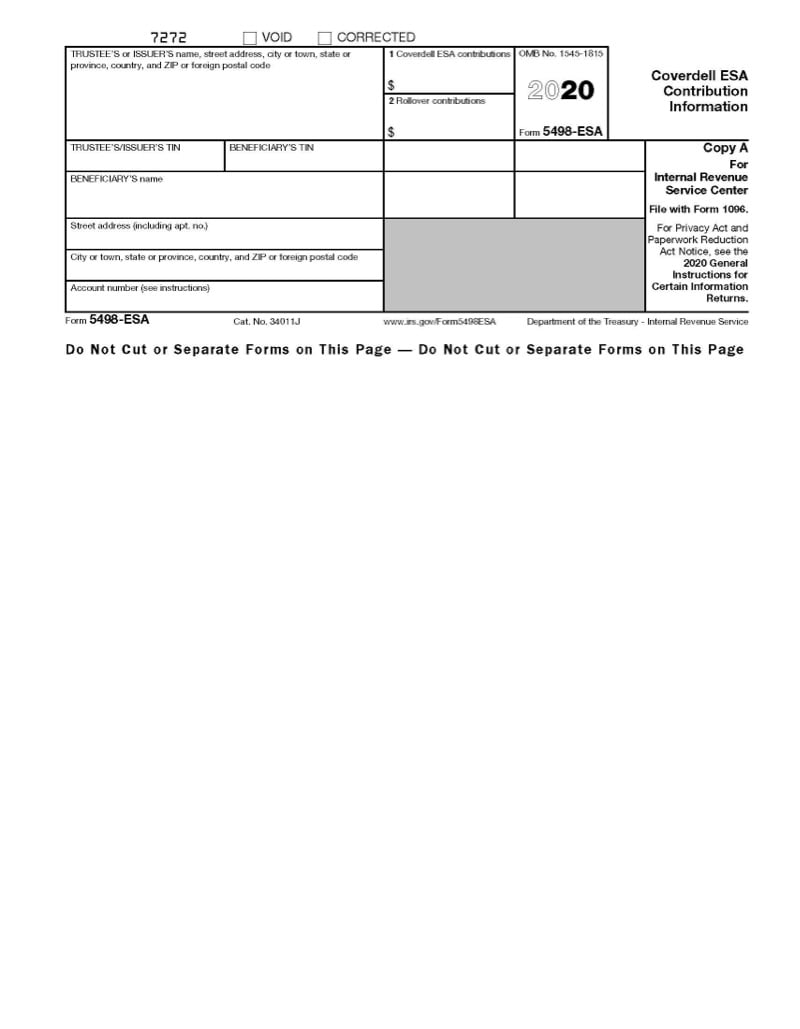

IRS FORMS: 5498

Understanding Form 5498: Reporting Certain Retirement Plan Contributions to the IRS

If you have a retirement plan where you have more control over the timing and amount of your contributions, such as a Roth IRA, you will receive a Form 5498 from the brokerage where you hold the account.

What is IRS Form 5498?

Form 5498 is an information form issued to owners of traditional and Roth IRAs, SEP (simplified employee pension), and SIMPLE (savings incentive match plan for employees) plans to report activity within these accounts. While predominantly known for reporting plan contributions, Form 5498 is also used to report Roth conversions and if any repayments were made to the account if you had prior distributions.

Additionally, Form 5498 reports the amount of required minimum distributions (RMDs) you withdrew during the year. The RMD must start by age 72 to avoid costly penalties. If you inherited the IRA, you are also subject to the RMD and the amount withdrawn will be shown on Form 5498.

You do not need to wait for Form 5498 to file your taxes since the form isn’t due until May.

If I have an employer-sponsored plan, will I receive Form 5498?

If you are contributing to an employer-sponsored retirement plan like a 401(k) or 403(b) plan, your contributions will be reported on your W-2 form issued by that employer. You will not receive Form 5498.

If you transfer your plan assets to a new employer’s account, commonly referred to as a rollover, the transfer will be reported on Form 1099-R with code “G” in Box 7. You will not receive Form 5498 unless your rollover contribution is made to an IRA, SEP, or SIMPLE plan.

Are the contributions reported on Form 5498 deductible?

The purpose of Form 5498 is to inform you that you made contributions to your IRA, SEP, or SIMPLE plan during the tax year, and whether you must begin receiving RMDs.

The amounts reported on Form 5498 may or may not be deductible depending on many factors including whether you or your spouse are covered by an employer-sponsored plan.

If Form 5498 reports a conversion, is it taxable?

A traditional IRA, SEP, SIMPLE, or 401(k) plan can be converted to a Roth IRA. If a taxpayer wishes to avoid taxes on their retirement income, the Roth is the way to do this.

Form 5498 reports the converted amount. Income taxes on the deferred amount will be due at the time of the conversion, although there is no early withdrawal penalty for this action.

The event creates taxable income, although the taxable amount may not be explicitly stated on Form 5498. Determining the taxable amount is the responsibility of the plan owner and their Tax Pro.

Because trust, guarantees, convenience & money all matter

-

TRUSTED GUARANTEES.

Be 100% certain about your money & your taxes, year after year.

-

NATIONAL PRESENCE. LOCAL HEART.

We’re in your neighborhood & inside your favorite Walmart store.

-

40+ YEARS. 65+ MILLION RETURNS.

The kind of trusted expertise that comes with a lifetime of experience.