- Find an office

-

File Your Taxes

Find a Location

Find a Location -

Resolve Tax Issues

Resolve Tax Issues

Resolve Tax IssuesResolve Tax Issues

-

Tax Resources

See all Tax Help

See all Tax HelpTax Tools

Tax Tips & Resources

- Where's My Refund

- Refund Advance

- Hiring Local Jobs!

- Tax Services

- Promotions & Coupons

- Careers

- Search

- Contact Us

- Feedback

-

Log in | Sign up

Log in | Sign up

JH Accounts

|

|

Oh no! We may not fully support the browser or device software you are using ! To experience our site in the best way possible, please update your browser or device software, or move over to another browser. |

IRS FORMS

Use IRS Transcripts to Identify your Stimulus Payments

Taxpayers have been using the IRS tool (“Get My Payment”) to check the amount and the date of their stimulus payment (i.e., the “economic impact payment” or “EIP”). In many cases, taxpayers have not been able to utilize this tool. Many taxpayers will need to know the amount of their payment when filing their 2020 and 2021 tax returns.

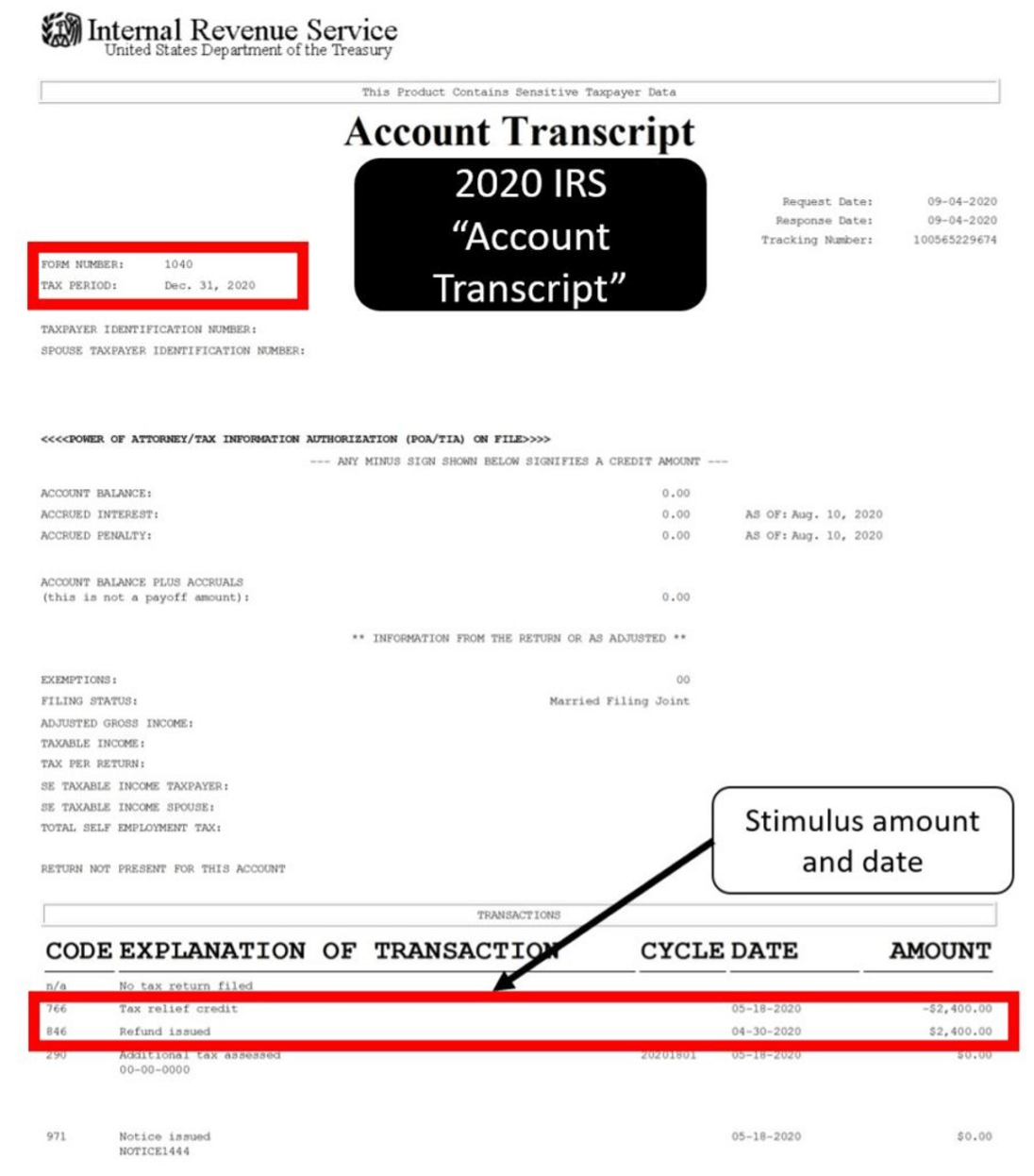

How can they get this information? Through an IRS account transcript! As of July 2020, taxpayers could find their stimulus information by accessing and reading their 2020 IRS account transcript. The 2020 IRS account transcript shows the amount and the date of the payment.

