- Find an office

-

File Your Taxes

Find a Location

Find a Location -

Resolve Tax Issues

Resolve Tax Issues

Resolve Tax IssuesResolve Tax Issues

-

Tax Resources

See all Tax Help

See all Tax HelpTax Tools

Tax Tips & Resources

- Refund Advance

- Hiring Local Jobs!

- Tax Services

- Promotions & Coupons

- Where's My Refund

- Careers

- Search

- Contact Us

- Feedback

-

Log in | Sign up

Log in | Sign up

JH Accounts

|

|

Oh no! We may not fully support the browser or device software you are using ! To experience our site in the best way possible, please update your browser or device software, or move over to another browser. |

How do I file taxes if I’m self-employed and also have a W-2?

If you’re an employee and also self-employed, you’ll likely receive Form 1099-NEC, Nonemployment Compensation, and Form W-2, Wage and Tax Statement, to file your tax return.

Form 1099-NEC reports income you earned as a freelancer, contractor, or self-employed person. Any business you worked for as a non-employee should send you one. Form W-2 reports income you earned as an employee, and all your employers should send you one.

If you don’t receive a 1099-NEC from the client/business you worked for as a non-employee or a W-2 from your employer, you’re still responsible for reporting your income accurately to the IRS. You can reach out to the business to request a copy of Form 1099 or W-2. If that is unsuccessful, contact the IRS directly, who can reach out to your employer on your behalf.

If you receive an inaccurate W-2 or do not receive one from your employer and cannot get an accurate W-2, you can use Form 4852, Substitute for Form W-2, Wage and Tax Statement, to report your income.

Filing taxes with self-employment income in the mix can be complicated. The good news? Our Tax Pros are here all year and always ready to help. Book your appointment today.

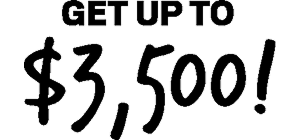

Money today, all day, every day! Terms apply.

With approved Tax Refund Advance loan on a prepaid card. Hurry in!

*This content is for general informational purposes only. It is not intended to be comprehensive and should not be construed as professional tax or financial advice for any specific individual tax situation. Taxpayers should always consult a qualified professional for individual guidance. This information constitutes a solicitation under the Treasury Department's Circular 230. Most offices are independently owned and operated.

Need money now?

Why wait for your tax refund when you could get money today!. Reserve your spot to apply for a Tax Refund Advance loan.

Find a locationSearch other topics

Because trust, guarantees, convenience & money all matter

-

TRUSTED GUARANTEES.

Be 100% certain about your money & your taxes, year after year.

-

NATIONAL PRESENCE. LOCAL HEART.

We’re in your neighborhood & inside your favorite Walmart store.

-

40+ YEARS. 65+ MILLION RETURNS.

The kind of trusted expertise that comes with a lifetime of experience.