- Find an office

-

File Your Taxes

Find a Location

Find a Location -

Resolve Tax Issues

Resolve Tax Issues

Resolve Tax IssuesResolve Tax Issues

-

Tax Resources

See all Tax Help

See all Tax HelpTax Tools

Tax Tips & Resources

- Where's My Refund

- Refund Advance

- Hiring Local Jobs!

- Tax Services

- Promotions & Coupons

- Careers

- Search

- Contact Us

- Feedback

-

Log in | Sign up

Log in | Sign up

JH Accounts

|

|

Oh no! We may not fully support the browser or device software you are using ! To experience our site in the best way possible, please update your browser or device software, or move over to another browser. |

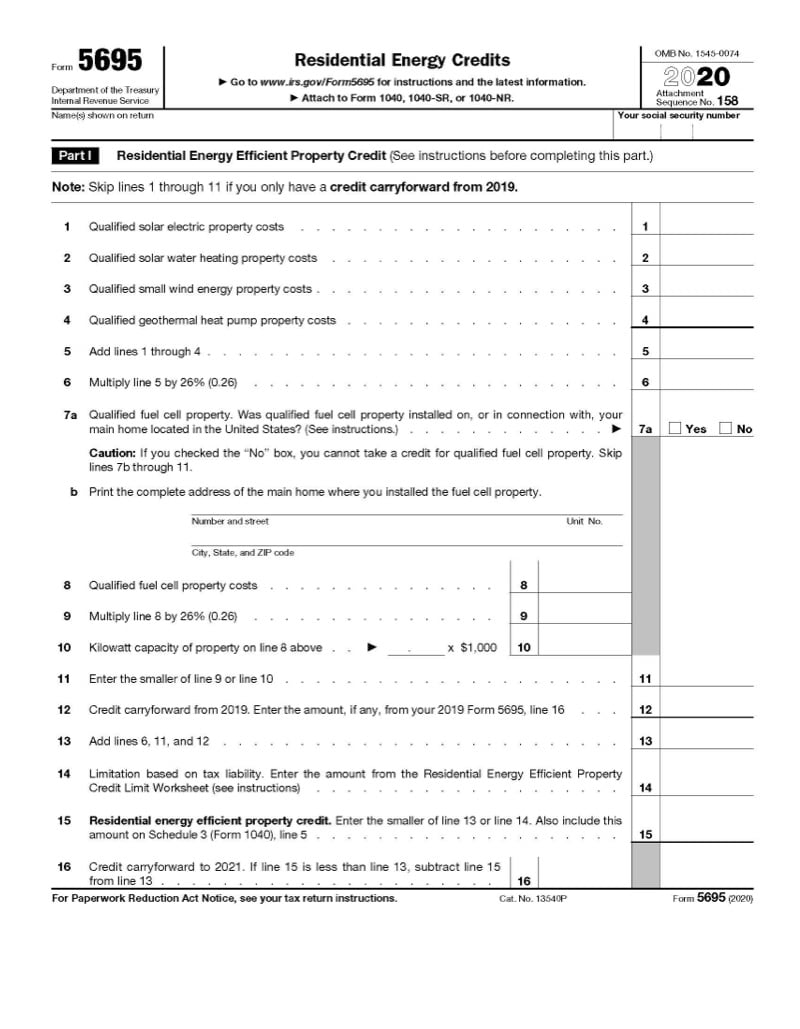

IRS FORMS: FORM 5695

Claiming Residential Energy Credits with Form 5695

What is IRS Form 5695? Learn about claiming residential energy credits using Form 5695 here.

What is Form 5695?

The IRS offers two different tax incentives for making energy-efficient home improvements and major infrastructure overhauls to your home, such as geothermal pumps, energy-efficient windows, solar panels, and other green technologies and sustainable energy investments.

The residential energy-efficient property credit, best known as the residential energy credit and most commonly claimed by homeowners, is claimed in Part I of Form 5695. The nonbusiness energy property credit is claimed in Part II.

Residential energy credit

The residential energy credit is based on a percentage of the cost paid for eligible energy-saving home improvements. You must own the residence in order to claim this credit, and leasehold improvements on rentals do not qualify. However, it does not need to be your primary residence.

Eligible improvements include:

- Solar electric panels

- Solar water heating

- Wind energy apparatuses

- Geothermal heat pumps

- Qualified fuel cells (up to $500 per 1/2 kilowatt of cell capacity)

For energy-efficient property placed into service in 2020, the credit is worth 26% of the improvement costs. The residence can also be new construction and installation expenses are eligible for the credit.

The residential energy credit is limited by your tax liability and can be carried forward to future tax years if your eligible home improvement costs exceed your tax liability. While the credit percentage wanes in future tax years due to the 2018 tax reform, the 26% threshold is still effective (30% for prior years) based on the date the energy-efficient property is placed into service.

Nonbusiness energy property credit

The nonbusiness energy property credit has a lifetime limitation, as well as limitation based on tax liability similar to the residential energy credit. This credit is currently scheduled to sunset in 2021.

The nonbusiness energy property credit is only available to taxpayers who did not claim more than $500 in residential energy credits in prior tax years with additional restrictions. Any tax credits received in prior years, even as far back as 2005, must be subtracted from the lifetime credit cap of $500.

Unlike the residential energy credit, the nonbusiness energy property credit can only be applied to your primary residence if it is not new construction. Qualified improvements include:

- Central air conditioning

- Energy-efficient doors and windows

- Roofing, asphalt, and insulation that improves energy flow

Some energy-efficient products have specific dollar caps, such as $150 for gas, propane, and oil furnaces while central air conditioning has a $300 limit. While installation costs generally qualify for under the residential energy credit, not all installation costs count for the nonbusiness energy property credit. For instance, installation costs are not eligible for energy-efficient insulation and roofing upgrades are limited to $500.

Regardless of which improvements you opt for, there is a $500 lifetime limit for the nonbusiness energy property credit. There is no limit on the residential energy credit which offer more opportunities for current and future tax and energy savings.

Because trust, guarantees, convenience & money all matter

-

TRUSTED GUARANTEES.

Be 100% certain about your money & your taxes, year after year.

-

NATIONAL PRESENCE. LOCAL HEART.

We’re in your neighborhood & inside your favorite Walmart store.

-

40+ YEARS. 65+ MILLION RETURNS.

The kind of trusted expertise that comes with a lifetime of experience.