- Find an office

-

File Your Taxes

Find a Location

Find a Location -

Resolve Tax Issues

Resolve Tax Issues

Resolve Tax IssuesResolve Tax Issues

-

Tax Resources

See all Tax Help

See all Tax HelpTax Tools

Tax Tips & Resources

- Where's My Refund

- Refund Advance

- Hiring Local Jobs!

- Tax Services

- Promotions & Coupons

- Careers

- Search

- Contact Us

- Feedback

-

Log in | Sign up

Log in | Sign up

JH Accounts

|

|

Oh no! We may not fully support the browser or device software you are using ! To experience our site in the best way possible, please update your browser or device software, or move over to another browser. |

IRS FORMS: FORM 6251

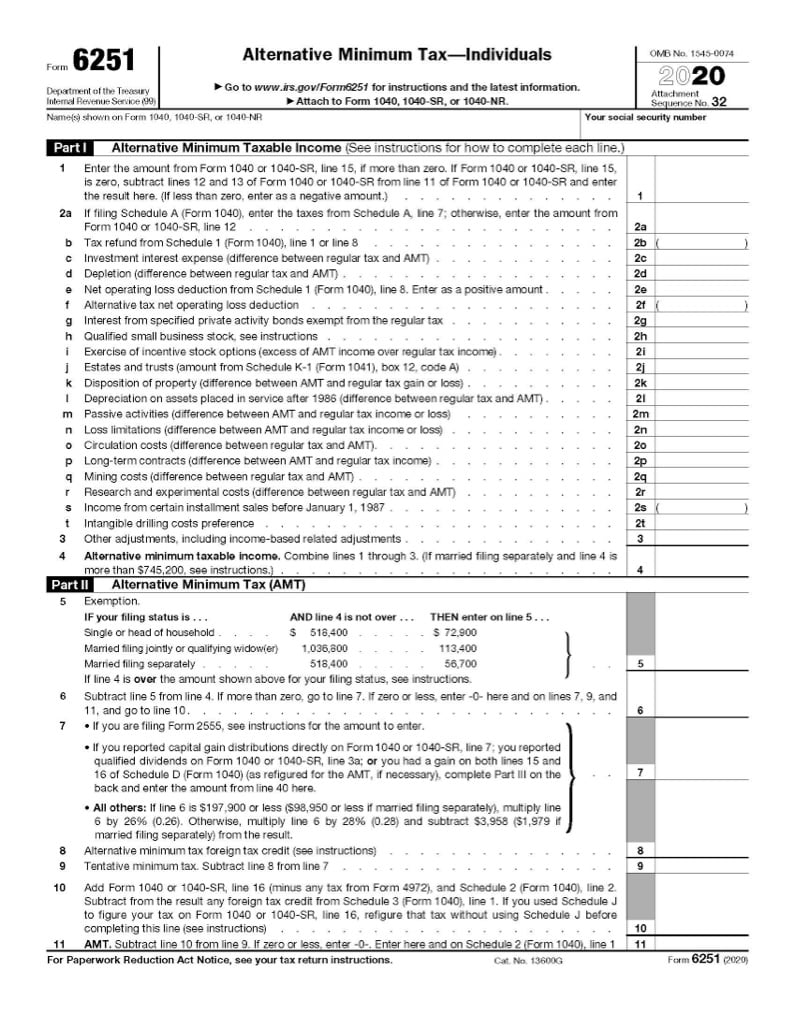

Determining Alternative Minimum Tax with Form 6251

Do you know what Alternative Minimum Tax is? It may actually be something that could affect your income tax. Read on to find out how.

What is Alternative Minimum Tax (AMT)?

Alternative minimum tax (AMT) functions as a tax floor for taxpayers with high income and low taxes due to a large amount of deductions.

Some tax benefits can vastly reduce a high-income taxpayer's tax obligation to the point they owe little or no federal income tax. AMT acts as a stopgap to ensure that the taxpayer still owes a minimum amount of tax.

Form 6251 determines your alternative minimum taxable income by computing your modified adjusted gross income (MAGI) through adding back certain tax-exempt items and removing certain deductions.

Which types of income and deductions are likely to trigger AMT?

Generally speaking, having a higher income, having a business that takes advantage of several tax credits, or having large itemized deductions on Schedule A are the most common triggers for AMT. Exercising stock options and having significant capital gains income have also historically triggered AMT for taxpayers who were normally not subject to it.

AMT entails several complex calculations that may include adding back significant tax benefits to recalculate the actual taxes you owe. A common item that frequently requires Form 6251 to be completed is the foreign earned income exclusion filed on Form 2555.

Significant amounts of tax-free income, such as interest on municipal bonds, are highly likely to trigger AMT if your total MAGI is in a high range and/or there are other preferential items claimed on your income tax return. These preferential items include net operating loss deduction, depletion, investment interest expense, depreciation, passive activities, and disposition of property.

Because trust, guarantees, convenience & money all matter

-

TRUSTED GUARANTEES.

Be 100% certain about your money & your taxes, year after year.

-

NATIONAL PRESENCE. LOCAL HEART.

We’re in your neighborhood & inside your favorite Walmart store.

-

40+ YEARS. 65+ MILLION RETURNS.

The kind of trusted expertise that comes with a lifetime of experience.