The second stimulus payment also showed on the 2020 account transcript. The third stimulus payment made in March 2021, will show up on the 2021 account transcript.

IRS Transcripts

Many taxpayers have no idea what an IRS transcript is. IRS transcripts are documents that contain detailed taxpayer information, tax history, and transactions with the IRS. There are 5 different types of IRS transcripts:

- Tax return transcript: This transcript is available for the current tax year and for returns processed in the previous 3 tax processing years. The “return transcript” provides most of the line items on the original filed tax return.

- Wage and income transcript: The Wage & Income transcript (W&I transcript) provides valuable information about the income reported to the IRS under a taxpayer identification number (I.e. SSN and more). The IRS has W&I transcripts available for the past 10 years. The W&I transcript is especially valuable to help file back returns, identify employment related tax identity theft, and for income verification. It also has a wealth of other income/asset information. For example, this transcript shows the balances of Individual Retirement Accounts (“IRA”) reported through Form 5498 to the IRS.

- Account transcript: The account transcript provides detailed information on activity on a taxpayer’s account. The account transcript can provide summary filing information and dates, payments made, refunds issued, refunds held or offset, compliance activity (like audits, collection actions, and notices), and stimulus payment information. Account transcripts can be difficult to understand as they contain IRS codes that need to be interpreted. For example, the stimulus payment is coded in the transaction section as two transaction codes that note a “tax relief credit” and “refund issued.” These two entries constitute the stimulus payment, but they can confuse taxpayers because of their double entries and different dates. Also, it is not explicit that this payment is the economic stimulus payment. This account transcript is available for the current tax year and up to 10 prior tax years.

- Record of account transcript: This transcript does not provide any information not already on the return and account transcript. The record of account transcript is simply a combination of the return and account transcript. This transcript is often used to help taxpayers with filing accurate amended tax returns because it provides original return information along with indicators of adjustments made to the return after it was filed.

- Verification of non-filing letter: This letter is a transcript that can be produced for a taxpayer to confirm that they did not file a tax return for that year. The letter was developed for taxpayers to use in obtaining some assistance programs.

The account transcript will contain most of the activity that taxpayers are interested in to understand post-filing actions and payments. The account transcript is available separately for each tax year. To understand a full tax history, taxpayers must obtain account transcripts for multiple tax years to see all of their transactions. For example, taxpayers would need to view their 2019 account transcript to see the amount of income that their stimulus payment was based on (or 2018 if no 2019 was filed) and their 2020 account transcript to see the stimulus payment that was made.

How to obtain the account transcript

The easiest way to get your account transcript is to set up an IRS online account. Taxpayers can go to “View your IRS account” on IRS.gov. Taxpayers will need to authenticate themselves to set up an account which includes having a cell phone and a financial account in their name. Many taxpayers have had issues with signing up with an IRS online account because they have not been able to authenticate their identities under the strict IRS authentication process.

If taxpayers cannot get their IRS account transcript through their IRS account, they can request it to be mailed to them. Taxpayers can go to the IRS website and request multiple transcripts to be sent to their last address using the IRS’s “Get Transcript” tool.

