- Find an office

-

File Your Taxes

Find a Location

Find a Location -

Resolve Tax Issues

Resolve Tax Issues

Resolve Tax IssuesResolve Tax Issues

-

Tax Resources

See all Tax Help

See all Tax HelpTax Tools

Tax Tips & Resources

- Where's My Refund

- Refund Advance

- Hiring Local Jobs!

- Tax Services

- Promotions & Coupons

- Careers

- Search

- Contact Us

- Feedback

-

Log in | Sign up

Log in | Sign up

JH Accounts

|

|

Oh no! We may not fully support the browser or device software you are using ! To experience our site in the best way possible, please update your browser or device software, or move over to another browser. |

IRS FORMS: FORM 4868

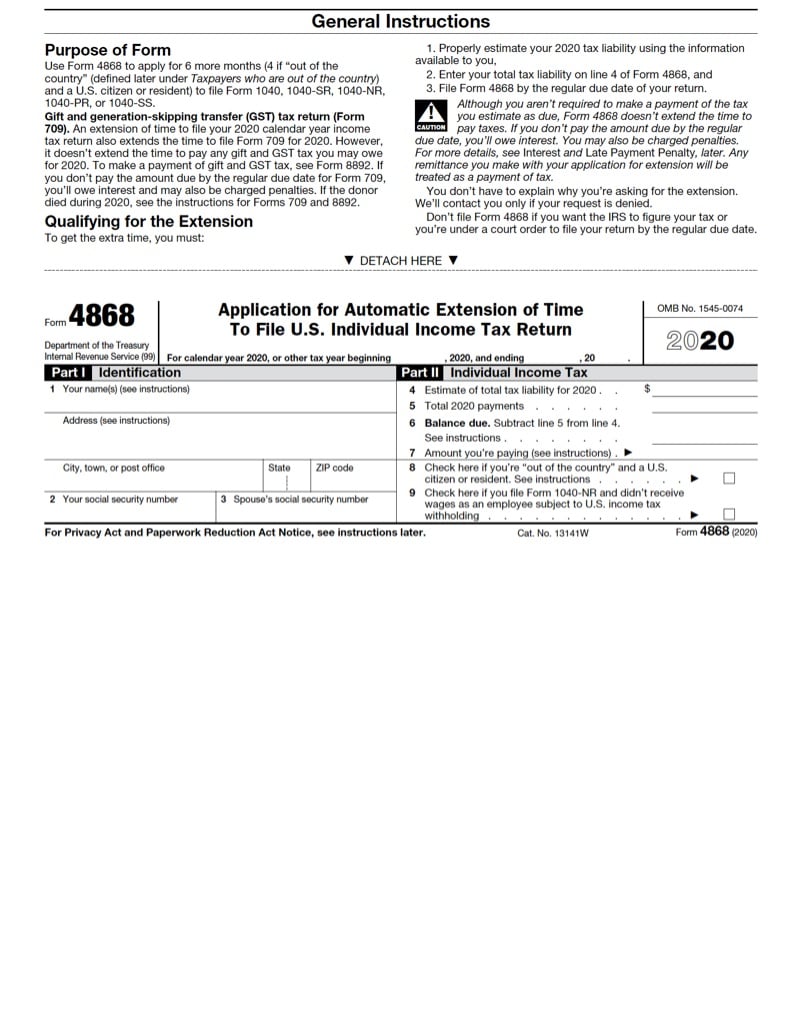

Using Form 4868 to Get a Tax Filing Extension

What is IRS Form 4868? Learn the basics of Form 4868 and filing an extension for tax returns.

How does filing for extension work?

Filing Form 4868 grants individual taxpayers six additional months from their tax return’s deadline (generally, April 15th of the following year) to file their individual tax return without being charged a late filing penalty. A valid, timely extension request extends the deadline to October 15th for a majority of individual taxpayers.

Ultimately, filing Form 4868 grants additional time to prepare and file one’s tax return. It does not extend the time to pay your balance due if you owe taxes. Interest and penalty charges will accrue until the balance due is paid even if the taxpayer files Form 4868. Interest does not accrue on a tax refund that is received after April 15th.

You do not need to provide the IRS with a reason for why you are requesting an extension. All you need to do is file the form by the tax filing deadline and estimate how much your balance due is.

Do I need to file Form 4868 if I am out of the country?

US citizens living abroad get an automatic two-month extension until June 15th to file their US tax returns. If June 15th is sufficient time to get your tax return prepared and filed, you do not need to request an extension.

However, you are considered “out of the country” by meeting the physical presence or bona fide residency test. If you need more time, filing Form 4868 grants an additional four-month extension through October15th.

Is form 4868 necessary if the IRS declares automatic extensions in some regions?

Automatic extensions that apply to regions affected by natural disasters, such as the Texas winter storm, or the entire U.S. from COVID-19, related extensions do not require Form 4868.

If you file for an extension and live or operate a business in the affected region, the IRS disaster declaration generally provides the length of extension for various tax forms and payments.

Can I skip Form 4868 and file for an extension online?

Most individual taxpayers file using a calendar year and the standard April 15th deadline. However, you must file Form 4868 on paper if you file taxes using a fiscal year.

If you would like to file Form 4868 electronically on your own, you may do so with Free File. You are then required to estimate your balance due and include full or partial payment. Payment is not required with Form 4868, but it is recommended if you are able to pay some or all of your estimated balance due in order to minimize interest and potential penalties.

Payment can also be made any time through IRS DirectPay or EFTPS separately of filing Form 4868, to minimize the impacts of any potential interest and penalties.

Because trust, guarantees, convenience & money all matter

-

TRUSTED GUARANTEES.

Be 100% certain about your money & your taxes, year after year.

-

NATIONAL PRESENCE. LOCAL HEART.

We’re in your neighborhood & inside your favorite Walmart store.

-

40+ YEARS. 65+ MILLION RETURNS.

The kind of trusted expertise that comes with a lifetime of experience.