- Find an office

-

File Your Taxes

Find a Location

Find a Location -

Resolve Tax Issues

Resolve Tax Issues

Resolve Tax IssuesResolve Tax Issues

-

Tax Resources

See all Tax Help

See all Tax HelpTax Tools

Tax Tips & Resources

- Where's My Refund

- Refund Advance

- Hiring Local Jobs!

- Tax Services

- Promotions & Coupons

- Careers

- Search

- Contact Us

- Feedback

-

Log in | Sign up

Log in | Sign up

JH Accounts

|

|

Oh no! We may not fully support the browser or device software you are using ! To experience our site in the best way possible, please update your browser or device software, or move over to another browser. |

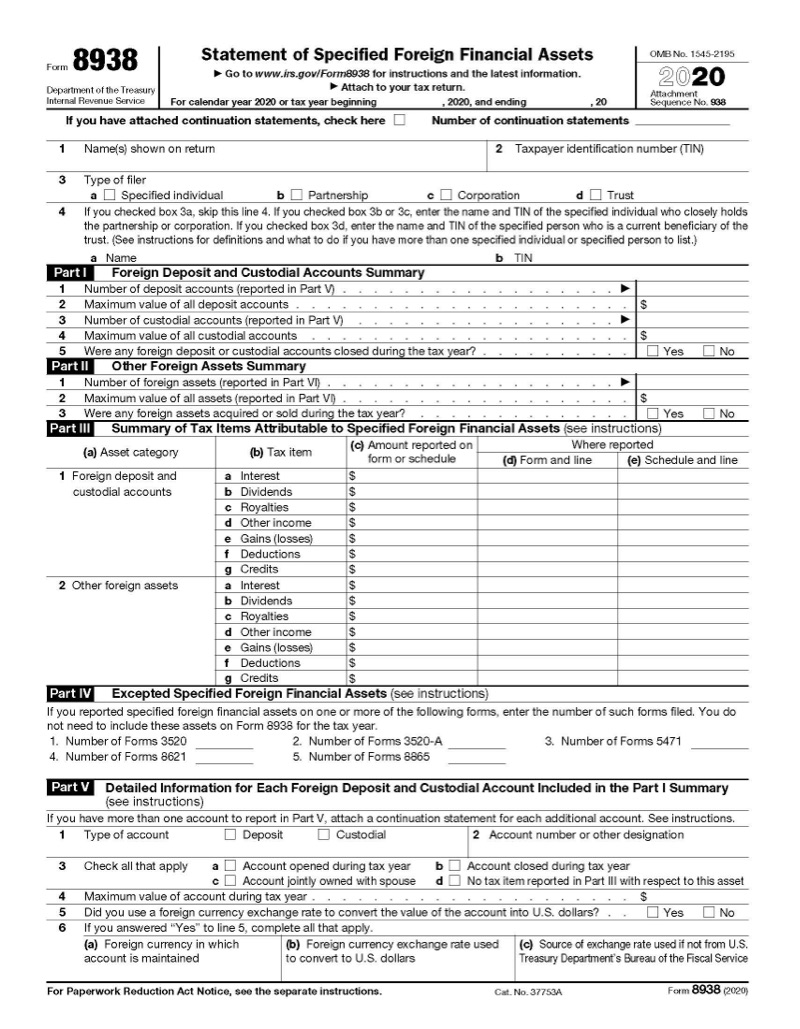

IRS FORMS: 8938

Understanding Form 8938: Disclosure of Foreign Financial Assets to the IRS

Form 8938 is used to report your foreign financial assets if the total value exceeds a certain threshold based on your filing status and the types of assets.

If you are considered a “specific individual” with ownership of particular types of foreign assets, such as a significant ownership stake in a foreign business or financial assets that produce interest and dividend income, you must report this ownership to the IRS even if your domestic or foreign tax liability is not actually affected.

Is Form 8938 the same as FBAR?

No. There are several key differences between Foreign Bank Account Reporting (FBAR) and reporting foreign asset ownership to the IRS.

The most crucial difference is that Form 8938 is reported with your tax return similar to any other tax form concerning investment income or foreign-sourced income, like Schedule D and Form 2555, respectively. FBAR uses FinCEN Form 114, which is remitted directly to the US Treasury. You do not need to prepare and file your federal tax return prior to fulfilling your FBAR requirements, although it is also due April 15 every year (October 15 if you request a six-month extension). If you file for an extension for your tax return, it does not cover your FBAR reporting requirements and a separate extension must be requested from the Treasury Department.

There are various types of assets that can be reported on both forms, such as foreign bank accounts. However, the reporting threshold for FBAR is significantly lower than for foreign asset reporting. If your total aggregate foreign bank account balances exceed $10,000 at any point of the year, you must file FBAR with the Treasury. Individuals who live in the United States are not required to disclose their foreign assets unless their total value exceeded $75,000 at any point during the year ($150,000 if married filing jointly), or the aggregate value exceeded $50,000 on the last day of the tax year ($100,000 if married filing jointly).

For U.S. citizens who live abroad, these figures are increased to a $200,000 threshold at year-end and $300,000 at any point of the year ($400,000 and $600,000, respectively, if married filing jointly). In order to meet this threshold, you must be a bona fide resident of a foreign country or have resided in any country (or countries) for 330 full days during the 12 months following the tax year in question.

What types of assets must be reported on Form 8938?

While FBAR requirements are primarily restricted to depository accounts held overseas, foreign asset disclosure is more complex.

Bank and investment accounts must be reported. Owning the following types of assets also must be reported on Form 8938 if your total foreign asset value exceeds the appropriate threshold:

- Retirement assets maintained at foreign institutions

- Bonds issued by a foreign company

- Any level of ownership in a foreign business entity or trust

- Personal residences and rental properties that are held by a foreign entity

- Interest in a foreign estate

While the IRS has a more exhaustive list of foreign assets that you are required to report, these types of assets are the most common.

Foreign asset reporting exemption if you do not need to file a tax return

While you must file FBAR regardless of your income tax situation, you do not need to file Form 8938 if you are exempt from having to file a tax return for the year, such as not meeting the gross income filing requirements. This is true even if your foreign assets exceed the threshold for your filing status and residency.

Because trust, guarantees, convenience & money all matter

-

TRUSTED GUARANTEES.

Be 100% certain about your money & your taxes, year after year.

-

NATIONAL PRESENCE. LOCAL HEART.

We’re in your neighborhood & inside your favorite Walmart store.

-

40+ YEARS. 65+ MILLION RETURNS.

The kind of trusted expertise that comes with a lifetime of experience.