- Find an office

-

File Your Taxes

Find a Location

Find a Location -

Resolve Tax Issues

Resolve Tax Issues

Resolve Tax IssuesResolve Tax Issues

-

Tax Resources

See all Tax Help

See all Tax HelpTax Tools

Tax Tips & Resources

- Where's My Refund

- Refund Advance

- Hiring Local Jobs!

- Tax Services

- Promotions & Coupons

- Careers

- Search

- Contact Us

- Feedback

-

Log in | Sign up

Log in | Sign up

JH Accounts

|

|

Oh no! We may not fully support the browser or device software you are using ! To experience our site in the best way possible, please update your browser or device software, or move over to another browser. |

IRS FORMS: 1099-R

What Should I Do if I Receive a Form 1099-R?

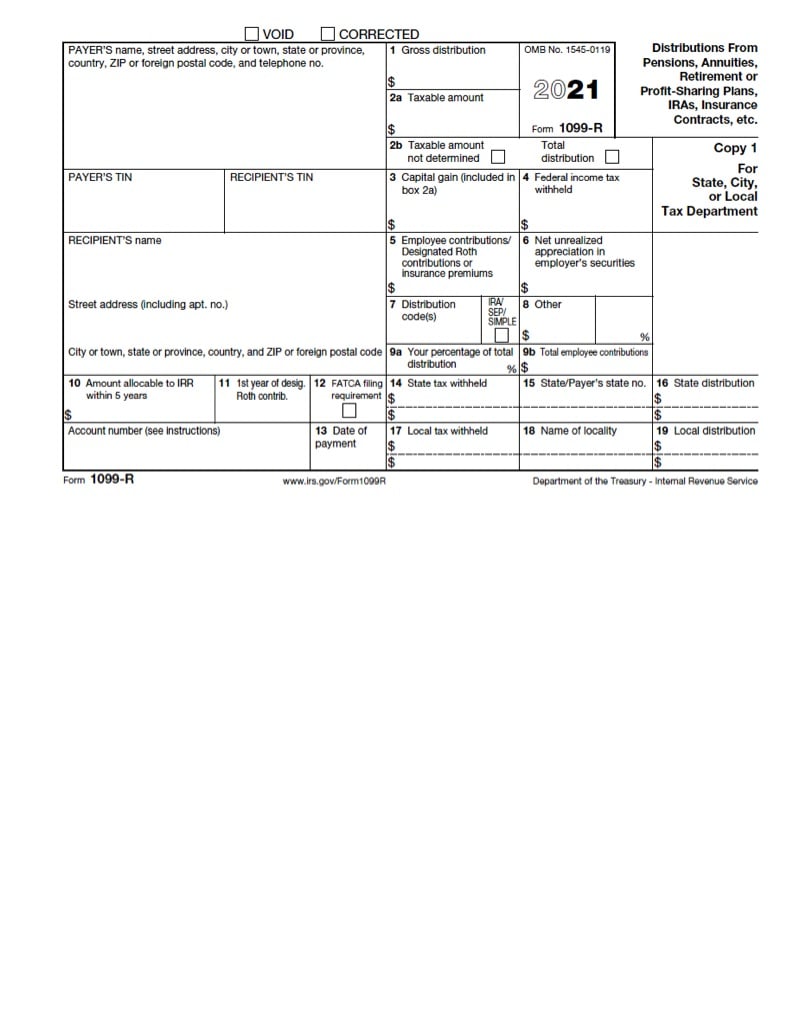

Form 1099-R is part of the IRS Forms 1099 series and issued whenever you receive more than $10 in retirement income.

What is a Form 1099-R?

Distributions for the year that exceed $10 from the following types of accounts will result in a 1099-R being sent to you:

- Traditional and Roth IRAs

- Pensions

- Annuities

- Employer-sponsored retirement and profit-sharing plans

Box 2b will dictate if the taxable amount of these distributions has been determined or not. 1099-R income should be reported on your tax return, but not all distributions are taxable based on the entry in Box 2a.

I’m not retired yet, but I received a 1099-R

There are several situations where you will receive a Form 1099-R before you retire. If you inherit an IRA and roll the contents over to your own retirement plan or take a distribution it will all be reported on a Form 1099-R. This tax form is also issued if you receive disability payments or are the beneficiary of a pension. You may need to determine the taxable amount of your IRA distributions. Report both the total and taxable amounts of the distribution on your tax return. Remember to include your withholding on your tax return as well.

There are times when the information reported on the 1099-R aren’t taxable. Box 7 has the distribution code which determines how the distribution is to be treated on your tax return. For example:

- Code 1 means the distribution is subject to an additional 10% tax because the taxpayer is below 59 ½.

- Code 7 is assigned to normal distributions. This type of distribution is taxable but not subject to the additional 10% tax if the taxpayer is under age 59 ½.

- Code G designates a rollover between retirement accounts. This type of distribution is not taxable.

While Roth IRA distributions are generally not taxable, they may be subject to early withdrawal penalties if taken before age 59 ½.

How do I get taxes withheld on income that gets reported on 1099-R?

When you withdraw money from your retirement plan before beginning your regular retirement distributions, you will generally have an automatic withholding of 20%. Once you retire and start regular distributions, you may need to request to have federal income tax withheld from your retirement plan, annuity, or insurance payments.

The federal withholding for regular retirement distributions is computed based on your filing status and total projected income using an allowance method. You may also elect to have additional amounts withheld from each periodic payment.

You can also arrange to have state income taxes withheld from these payments by finding the correct form through your state’s revenue department. If you are retired, you may opt out of state withholding since some states, such as Pennsylvania, do not tax retirement income, while states like New York exempt the first $20,000 of pension income (offering a full exemption for state public employee pensions). Other states tax the full pension amount.

Because trust, guarantees, convenience & money all matter

-

TRUSTED GUARANTEES.

Be 100% certain about your money & your taxes, year after year.

-

NATIONAL PRESENCE. LOCAL HEART.

We’re in your neighborhood & inside your favorite Walmart store.

-

40+ YEARS. 65+ MILLION RETURNS.

The kind of trusted expertise that comes with a lifetime of experience.