- Find an office

-

File Your Taxes

Find a Location

Find a Location -

Resolve Tax Issues

Resolve Tax Issues

Resolve Tax IssuesResolve Tax Issues

-

Tax Resources

See all Tax Help

See all Tax HelpTax Tools

Tax Tips & Resources

- Where's My Refund

- Refund Advance

- Hiring Local Jobs!

- Tax Services

- Promotions & Coupons

- Careers

- Search

- Contact Us

- Feedback

-

Log in | Sign up

Log in | Sign up

JH Accounts

|

|

Oh no! We may not fully support the browser or device software you are using ! To experience our site in the best way possible, please update your browser or device software, or move over to another browser. |

IRS FORMS: FORM 2848

What You Need to Know About Form 2848, Power of Attorney with the IRS

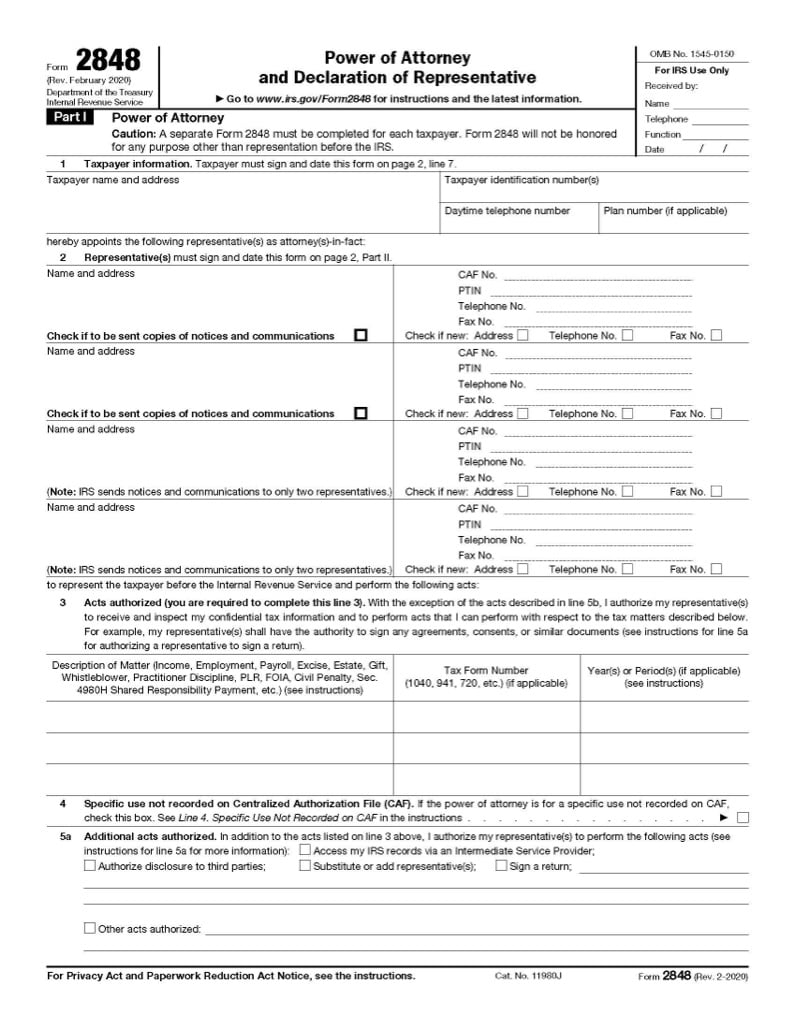

Form 2848 is filed with the IRS when you wish to grant someone Power of Attorney (POA) with respect to your federal tax matters.

What is Form 2848?

Specifically, a valid Form 2848 grants the listed representative(s) power to do the following:

- Sign documents on your behalf

- Speak with IRS officials concerning your tax matters

- Sign agreements and waivers

- Receive notices and other IRS communications designated for you, if you consent to this by checking the appropriate box

A POA on file with the IRS does not authorize the representative(s) to sign your tax returns, give tax information to third parties, or deposit your refund checks unless you explicitly grant permission for any of these actions and designated representative is eligible to do so. Tax preparers may not sign a client’s tax return or endorse or deposit a client’s refund check at any time.

Up to two representatives may be designated on Form 2848. If you want to submit a POA to invalidate prior authorizations granted to other representatives, you must check the box on Line 6.

Power of attorney can also be revoked at any time by you or your representative.

Why would I need to give someone Power of Attorney?

Many taxpayers have unresolved tax issues that require frequent contact with the IRS and/or pertain to tax matters that they would rather delegate to a tax professional. Having an active POA on file enables the professional to minimize contact between the taxpayer and the IRS to help expedite resolution of the tax issue in question.

Individuals are not the only parties who can authorize POA with a representative. Businesses, estates, and other organizations can appoint representatives to the IRS in order to focus their time and resources on operations instead of tax matters.

You can limit the areas your Tax Pro is authorized to deal with on Form 2848. For example, if you have business tax filings under audit, you can elect to have your Tax Pro only speak with the IRS regarding the business form series and not your personal taxes. You can also limit their authority to certain tax years.

Who is eligible to have Power of Attorney for my tax matters?

The following tax professionals can be authorized representatives, and discuss any of a taxpayer's issues with the IRS:

- Attorneys

- Certified Public Accountants

- Enrolled Agents

Representatives in the following categories have limited powers, extending only to the tax matters in which they were engaged:

- Enrolled Actuaries

- Enrolled Retirement Plan Agent

- Unenrolled Return Preparers such as the Annual Filing Season Participant

- Qualified Students in Student Tax Clinic Programs and Low-Income Taxpayer Clinics

Taxpayers can also be represented by their spouse or parents, children, siblings, grandparents, stepparents, and stepchildren. Aunts, uncles, cousins, and stepsiblings cannot represent a taxpayer under the family member designation.

For business POA authorizations, officers of the organization and full-time employees of the taxpayer may represent them.

Does Form 2848 also work for state tax matters?

Form 2848 does not have reciprocity with all state tax agencies. If you need representation for state tax matters, you will need to have a the appropriate POA on file with the applicable state tax department. Each state may have different rules regarding the limits of a POA, as well eligible requirements.

Because trust, guarantees, convenience & money all matter

-

TRUSTED GUARANTEES.

Be 100% certain about your money & your taxes, year after year.

-

NATIONAL PRESENCE. LOCAL HEART.

We’re in your neighborhood & inside your favorite Walmart store.

-

40+ YEARS. 65+ MILLION RETURNS.

The kind of trusted expertise that comes with a lifetime of experience.