- Find an office

-

File Your Taxes

Find a Location

Find a LocationFile Your Taxes

-

Resolve Tax Issues

Resolve Tax Issues

Resolve Tax IssuesResolve Tax Issues

-

Tax Resources

See all Tax Help

See all Tax HelpTax Tools

Tax Tips & Resources

- Refund Advance

- Promotions & Coupons

- Where's My Refund

- Hiring Local Jobs!

- Careers

- Search

- Contact Us

- Feedback

-

Log in | Sign up

Log in | Sign up

JH Accounts

|

|

Oh no! We may not fully support the browser or device software you are using ! To experience our site in the best way possible, please update your browser or device software, or move over to another browser. |

How do I avoid the 20% tax on my 401k withdrawal?

There are a few ways to avoid the 20% withholding on 401(k) withdrawals.

- Take out a series of substantially equal periodic payments (SEPPs) instead of a lump sum. If payments are made at least annually, they are not subject to the 20% withholding.

- Roll over the funds to another retirement account.

- If you need funds for a qualifying hardship, like for expenses related to repairing damage to your home, preventing foreclosure or eviction, a funeral or burial, or unreimbursed medical expenses, take out a hardship withdrawal.

- If your plan allows it, take out a loan from your 401(k). Typically, you’ll be required to pay back what you borrow within 5 years, and the interest you pay goes directly into your account.

It’s important to note that the 20% withholding is not extra tax, but rather a prepayment toward the federal tax you owe on the withdrawal of a lump sum. If you end up owing less than 20%, you’ll get the rest back as a tax refund.

Have questions or concerns about the 20% withholding on 401(k) withdrawals, or about how these withdrawals are taxed? Don’t guess. Talk taxes with the pros for real answers to your biggest tax questions. Book your appointment today.

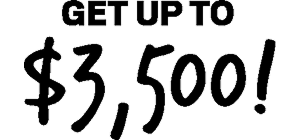

Money today, all day, every day! Terms apply.

With approved Tax Refund Advance loan on a prepaid card. Hurry in!

*This content is for general informational purposes only. It is not intended to be comprehensive and should not be construed as professional tax or financial advice for any specific individual tax situation. Taxpayers should always consult a qualified professional for individual guidance. This information constitutes a solicitation under the Treasury Department's Circular 230. Most offices are independently owned and operated.

Need money now?

Why wait for your tax refund when you could get money today!. Reserve your spot to apply for a Tax Refund Advance loan.

Find a locationSearch other topics

Because trust, guarantees, convenience & money all matter

-

TRUSTED GUARANTEES.

Be 100% certain about your money & your taxes, year after year.

-

NATIONAL PRESENCE. LOCAL HEART.

We’re in your neighborhood & inside your favorite Walmart store.

-

40+ YEARS. 65+ MILLION RETURNS.

The kind of trusted expertise that comes with a lifetime of experience.