- Find an office

-

File Your Taxes

Find a Location

Find a Location -

Resolve Tax Issues

Resolve Tax Issues

Resolve Tax IssuesResolve Tax Issues

-

Tax Resources

See all Tax Help

See all Tax HelpTax Tools

Tax Tips & Resources

- Where's My Refund

- Refund Advance

- Hiring Local Jobs!

- Tax Services

- Promotions & Coupons

- Careers

- Search

- Contact Us

- Feedback

-

Log in | Sign up

Log in | Sign up

JH Accounts

|

|

Oh no! We may not fully support the browser or device software you are using ! To experience our site in the best way possible, please update your browser or device software, or move over to another browser. |

BACK TAXES AND TAX DEBT

Top-10 Taxpayer Disputes with the IRS

Each year, the IRS National Taxpayer Advocate (NTA) issues their Annual Report to Congress. This report is great reading for taxpayers who want to know common disagreements and issues between the IRS and taxpayers.

Included in the report are the ten most serious problems (MSPs) at the IRS with respect to taxpayer rights. Many of these MSPs are continuous problems between the IRS and taxpayers and have been sore spots in tax administration for years.

One of the most interesting areas to watch is the ten most litigated issues. This list provides a peek into common disagreements between the IRS and taxpayers in federal courts. Interestingly, in many of these cases, taxpayers represent themselves in court before the IRS. Unsurprisingly, the IRS wins most cases.

The top ten most litigated issues

Of the millions of IRS compliance enforcement cases litigated annually, only a few hundred tax cases are litigated. Most issues are administratively resolved with the IRS during IRS examinations (audits), collection proceedings, and appeals. All in all, tax disputes heard in court are the rare exception to the rule.

However, the litigated cases provide us a good indication of the common taxpayer disputes with the IRS. Here are the top ten litigated issues along with the number of cases for each issue in the fiscal year 2020, how often the IRS wins in these cases, and how and where these cases originated and are likely resolved BEFORE going to court:

Issue #10: Frivolous issues

Number of cases in 2020: 14

Number of cases won by the IRS: 14 (100%)

How the case usually arises: An IRS audit, court proceeding, or criminal investigation.

Where you are likely to resolve this issue administratively before going to court: These cases generally involve nonsense arguments by taxpayers about the validity of the tax code. The best way to resolve these cases is to avoid a frivolous argument. Sometimes taxpayers are frustrated with trying to resolve a tax problem with the IRS (penalty, late filing, audit, collection issues, etc.) and they make what the IRS constitutes a frivolous argument (i.e., the tax code is illegal). Proper representation in court can be helpful when facing prepared and determined opponents like the IRS.

Issue #9: Charitable contribution deductions

Number of cases in 2019: 17

Number of cases won by the IRS: 13 (The other 4 cases were split decisions)

How the case usually arises: An IRS audit.

Where you are likely to resolve this issue administratively before going to court: In these disputes, taxpayers should seek to resolve the issue at the audit or appeals level. Many contribution deduction issues are resolved with IRS appeals. Most issues here involve inadequate taxpayer documentation or valuation of the donation. Also, there are several cases related to a current IRS compliance target: Conservation Easement Contributions. The IRS has seen aggressive tax positions for these type of transactions and is taking some of these cases to court to show they are serious about enforcing noncompliance.

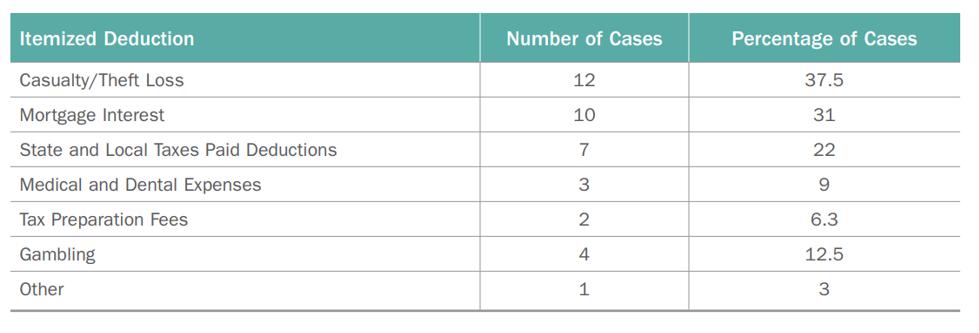

Issue #8: Itemized deductions

Number of cases in 2019: 32

Number of cases won by the IRS: 29 (91%)