Tax Pros can get client transcripts and stimulus information

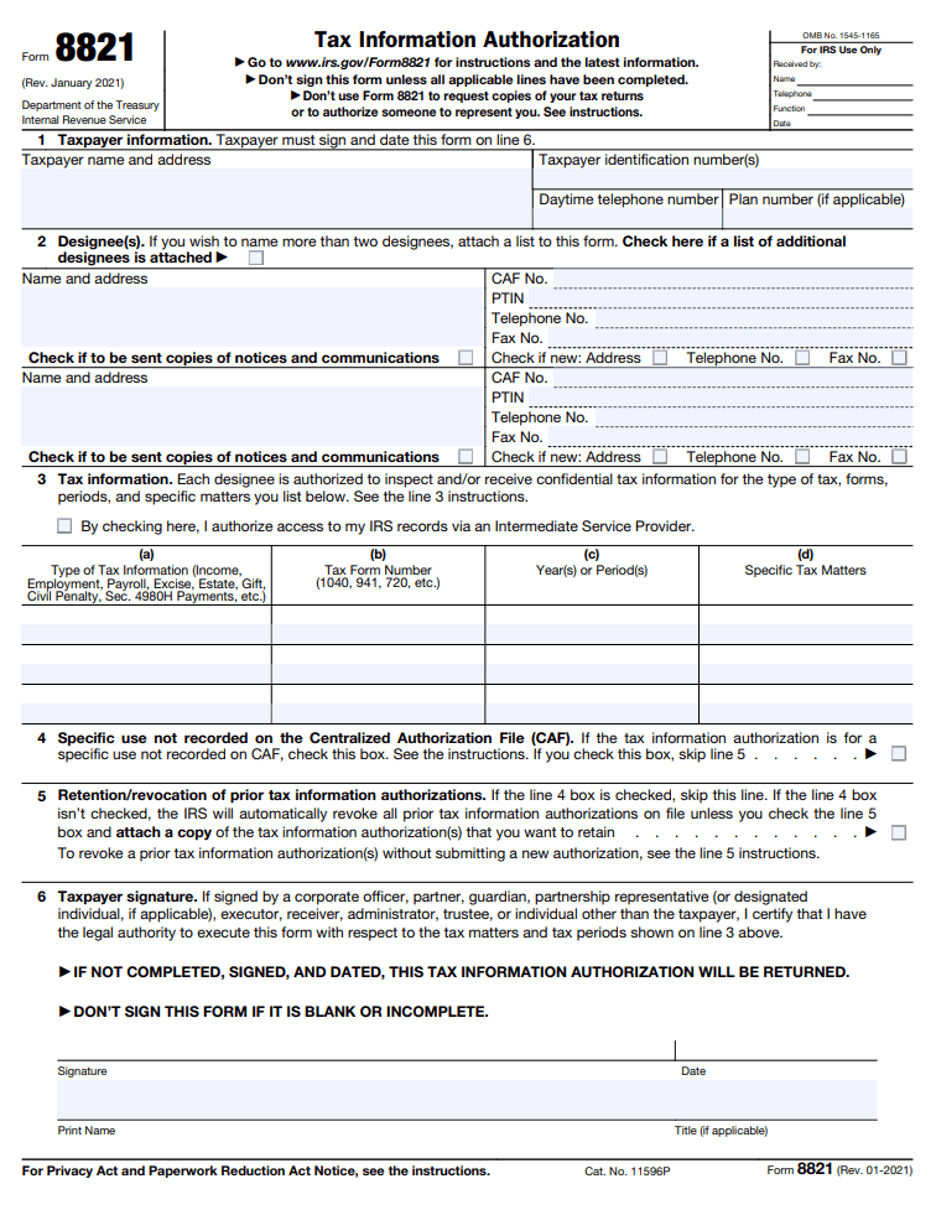

Another option that may be easier for taxpayers is to use their Tax Pro to get their tax information. Tax Pros who have an e-services account with access to the IRS electronic “Transcript Delivery System” (TDS) can routinely obtain their clients’ transcripts online after their client has authorized them to receive their tax information. Taxpayers can authorize their Tax Pro to access to their transcripts by using IRS Form 8821: Tax Information Authorization, or Form 2848, Power of Attorney and Declaration of Representative. Tax Pros can file this authorization by fax with the IRS (to the IRS’s Centralized Authorization File unit) and use their IRS e-services account to access their transcripts. Alternatively, Tax Pros can contact a special practitioner hotline (called the “Practitioner Priority Service”) and obtain the transcripts and account information for the taxpayer.

Taxpayers and Tax Pros may want to think about getting this authorization in anticipation of 2021 tax filing season question. It can take several weeks, depending on the state of IRS operations, to get a Form 8821 on record with the IRS to retrieve transcripts via TDS. During the pandemic, the IRS stopped processing Forms 8821 for over 3 months. Many taxpayers and Tax Pros who needed taxpayer account information wished they had filed Form 8821 in advance to access their transcripts. Getting IRS transcripts by mail was not available during this period.

Working with the IRS online

Currently, the IRS is in the beginning of a 6-year modernization effort. IRS modernization will include more online account features for taxpayers to get their information and interact with the IRS. In the future, taxpayers will likely find it easier to work with the IRS online. Taxpayers can get their stimulus payment information on their IRS account. Taxpayers can also get their stimulus payment details by accessing their IRS 2020 and 2021 account transcripts (when available).

Taxpayers and Tax Pros should consider filing Form 8821 as soon as possible. This allows the Tax Pro to use their IRS e-services account to quickly get their tax information. Thinking ahead may help taxpayers have their information even when the IRS is unreachable. For assistance creating a strategy to address your tax issue, visit Jackson Hewitt’s Tax Resolution Hub to see the various ways we can help you.

Because trust, guarantees, convenience & money all matter

-

TRUSTED GUARANTEES.

Be 100% certain about your money & your taxes, year after year.

-

NATIONAL PRESENCE. LOCAL HEART.

We’re in your neighborhood & inside your favorite Walmart store.

-

40+ YEARS. 65+ MILLION RETURNS.

The kind of trusted expertise that comes with a lifetime of experience.