- Find an office

-

File Your Taxes

Find a Location

Find a Location -

Resolve Tax Issues

Resolve Tax Issues

Resolve Tax IssuesResolve Tax Issues

-

Tax Resources

See all Tax Help

See all Tax HelpTax Tools

Tax Tips & Resources

- Where's My Refund

- Refund Advance

- Hiring Local Jobs!

- Tax Services

- Promotions & Coupons

- Careers

- Search

- Contact Us

- Feedback

-

Log in | Sign up

Log in | Sign up

JH Accounts

|

|

Oh no! We may not fully support the browser or device software you are using ! To experience our site in the best way possible, please update your browser or device software, or move over to another browser. |

IRS FORMS: 9465

IRS Installment Agreements Using Form 9465

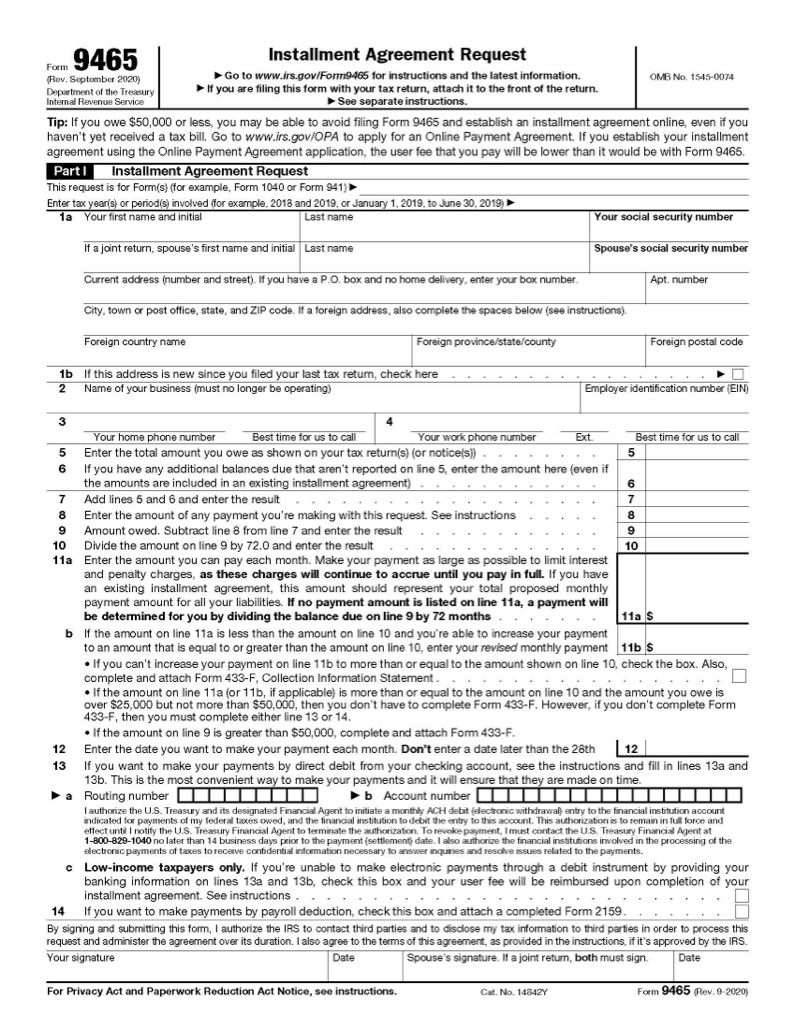

Form 9465 is used to request an installment agreement with the IRS when you can’t pay your tax bill when due and need more time to pay.

If you do not qualify for an online payment agreement, or do not wish to apply for an installment agreement online, you can submit Form 9465 by mail.

Is Form 9465 required if I use the IRS’ online tools to create a payment agreement?

Creating an online payment agreement will expedite the process and save you money. It also does not require filing Form 9465, although not all taxpayers are eligible. You may select a short-term payment plan (less than 180 days – 120 days for years other than 2020) or long-term plan. If you would like a long-term payment plan and owe less than $250,000 in taxes, penalties, and interest, or less than $100,000 if a short-term plan, you can apply for an online payment agreement.

If you do not qualify for an online payment agreement based on how much time you need and how much you owe, you must file Form 9465 to request an installment agreement.

The default payment term for an IRS installment agreement is 72 months (6 years), although you can always pay your balance due before then.

How much does an IRS installment plan cost?

There are setup charges to create an installment agreement. If you applied for an installment agreement online, it costs $31 for direct debit from your bank account and $149 for other payment methods like checks, money orders, and credit and debit cards. When paying with a debit or credit card there will be additional fees to the card agency. If you are filing Form 9465 or over the phone, the fees are $107 and $225, respectively.

Low-income taxpayers are eligible to have these fees waived or reduced.

The IRS will notify you within 30 days whether your request for an installment agreement was approved. If your agreement was not approved, this is typically due to current or prior year tax returns not being on file.

If your agreement is approved, you must make your payments on time and future tax refunds are applied toward your balance until it is paid off. Even if your tax refund was applied to the balance, you still must make your regular scheduled monthly payments.

Is an installment agreement right for my situation?

Installment agreements are long-term obligations for tax bills you cannot afford to pay upfront. If you anticipate that you can pay your entire balance in 180 days or less, interest will accrue on the balance, but you will not pay any additional fees.

If you are going through a financial hardship and do not believe you will be able to make monthly payments on an installment agreement on time, there are actions you can take to avoid collections activity. If the balance due would otherwise be affordable under an installment agreement but you currently cannot afford payments, you can request your account to be classified as temporarily uncollectible then apply for an online payment agreement or file Form 9465 at a later date. Penalties and interest continue to accrue while your account is in an uncollectible status.

Because trust, guarantees, convenience & money all matter

-

TRUSTED GUARANTEES.

Be 100% certain about your money & your taxes, year after year.

-

NATIONAL PRESENCE. LOCAL HEART.

We’re in your neighborhood & inside your favorite Walmart store.

-

40+ YEARS. 65+ MILLION RETURNS.

The kind of trusted expertise that comes with a lifetime of experience.