- Find an office

-

File Your Taxes

Find a Location

Find a Location -

Resolve Tax Issues

Resolve Tax Issues

Resolve Tax IssuesResolve Tax Issues

-

Tax Resources

See all Tax Help

See all Tax HelpTax Tools

Tax Tips & Resources

- Where's My Refund

- Refund Advance

- Hiring Local Jobs!

- Tax Services

- Promotions & Coupons

- Careers

- Search

- Contact Us

- Feedback

-

Log in | Sign up

Log in | Sign up

JH Accounts

|

|

Oh no! We may not fully support the browser or device software you are using ! To experience our site in the best way possible, please update your browser or device software, or move over to another browser. |

IRS FORMS: FORM 8615

Knowing When to File Form 8615: Tax for Certain Children with Unearned Income

What is IRS Form 8615? Learn about Form 8615 and calculating children’s unearned income here.

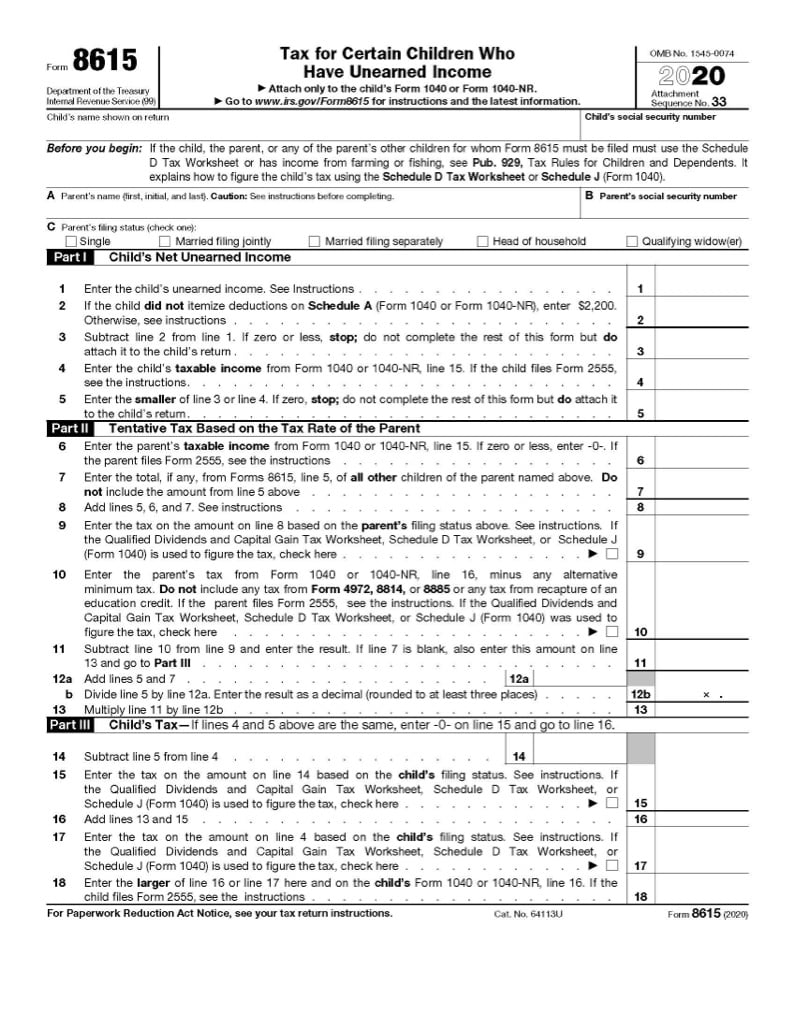

What is Form 8615?

Form 8615 is used to calculate taxes on certain children's unearned income.

Unearned income typically refers to investment income such as interest, dividends, capital gains, and rental income. However, for this particular tax, a larger definition is utilized for unearned income and more sources of income in the child's name are considered. These sources may include unemployment compensation, IRA and other retirement plan distributions, scholarship and grant payments, royalty income, and taxable portions of Social Security benefits.

If a child is under 18 and received more than $2,500 of non-wage income, Form 8615 may be required. This situation is most common with parents who have set up savings and investment accounts for their children and have them named as co-owners, but can also arise from the child being named in a will, recipient of scholarship funds, and being named as a beneficiary on an account while still a minor.

When is Form 8615 required?

Form 8615 must be filed with the child’s tax return if any of the following apply:

- The child is required to file a tax return for any reason

- The child's tax return is not a joint one

- At least one of the child's parents is still living

- The child has more than $2,500 in unearned income for the year

- The child is under 18 as of the end of the tax year, or was a full-time student between the ages of 19-24 and did not earn at least 50% of their own support

If these conditions are met, Form 8615 needs to be filed regardless of whether the child is another taxpayer's dependent or not. The only time Form 8615 will not be required is if both of the child's parents are deceased by the end of the tax year.

If a child only has investment income to report, can the parent claim it instead?

If the only unearned income the child is reporting is comprised of interest, dividends, and/or Alaska permanent fund dividends of less than $12,500, the parents can make an election to file Form 8814 and claim this income as their own.

While the child will not need to file a tax return, and subsequently will not need to file Form 8615, it may result in higher taxes for the parent(s) and potentially negate certain tax benefits such as the Earned Income Tax Credit, or trigger the net investment income tax, since these figures are based on total investment income.

Because trust, guarantees, convenience & money all matter

-

TRUSTED GUARANTEES.

Be 100% certain about your money & your taxes, year after year.

-

NATIONAL PRESENCE. LOCAL HEART.

We’re in your neighborhood & inside your favorite Walmart store.

-

40+ YEARS. 65+ MILLION RETURNS.

The kind of trusted expertise that comes with a lifetime of experience.