- Find an office

-

File Your Taxes

Find a Location

Find a Location -

Resolve Tax Issues

Resolve Tax Issues

Resolve Tax IssuesResolve Tax Issues

-

Tax Resources

See all Tax Help

See all Tax HelpTax Tools

Tax Tips & Resources

- Refund Advance

- Hiring Local Jobs!

- Tax Services

- Promotions & Coupons

- Where's My Refund

- Careers

- Search

- Contact Us

- Feedback

-

Log in | Sign up

Log in | Sign up

JH Accounts

|

|

Oh no! We may not fully support the browser or device software you are using ! To experience our site in the best way possible, please update your browser or device software, or move over to another browser. |

We can help resolve your tax issues. Call (855) 580-9375 today.

IRS AUDITS & TAX NOTICES

IRS audit priorities

There has always been a big mystery among taxpayers and tax professionals on how the IRS selects taxpayers for an audit and what issues are important to the IRS. Taxpayers always want to know the chances that they will be audited and what triggers an IRS audit.

The reality is that most IRS audits are mail inquiries related to issues that the IRS sees as obvious errors, such as not qualifying for the earned income tax credit. In fact, more than 7 out of 10 audits are mail audits. Likely mail audit targets are those taxpayers who make obvious errors on their return. In mail audits, the IRS has a 90% change rate meaning many taxpayers owe additional tax as a result of the IRS audit selection process. These audits are usually not very intrusive and can be handled in a one-time response to the IRS.

What taxpayers generally fear most is the IRS office or field audit. These audits are much more than a review of line items on the tax return. In these audits, the IRS may also be looking for what is NOT on the return. These comprehensive audits form many of the nightmare stories taxpayers have about interacting with the IRS. They are also the source of most of the IRS’s criminal prosecution cases.

Face-to-face audits: the “real” IRS audit

When it comes to IRS audits that people fear most (face-to-face audits), taxpayers can be selected for several reasons. A Treasury Inspector General for Tax Administration (TIGTA) audit report illustrated the 10 common audit selection areas employed by the IRS to decide what individual taxpayers will be audited. These 10 examination areas show IRS audit priorities.

Here are the 10 priority areas with a brief explanation of who they are targeting:

|

IRS audit selection category |

The audit targets |

| National Research Program (NRP) |

These are random audits done by the IRS to study an area of noncompliance. If a taxpayer is selected for an NRP exam, watch out. The IRS is gathering data and usually does a thorough job of looking closely into the taxpayer’s finances. Over the years, there have been many complaints about these audits. Seemingly benign tax returns have been randomly selected but have gone through months of IRS audit work – all in an effort for the IRS to gather information so that they can do a better job in selecting others for an audit. The complaint- that is a lot of taxpayer burden for IRS learnings. Isn’t there a better way? The IRS has not found one yet. |

| Promoters and Return Preparer Strategies (P&RP) | If a tax preparer has been singled out for a compliance project, watch out clients. The IRS will pull the preparer’s returns and start auditing most, if not all of them, to investigate the preparer for penalties. Included in this category are promoters who provide taxpayers a deal that is too good to be true (and the IRS knows it). The promoters are also signed out for penalties, injunctions, and prosecution. |

| Offshore | The IRS likes to audit anything that appears to have abusive issues related to offshore accounts or international issues. The IRS much more information now in this area because of the FATCA reporting. This priority area is here to stay at the IRS. Taxpayers with “international” aspects on their return saw a 5.2% audit rate in 2017. |

| Abusive Transactions | IRS focuses on specific domestic abusive transactions, including tax shelter activity. Interestingly, the IRS has not done a lot of exams in this area lately, but it is still in the top ten priority list. Some of the IRS “Dirty Dozen ” tax scams fall into this category of audits. |

| High income/High wealth (HIHW) | “Have money, will audit” has always been an IRS mantra. The IRS has slipped lately in the number of high wealth audits. Individual taxpayers making over $1,000,000 had a 4.4% audit rate in 2017- down from prior years where taxpayers in the HIHW category saw audit rates in excess of 10%. |

| Unreported and Underreported Income | Cash businesses, online sales, Forms 1099-K recipients, cryptocurrency – these and more are targets of the IRS. Many an IRS fraud case has started from the unreported income audit. In these audits, taxpayers face a good deal of scrutiny over their finances, banking transactions, net worth, and business operations. In the end, these are very long audits done by suspicious IRS agents. |

| Special Enforcement and Fraud Programs | The IRS has always had SEP agents tracking illegal income and pursuing taxes, penalties, and jail time. Taxpayers know when they are in this category because other law enforcement agencies are usually chasing (or done chasing) the taxpayer under audit. |

| Other priority programs | These are projects that the IRS does that have unique compliance issues. For example, individual taxpayers who have an S corporation loss – the IRS will audit these taxpayers and look to see if they have enough basis to deduct the loss. Another area is rental property owners- a favorite of the IRS because of the high audit change rates in these exams. |

| Discriminant Function (DIF) | These are the computer selected audits based on their probability of change. The taxpayer’s DIF score represents their likelihood of a change. The TIGTA report was critical of the DIF algorithm (by the way, the NRP audits are done to update the DIF score). Out of all the 10 priority areas, DIF returns had the greatest number of audits, but had one of the highest no-change rates at 12%. |

| All other | If it falls outside of the other 9 areas, it is an “other.” These are usually legacy projects that the IRS is still pursuing and doing audits. |

