- Find an office

-

File Your Taxes

Find a Location

Find a Location -

Resolve Tax Issues

Resolve Tax Issues

Resolve Tax IssuesResolve Tax Issues

-

Tax Resources

See all Tax Help

See all Tax HelpTax Tools

Tax Tips & Resources

- Where's My Refund

- Refund Advance

- Hiring Local Jobs!

- Tax Services

- Promotions & Coupons

- Careers

- Search

- Contact Us

- Feedback

-

Log in | Sign up

Log in | Sign up

JH Accounts

|

|

Oh no! We may not fully support the browser or device software you are using ! To experience our site in the best way possible, please update your browser or device software, or move over to another browser. |

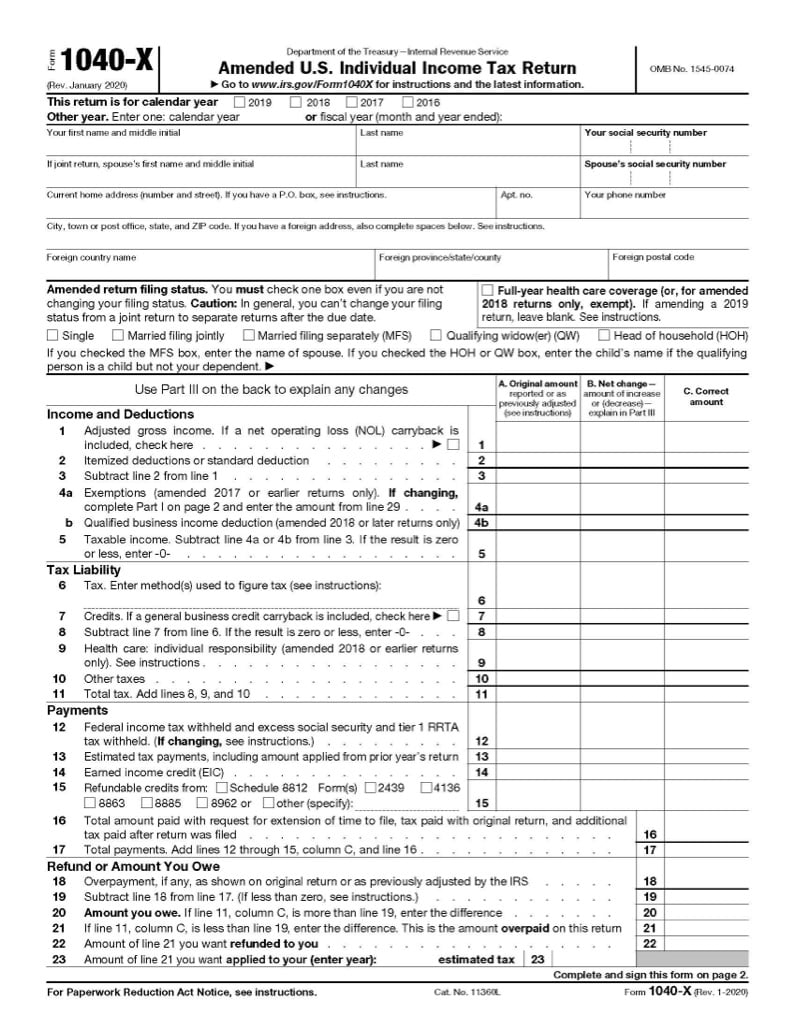

IRS FORMS: FORM 1040X

Filing an Amended Tax Return with Form 1040X

Did you make a mistake on your return or omit an item? You will have to then file an amended form. Read on to see how to file Form 1040X.

What is an amended tax return?

If you made a mistake on your tax return, such as forgetting income or not claiming a deduction or credit, you can use Form 1040X: Amended U.S. Individual Tax Return, to report missing information and to correct mistakes.

If you are filing your amended return on paper, you should attach any new sources of income documents such as a W-2, a 1099-R with withholding, or a W-2G with withholding. In addition, include any new or changed forms, other than the Form 1040 or 1040-SR.

Do I need to wait for an IRS notice to file an amended tax return?

No. File an amended return as soon as you determine there was an error. The longer you wait the more potential penalties and interest can accumulate. If the changes result in a balance due, pay the bill with the return and the IRS will bill you for any penalty and/or interest, if applicable. If you are eligible for a refund, the IRS may pay you interest.

If you receive a notice of change from the IRS and you agree with their changes, do not send an amended return with the changes. DO keep a copy of the notice in your file so you can start your following year return with the correct information.

If you receive a notice of change from the IRS and you disagree and feel the original return is correct, do not send an amended return. Respond back to IRS explaining why your original return is correct.

If you receive a notice of change from the IRS and you partially agree, send an amended return to clarify which changes you don’t agree with.

Is the deadline to file an amended tax return different?

Form 1040X can be filed at any time. However, if you catch an error, omission, or other discrepancy in a filed return prior to the filing deadline, you may be able to avoid additional penalties and interest by filing Form 1040X before the filing deadline.

If you want to claim a refund from a prior tax year in which you already filed, you must file Form 1040X no later than three years after you filed the original tax return, or two years after you paid the original tax amount due from that return.

Amended returns can take up to 16 weeks to process. To track the status of an amended return, you can use the Where’s My Amended Return? tool on the IRS website.

New for tax year 2020, Form 1040X for tax years 2020 forward can be filed electronically. At this time, returns can be filed electronically, protecting taxpayer information, and ensuring the tax return reaches the IRS. However, amended tax returns are still being processed by hand.

Because trust, guarantees, convenience & money all matter

-

TRUSTED GUARANTEES.

Be 100% certain about your money & your taxes, year after year.

-

NATIONAL PRESENCE. LOCAL HEART.

We’re in your neighborhood & inside your favorite Walmart store.

-

40+ YEARS. 65+ MILLION RETURNS.

The kind of trusted expertise that comes with a lifetime of experience.