- Find an office

-

File Your Taxes

Find a Location

Find a Location -

Resolve Tax Issues

Resolve Tax Issues

Resolve Tax IssuesResolve Tax Issues

-

Tax Resources

See all Tax Help

See all Tax HelpTax Tools

Tax Tips & Resources

- Where's My Refund

- Refund Advance

- Hiring Local Jobs!

- Tax Services

- Promotions & Coupons

- Careers

- Search

- Contact Us

- Feedback

-

Log in | Sign up

Log in | Sign up

JH Accounts

|

|

Oh no! We may not fully support the browser or device software you are using ! To experience our site in the best way possible, please update your browser or device software, or move over to another browser. |

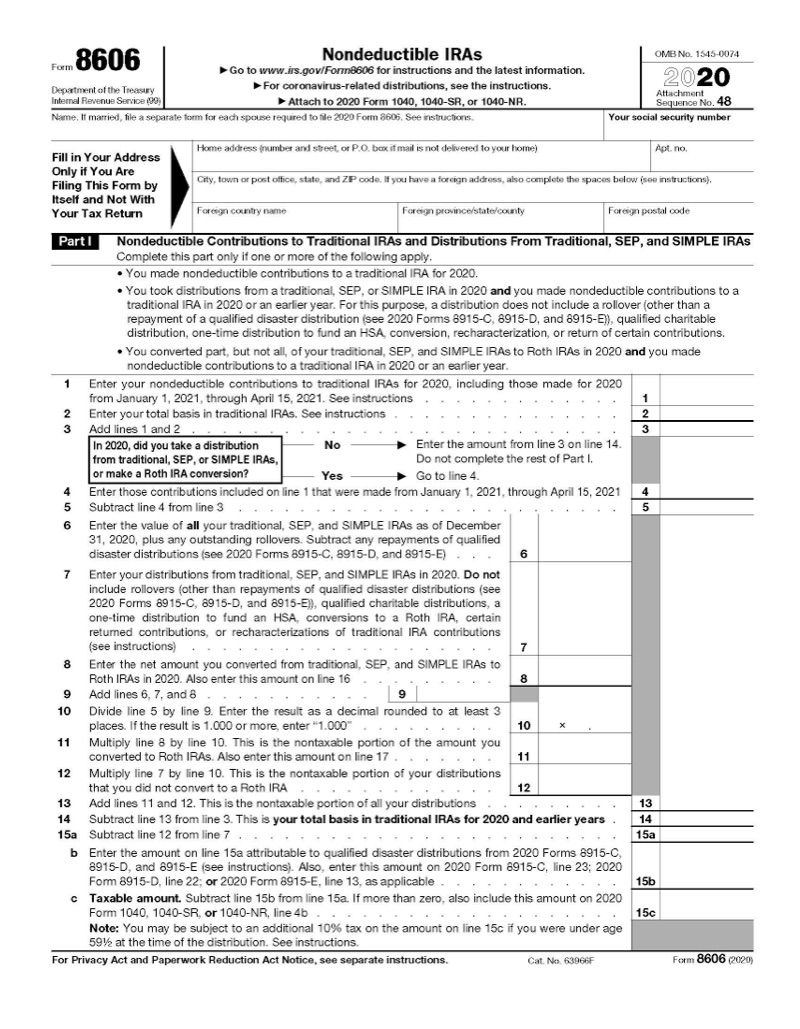

IRS FORMS: FORM 8606

Reporting Nondeductible IRAs on Form 8606

Are you contributing to a traditional or Roth IRA? You may need an IRS Form 8606. Learn more on this form and how to fill it out.

What gets reported on Form 8606?

Form 8606 is used to report a variety of transactions related to traditional individual retirement agreements (IRAs), Roth IRAs, and other types of retirement plans like SEP-IRAs and SIMPLE IRAs.

The main reasons for filing Form 8606 include the following:

- Contributing to a nondeductible traditional IRA

- Converting a “pre-tax” traditional, SEP, or SIMPLE IRA to a Roth IRA

- Early distributions from Roth IRAs

What is a nondeductible IRA?

Informally known as a “backdoor IRA,” a nondeductible IRA is a traditional IRA with contributions made with after-tax dollars.

Taxpayers who have traditional IRAs may opt to contribute to them despite the not being able to, or choosing not to, deduct their contribution. If you and/or your spouse do not have access to an employer-sponsored retirement plan at work, there are fewer restrictions on deducting IRA contributions.

Non-deductible contributions should be reported on Form 8606 to prevent double taxation of your IRA distributions in the future. A traditional IRA means you are deferring the taxation of the interest earned and all contributions you deduct until you make withdrawals from your account. You would receive a deduction in the year of contribution, then owe taxes on the distributions when you take them. A nondeductible IRA has a basis, an amount you already paid taxes on, and a pro-rated portion of each distribution is non-taxable.

How does IRA conversion impact my taxes?

A Roth IRA is an IRA with no allowed deduction on contributions, but any distributions in later years are completely tax-free. This means the earnings in a Roth IRA are not taxable and a Roth account doesn’t require distributions at any age.

Converting a pre-tax plan like a traditional IRA to a Roth IRA can be beneficial, but can also carry tax consequences in the year of conversion.

If you choose to convert your traditional plan to a Roth, you will need to file Form 8606.

The amount of the IRA converted to the Roth will be treated as ordinary income not subject to the additional 10% tax if you are under age 59 1/2 at the time of conversion. The taxable amount of the conversion is the amount that was deductible from income when contributed to the account. If you weren’t able to deduction all of your previous traditional IRA contributions, the non-deductible portion is not taxable during a conversion.

Generally, there is no withholding when accounts are fully or partially converted, so be prepared to pay estimated taxes when you convert to a Roth IRA and to possibly pay taxes when you file your return.

Are early Roth IRA distributions taxable?

If you are under age 59 1/2 at the time of receiving a Roth IRA distribution, you may owe taxes and early withdrawal penalties on the amount withdrawn. Currently, the early withdrawal provision has been suspended through 2021 for COVID related distributions.

Form 8606 is used to report the amount distributed, how long the assets have been held in the account, and if your distribution meets an exception (such as being a first-time homebuyer). If the assets have remained in the Roth IRA for five years or longer after the contributions, you may be subject to fewer or no early withdrawal penalties.

Form 8606 does not need to be completed if you are over age 59 ½ at the time you received Roth IRA distribution

Because trust, guarantees, convenience & money all matter

-

TRUSTED GUARANTEES.

Be 100% certain about your money & your taxes, year after year.

-

NATIONAL PRESENCE. LOCAL HEART.

We’re in your neighborhood & inside your favorite Walmart store.

-

40+ YEARS. 65+ MILLION RETURNS.

The kind of trusted expertise that comes with a lifetime of experience.