Less field audits but high no-change rates

The IRS uses many of its field auditors (called revenue agents) for business and specialty tax (employment, trusts, tax-exempts, employee plans, etc.) audits. These days there are few IRS field audits of individuals. However, when the IRS audits these individuals, the chances of a change are high. Typically, 89% overall.

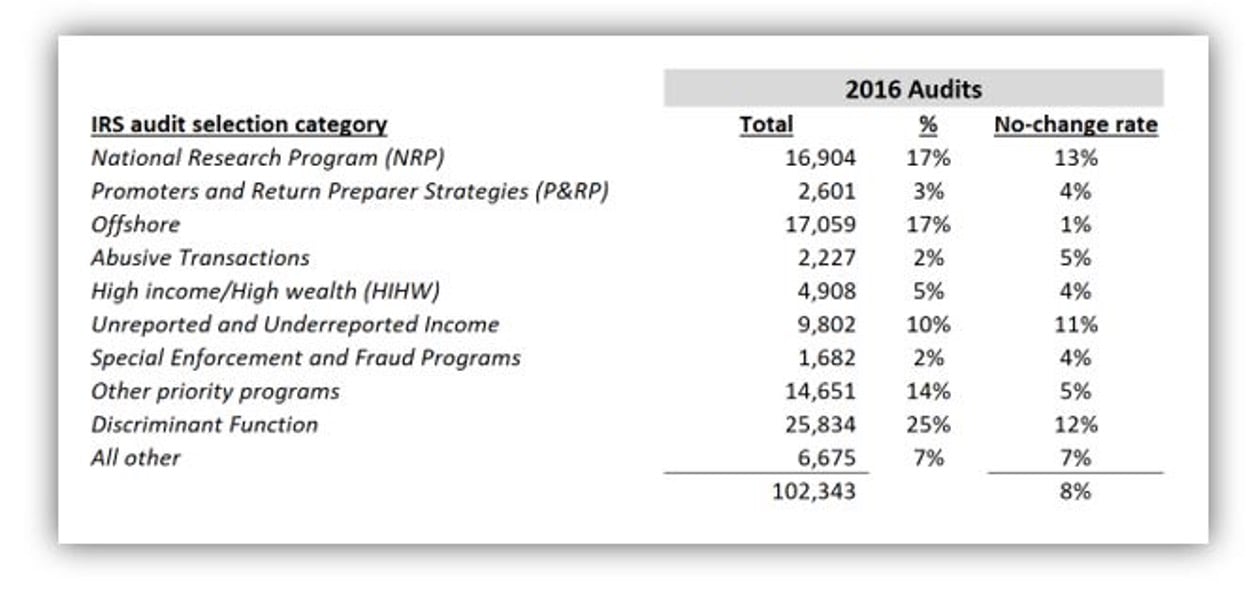

For the 10 priority areas, here is the # of audits and the no-change rates:

Avoiding an IRS audit

There are a few ways to stay under the IRS’s radar for an audit:

- Don’t engage with risky tax preparers

- Avoid abusive tax schemes and “too good to be true” tax saving transactions

- Stay away from international issues and offshore accounts. If you do have these transactions and accounts, report them properly

- Report all your income

- Don’t do anything illegal (IRS likes to piggyback on taxing reported illegal activities)

- Prepare and file an accurate tax return

For most individuals, this list is easy but will not guarantee relief from an audit. If you make more than $1 million, have a cash-based small business, or fall into another project of interest at the IRS, you have a higher risk of audit. . Also, the IRS focuses on “large, unusual, and questionable items” on a return. These make it past IRS screeners and into the hands of revenue agents to audit.

Although your chances of an audit may appear to be small, the best defense is to prepare your return as if it was being audited.

Keep researching, or ask us for help…

For assistance creating a strategy to address your tax issue, visit Jackson Hewitt’s Tax Resolution Hub to see the various ways we can help you.

Because trust, guarantees, convenience & money all matter

-

TRUSTED GUARANTEES.

Be 100% certain about your money & your taxes, year after year.

-

NATIONAL PRESENCE. LOCAL HEART.

We’re in your neighborhood & inside your favorite Walmart store.

-

40+ YEARS. 65+ MILLION RETURNS.

The kind of trusted expertise that comes with a lifetime of experience.