How the case usually arises: An IRS audit. The most commonly disputed issues were:

Where you are likely to resolve this issue administratively before going to court: Similar to the charitable contribution disputes, taxpayers may attempt to resolve these issues during an audit. If resolving during the audit is not successful, many of these disputes are resolved in IRS appeals.

One future note: Itemized deduction disputes may start decreasing dramatically in the future as tax reform has reduced the number of itemizers from 43 million in 2018 (2017 returns) to 15 million in 2019 (2018 returns).

Issue #7: Relief from the failure to file/pay penalties and the estimated tax penalty

Number of cases in 2019: 34

Number of cases won by the IRS: 32 (94%)

How the case usually arises: A penalty abatement request and unresolved IRS appeal.

Where you are likely to resolve this issue administratively before going to court: Most of the litigated cases were taxpayers trying to show reasonable cause for late filing. Taxpayers with rejected penalty relief should always appeal if they believe that their argument warrants relief due to reasonable cause. Taxpayers can use a Service Center appeal or, if available, a Collection Due Process hearing to resolve the issue.

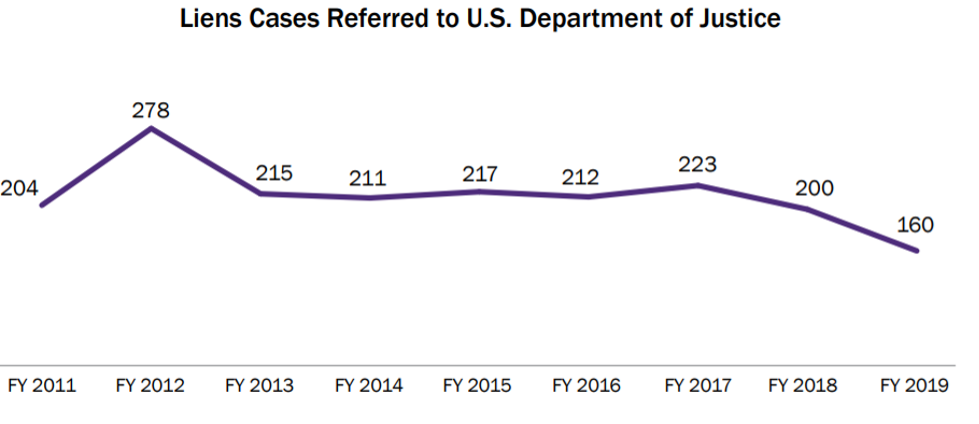

Issue #6: Enforcement of federal tax liens

Number of cases in 2019: 52

Number of cases won by the IRS: 48 (two were split decisions)

How the case usually arises: An IRS collection proceeding when the collection statute expiration date is imminent.

Where you are likely to resolve this issue administratively before going to court: The IRS (through the Department of Justice) can enforce a lien and foreclose on a property to pay outstanding tax debts. The IRS does not initiate an enforcement suit often. Usually, the IRS relies on its normal collection actions before this final attempt to collect before the statute of limitations expires. In fact, these suits are rare and are saved for high debt taxpayers who have assets the IRS can seize to pay their debt.

If a taxpayer is in this situation, their circumstances are dire and they often litigate to keep their property. The solution is a collection agreement with the IRS that precludes a foreclosure suit.

Issue #5: Enforcement of an IRS summons for information

Number of cases in 2019: 60

Number of cases won by the IRS: 56 (two cases were split decisions)

How the case usually arises: An IRS audit.

