- Find an office

-

File Your Taxes

Find a Location

Find a Location -

Resolve Tax Issues

Resolve Tax Issues

Resolve Tax IssuesResolve Tax Issues

-

Tax Resources

See all Tax Help

See all Tax HelpTax Tools

Tax Tips & Resources

- Where's My Refund

- Refund Advance

- Hiring Local Jobs!

- Tax Services

- Promotions & Coupons

- Careers

- Search

- Contact Us

- Feedback

-

Log in | Sign up

Log in | Sign up

JH Accounts

|

|

Oh no! We may not fully support the browser or device software you are using ! To experience our site in the best way possible, please update your browser or device software, or move over to another browser. |

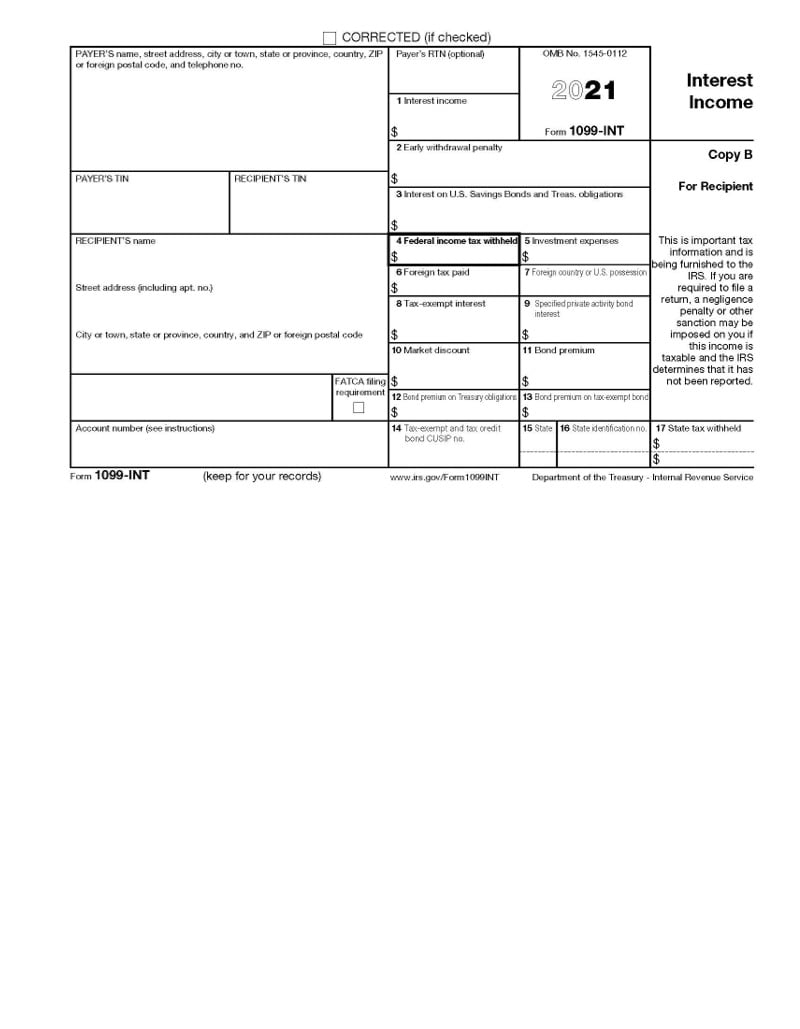

IRS FORMS: FORM 1099-INT

Understanding Your Form 1099-INT: Interest and Investment Income

What is IRS Form 1099-INT? Learn the basics of Form 1099-INT and reporting interest and investment income.

What is Form 1099-INT?

Form 1099-INT is furnished to you by your financial institution, broker, or other entity that has paid you interest totaling $10 or more during the year.

It is common for taxpayers who have investment and wealth management accounts to receive a “1099 combination statement” from the financial institution which consolidates several investment-related tax forms such as 1099-INT, 1099-DIV, and 1099-B.

All other payers will issue Form 1099-INT where appropriate. Common types of interest income include interest on savings accounts, CDs, and corporate and government bonds. Interest can also comprise part of a mutual fund distribution, and accrue on security deposits you made.

What is the difference between 1099-INT and 1099-OID?

Form 1099-INT is used to report interest earned from all accounts other than bonds sold below face value and interest earned in a mutual fund.

Form 1099-OID is used to report the annual increase in the value of a bond sold below face value.

Form 1099-DIV will include interest earned on a mutual fund.

Income reported on both 1099-INT and 1099-OID is considered investment income and is taxed as ordinary income. This means interest doesn’t get the same lower capital gain rate as long-term capital gains and certain dividend income.

What do the boxes on Form 1099-INT mean?

The left side of Form 1099-INT reports you and the payer's address, tax identification number, and account number. Most taxpayers are likely to encounter the following boxes filled out on their Forms 1099-INT:

Box 1 reports the interest income you received, which would be reported on your tax return as ordinary interest.

However, if Box 3 reports interest on US treasury bonds or specific municipal and private activity bonds in Boxes 8 and 9, you still need to report them though they may result in different tax treatment. US treasury bonds are not taxable on state tax returns but are taxable on federal tax returns.

Municipal bonds, reported in boxes 14, 15, and 16, are not taxable on the federal return but the Form 1099 does specify which states are applicable because you may also receive state-level tax exemptions for these bonds.

Form 1099-INT may also have federal income taxes withheld in Box 4 if you are subject to backup withholding. If you are not mandated to have backup withholding, as is the case with most US citizens, you will need to make estimated tax payments if you have significant interest income.

If you have foreign investments, your broker may automatically withhold foreign taxes (such as Ireland's dividend and interest retention tax). If you cannot get a refund for these taxes or seek exemption from them from the foreign government in question, you may be eligible for the foreign tax credit or foreign tax deduction.

Because trust, guarantees, convenience & money all matter

-

TRUSTED GUARANTEES.

Be 100% certain about your money & your taxes, year after year.

-

NATIONAL PRESENCE. LOCAL HEART.

We’re in your neighborhood & inside your favorite Walmart store.

-

40+ YEARS. 65+ MILLION RETURNS.

The kind of trusted expertise that comes with a lifetime of experience.