- Find an office

-

File Your Taxes

Find a Location

Find a Location -

Resolve Tax Issues

Resolve Tax Issues

Resolve Tax IssuesResolve Tax Issues

-

Tax Resources

See all Tax Help

See all Tax HelpTax Tools

Tax Tips & Resources

- Where's My Refund

- Refund Advance

- Hiring Local Jobs!

- Tax Services

- Promotions & Coupons

- Careers

- Search

- Contact Us

- Feedback

-

Log in | Sign up

Log in | Sign up

JH Accounts

|

|

Oh no! We may not fully support the browser or device software you are using ! To experience our site in the best way possible, please update your browser or device software, or move over to another browser. |

Taxes are easy with Drop-off

This guide will walk you through using our Drop-off service, step-by-step.

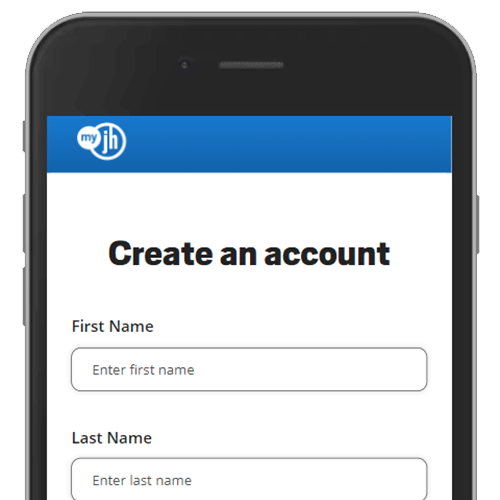

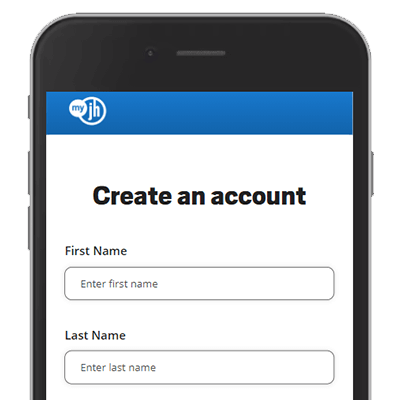

Set up your MyJH account

Get started by signing in or creating a MyJH account. Learn how to set up your account here.

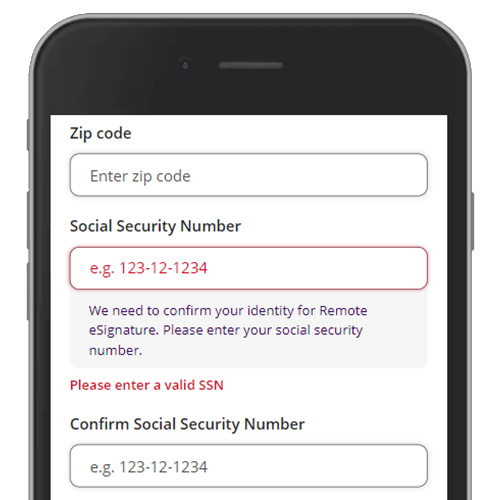

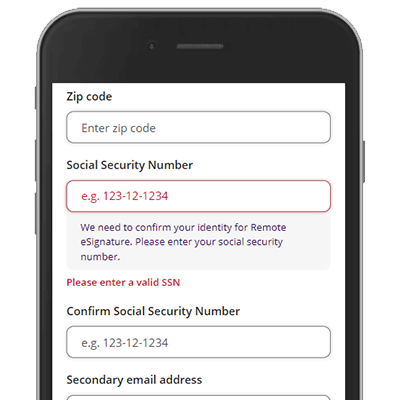

Register for eSignature

Once you complete your profile, you can register for eSignature. Click the Continue button. Fill in your Social Security Number and the rest of the fields. Click save.

Which documents should I drop off?

Your personalized document checklist is just a few clicks away. Select all that applied this tax year.

The tax documents & info you’ll need to file

- Government-issued photo ID (e.g., your driver's license)

- Social Security numbers or other tax ID numbers

- Any IRS or state notices or letters

- 1099-INT, 1099-OID or 1099-DIV

- 1099-B

- K-1 business/farm income and deductions support

Optional documents to bring if you have on hand

- Your prior-year tax return, if available

- Social Security cards, if available

Call

1-800-234-1040

or visit

www.jacksonhewitt.com

for more information.

- Government-issued photo ID (e.g., your driver's license)

- Social Security numbers or other tax ID numbers

- Any IRS or state notices or letters

- 1099-INT, 1099-OID or 1099-DIV

- 1099-B

- K-1 business/farm income and deductions support

Optional documents to bring if you have on hand

- Your prior-year tax return, if available

- Social Security cards, if available

- Your prior-year tax return, if available

- Social Security cards, if available

Call 1-800-234-1040 or visit www.jacksonhewitt.com for more information.

What if I forgot to include a document?

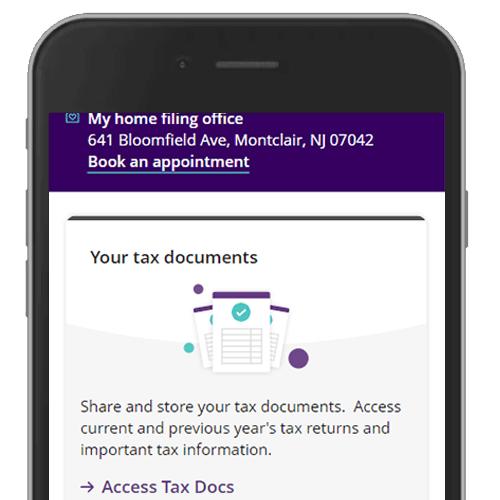

No problem. Just log into your MyJH account to upload any other documents. From the home screen click "Access Tax Docs." Upload a file from your phone or computer. Or snap a picture to upload.

Because trust, guarantees, convenience & money all matter

-

TRUSTED GUARANTEES.

Be 100% certain about your money & your taxes, year after year.

-

NATIONAL PRESENCE. LOCAL HEART.

We’re in your neighborhood & inside your favorite Walmart store.

-

40+ YEARS. 65+ MILLION RETURNS.

The kind of trusted expertise that comes with a lifetime of experience.