Where you are likely to resolve this issue administratively before going to court: Summons enforcement suits have been on the top ten most litigated issue list since 2005. These disputes arise when the IRS requests information in an audit or other compliance enforcement function, the taxpayer does not comply, the IRS issues a summons to force the taxpayer or a third-party to turn over information, and the taxpayer does not respond or attempts to quash the third-party summons. Many of these cases involve disputes as to whether an attorney-client privilege exists that protects disclosure of the information to a third-party – such as the IRS. Summons enforcement cases usually arise from complex field audits and/or contentious investigations by IRS compliance personnel.

Issue #4: Gross income

Number of cases in 2019: 72

Number of cases won by the IRS: 60 (7 cases were split decision)

How these disputes start: An IRS audit or CP2000 notice.

Where you are likely to resolve this issue administratively before going to court: These cases usually start with an audit or underreporter notice. The NTA report noted that discharge of indebtedness income was involved in several cases. Other common issues include gambling income, IRA distributions, and business income. Some cases were simple decisions on the taxability of unreported business gross receipts. One lesson from these cases: taxpayers often benefit from having representation and attempting to resolve the issue during the audit and subsequent appeal. Taxpayers who represented themselves did not prevail in any of their cases before the court. Overall, only 5 out of the 72 cases were won by the taxpayer.

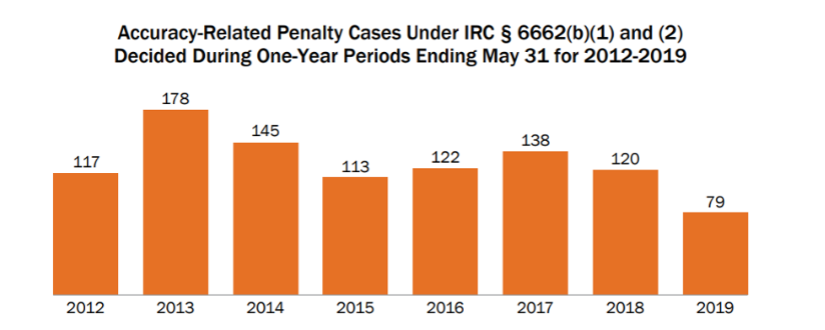

Issue #3: Accuracy related penalties

Number of cases in 2019: 79

Number of cases won by the IRS: 52 (2 cases were split decisions)

How these disputes start: An IRS audit or CP2000 notice.

Where you are likely to resolve this issue administratively before going to court: Challenging an accuracy penalty (negligence or substantial understatement) should always start with the IRS auditor. If the auditor does not see it your way, you should request a conference with their manager. If that fails, the last resort before heading to court is to go to IRS Appeals on this issue.

One common issue: Many accuracy penalties are automatically assessed from the IRS Automated Underreporter program (CP2000 notices). If the taxpayer has a reason to argue the penalty, they need to contest the penalty during the CP2000 notice. Many taxpayers fail to do so with the auditor or request an appeal on this issue. The results? They must contest the penalty in court prior to assessment.

Several accuracy cases have been heard that are testing the requirement for IRS managers to approve accuracy penalties in writing. The courts have also been hearing accuracy penalty cases in which an IRS manager did not provide their approval of the penalty as required under section 6751(b) of the Internal Revenue Code. Many taxpayers and their representatives have been requesting reconsideration of their accuracy penalty due to the IRS failure to meet their written approval requirements under section 6751(b).

Fewer audits have resulted in fewer court cases related to the accuracy penalty. There has been a significant drop in accuracy penalty cases. It is possible the IRS may not want to contest additional 6751(b) approval cases.

