- Find an office

-

File Your Taxes

Find a Location

Find a Location -

Resolve Tax Issues

Resolve Tax Issues

Resolve Tax IssuesResolve Tax Issues

-

Tax Resources

See all Tax Help

See all Tax HelpTax Tools

Tax Tips & Resources

- Where's My Refund

- Refund Advance

- Hiring Local Jobs!

- Tax Services

- Promotions & Coupons

- Careers

- Search

- Contact Us

- Feedback

-

Log in | Sign up

Log in | Sign up

JH Accounts

|

|

Oh no! We may not fully support the browser or device software you are using ! To experience our site in the best way possible, please update your browser or device software, or move over to another browser. |

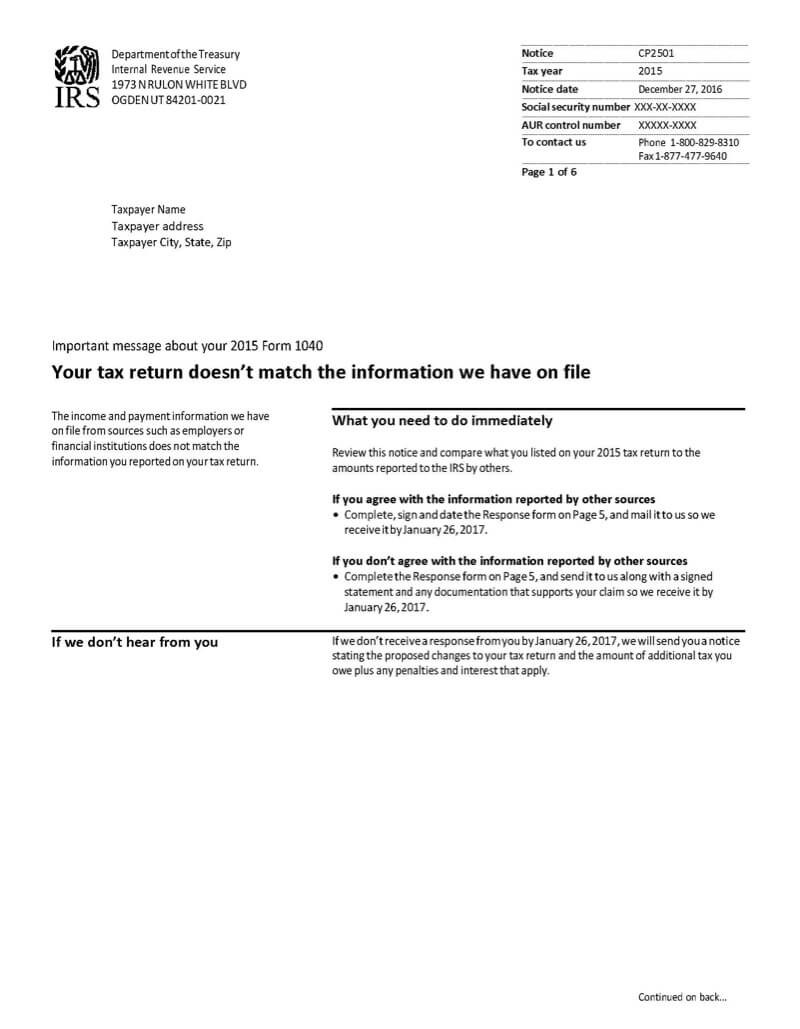

IRS NOTICES: REQUEST FOR INFORMATION

What is a CP2501 notice?

IRS notices are letters sent to inform taxpayers of important tax information. Each one is different, but we can explain what the CP2501 is about.

Understanding your CP2501 notice

The IRS received income information that doesn’t match the information on your tax return. If you agree, sign and send this letter back. If you don’t agree, submit documentation and an explanation why your original return was correct.

Type of Notice

Request for information

Why you received the CP2501 notice

The income information received by the IRS doesn’t match what was reported on your tax return.

Likely next steps

As always, carefully read the notice, which will explain the new information that the IRS received.

If you believe the notice is correct, sign and date it and send it back. The IRS will send a CP2000 (or Letter 2030) with the amount of additional taxes, and any penalties and interest you owe.

If you don’t agree with the assessment, submit supporting documentation and an explanation to the IRS by the due date. The IRS will either accept your response and make no change to the original return or they will deny the full request. You will receive a CP2000 (or Letter 2030) with an explanation and any amount of taxes, penalties, and interest you may owe.

CP2501 Notice deadline

You have 30 days from the date of the notice to complete the form or contact the IRS either by phone or mail.

If you miss the deadline

If you do not make a payment or contact the IRS within 30 days, the IRS will send you another notice with information about your corrected tax return.

Because trust, guarantees, convenience & money all matter

-

TRUSTED GUARANTEES.

Be 100% certain about your money & your taxes, year after year.

-

NATIONAL PRESENCE. LOCAL HEART.

We’re in your neighborhood & inside your favorite Walmart store.

-

40+ YEARS. 65+ MILLION RETURNS.

The kind of trusted expertise that comes with a lifetime of experience.