- Find an office

-

File Your Taxes

Find a Location

Find a Location -

Resolve Tax Issues

Resolve Tax Issues

Resolve Tax IssuesResolve Tax Issues

-

Tax Resources

See all Tax Help

See all Tax HelpTax Tools

Tax Tips & Resources

- Where's My Refund

- Refund Advance

- Hiring Local Jobs!

- Tax Services

- Promotions & Coupons

- Careers

- Search

- Contact Us

- Feedback

-

Log in | Sign up

Log in | Sign up

JH Accounts

|

|

Oh no! We may not fully support the browser or device software you are using ! To experience our site in the best way possible, please update your browser or device software, or move over to another browser. |

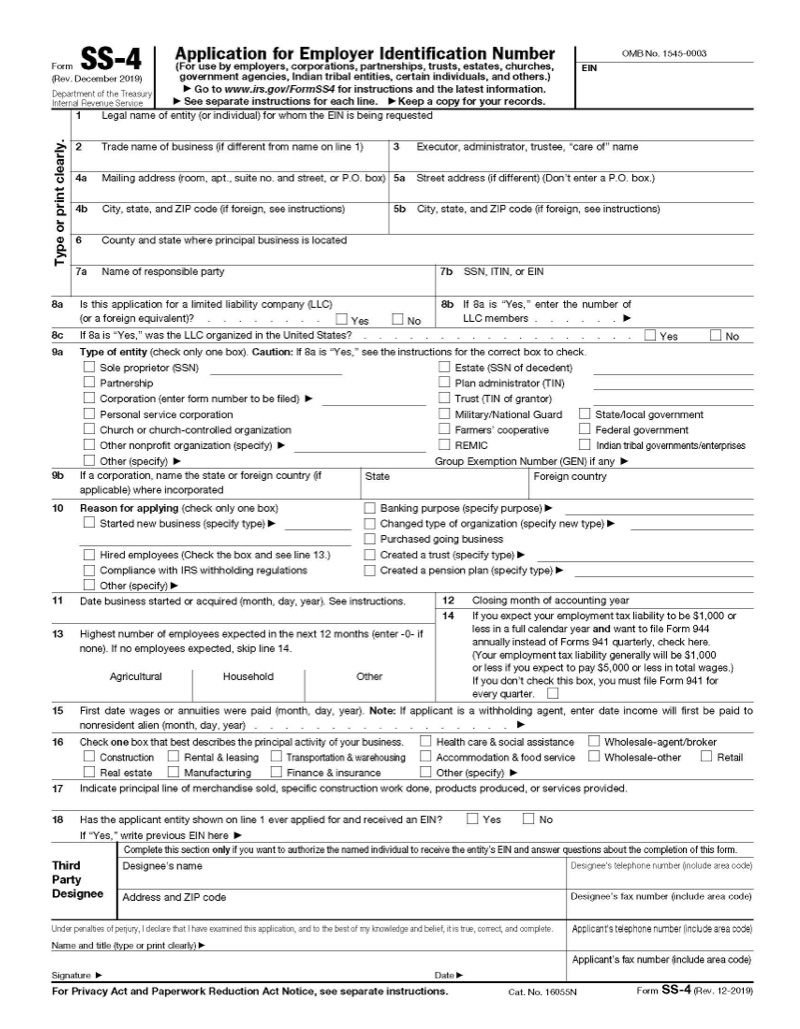

IRS FORMS: SS-4

Requesting an Employer Tax ID with Form SS-4

If you need an employer identification number (EIN), you need to file Form SS-4 or complete the IRS’ online application, where individuals or businesses could receive this number in minutes.

Why would I need an Employer Identification Number (EIN)?

Most people need an EIN when they decide to open a new business or hire employees. However, government agencies, nonprofit organizations, and trusts and estates also need to request EINs in order to pay vendors, hire employees, and file tax forms that are separate from the owners’ and managers’ personal finances.

While the word “employer” might suggest you have and are paying employees, you do not need to actually hire employees to apply for and use an EIN.

Even if you are a freelancer, have a side gig or operate as a sole proprietor with no employees, there are numerous benefits to using an EIN to file your taxes instead of your Social Security number. For example, EINs helps provide an extra layer of protection as enterprise-scale data breaches are becoming more common. A hacker who only possesses your EIN may not be able to do as much damage to your personal finances as they could if they gained access to your Social Security number.

When should I file Form SS-4 and receive my EIN?

If you plan on forming a business entity other than a Sole Proprietorship, you should wait until you have your approved articles of organization or corporate charter from the state where you formed your business. Once you have these documents, you should file for an EIN before you take other steps to formalize your operations, such as opening a business bank account.

If you are operating as a sole proprietorship without creating an actual business entity, you can request an EIN right away and immediately begin using it with your clients, bank accounts, and any other situations requiring a tax identification number.

Your EIN will be created instantly if you use the online application and the IRS will also mail a copy of the notice containing your new EIN. If you are filing SS-4 on paper, your EIN will arrive in 4-6 weeks, 8-10 weeks if you are outside the United States.

Do I need to file Form SS-4 again after receiving my EIN?

There are several situations where you are mandated to change your EIN. The most common reasons include:

- Winding down your current company and creating a new one

- A new partnership is formed after a partner exists or enters the current partnership

- You bought or inherited a business

- Bankruptcy proceedings

- New corporate charter issued by your state

- An estate operates a business after the owner dies

However, if you simply change the name or location of your business, you do not need to request a new EIN.

Because trust, guarantees, convenience & money all matter

-

TRUSTED GUARANTEES.

Be 100% certain about your money & your taxes, year after year.

-

NATIONAL PRESENCE. LOCAL HEART.

We’re in your neighborhood & inside your favorite Walmart store.

-

40+ YEARS. 65+ MILLION RETURNS.

The kind of trusted expertise that comes with a lifetime of experience.