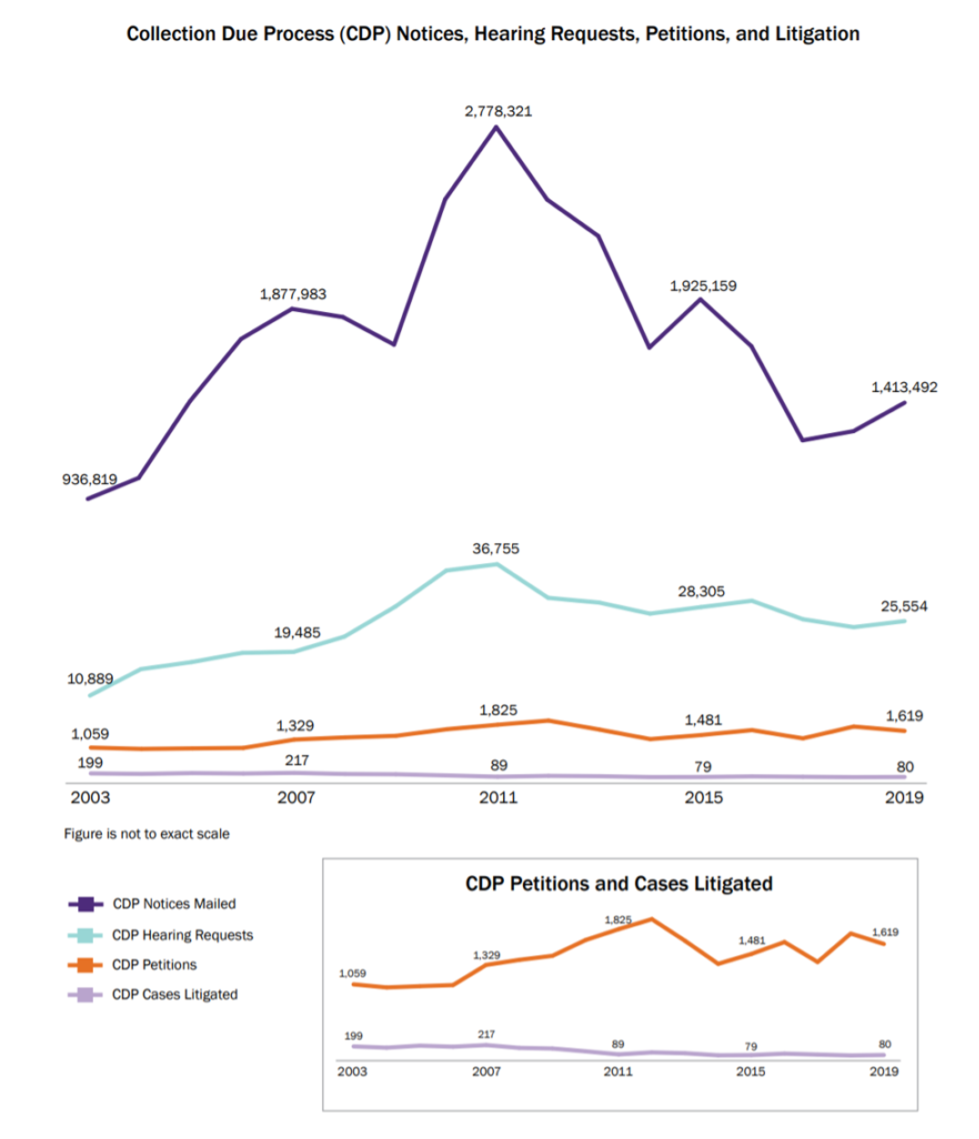

Issue #2: Contesting a Collection Due Process hearing appeals decision

Number of cases in 2019: 80

Number of cases won by the IRS: 74 (2 cases were split decisions)

How these disputes start: An IRS collection enforcement proceeding involving a lien or levy and a proposed collection alternative.

Where you are likely to resolve this issue administratively before going to court: Most IRS collection disputes do not make their way to court. Here are IRS statistics on the number of Collection Due Process (CDP) notices and how they were resolved:

Taxpayers have the ability to contest adverse collection actions with IRS personnel and other information appeals venues. The Collection Due Process (CDP) hearing was intended to protect taxpayer rights and provide a last resort to a substantive appeal before an adverse collection action. CDP hearings make sure that IRS collection personnel do not overstep their bounds and follow collection procedures. The key to avoiding the court (i.e., succeeding in appeals) is knowing the IRS procedures and options for collection.

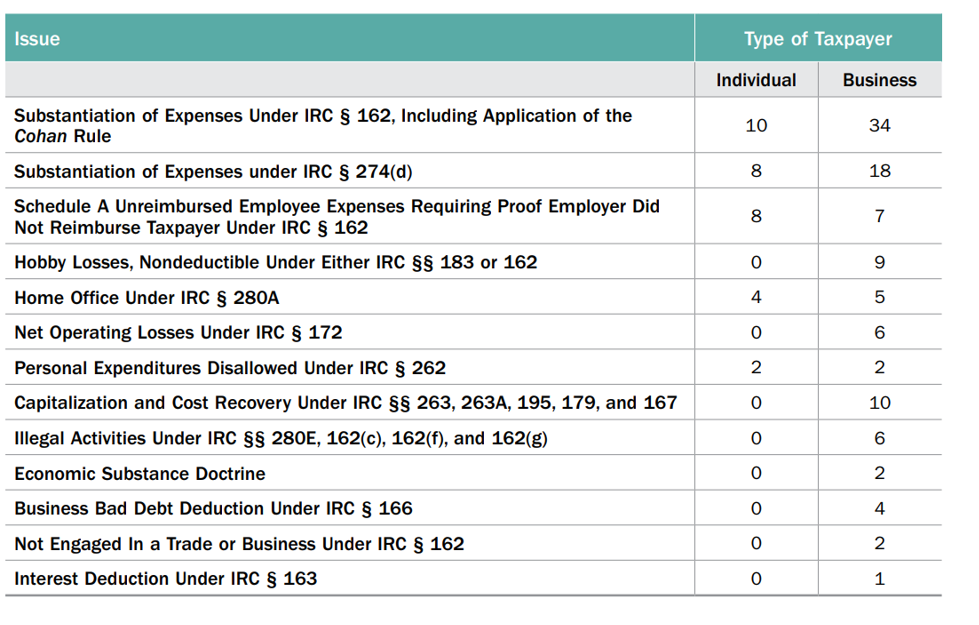

Issue #1: Trade or business expense deductions

Number of cases in 2019: 82

Number of cases won by the IRS: 61 (19 cases resulted in split decisions)

How these disputes start: An IRS audit.

Where you are likely to resolve this issue administratively before going to court: These cases can usually be resolved with the IRS auditor or their manager. In many cases, the taxpayer does not have documentation to prove the expense. Other common disputes involve whether the expense was ordinary and necessary or whether the expense was a capital expense.

Common issues include:

The reality: Most tax disputes never see the courthouse

Of the 524 cases that make up the ten categories of most litigated issues, taxpayers only prevailed in full or in part in 16% of the cases. However, that should not deter a taxpayer from contesting adverse IRS actions in an audit, underreporter notice, penalty relief determination, collection action or other IRS action.

Taxpayers need to exhaust their options at the IRS. Why? Because most tax issues are resolved within the IRS.

Most tax disputes with the IRS are usually settled administratively; long before the need for litigation. For example, the IRS resolves most penalty relief cases administratively. Each year, millions of taxpayers request and receive penalty relief through normal IRS channels. Meaning they make requests to IRS compliance functions, IRS accounts management, or in IRS Appeals. Only a few make their way to litigation.

The first place to start to resolve a problem is to work within IRS procedures and to exhaust your IRS appeal rights. This usually resolves the issue. Resolving the case in court is usually very expensive and may take years to resolve. This is not a practical remedy for most taxpayers.

Taxpayers need to take a judicious approach when dealing with the IRS administratively. This may result in a positive outcome for the taxpayer and help them avoid a long, involved dispute in court.

For assistance creating a strategy to address your tax issue, visit Jackson Hewitt’s Tax Resolution Hub to see the various ways we can help you.

Because trust, guarantees, convenience & money all matter

-

TRUSTED GUARANTEES.

Be 100% certain about your money & your taxes, year after year.

-

NATIONAL PRESENCE. LOCAL HEART.

We’re in your neighborhood & inside your favorite Walmart store.

-

40+ YEARS. 65+ MILLION RETURNS.

The kind of trusted expertise that comes with a lifetime of experience.