- Find an office

-

File Your Taxes

Find a Location

Find a Location -

Resolve Tax Issues

Resolve Tax Issues

Resolve Tax IssuesResolve Tax Issues

-

Tax Resources

See all Tax Help

See all Tax HelpTax Tools

Tax Tips & Resources

- Where's My Refund

- Refund Advance

- Hiring Local Jobs!

- Tax Services

- Promotions & Coupons

- Careers

- Search

- Contact Us

- Feedback

-

Log in | Sign up

Log in | Sign up

JH Accounts

|

|

Oh no! We may not fully support the browser or device software you are using ! To experience our site in the best way possible, please update your browser or device software, or move over to another browser. |

How to set up your MyJH account

Connecting with your local office through MyJH is easy. Learn how to create a MyJH account, set up your account profile, and upload your tax documents.

Step 2

Fill out the form

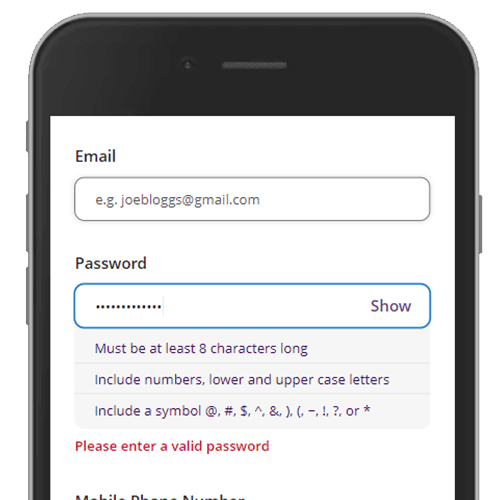

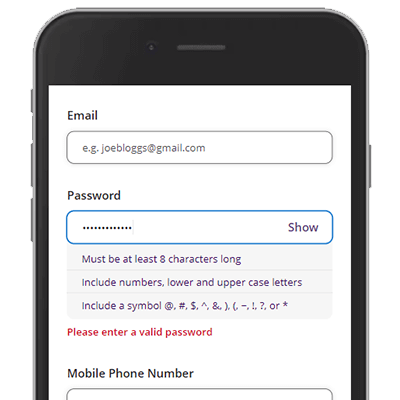

Fill out the form fields on the Create an account page with your information. A few reminders:

- You must have a unique username and email address.

- Your phone number should be specific to you or your household.

- Passwords need to be strong and follow IRS requirements for password strength.

- You should also review our terms and conditions before creating an account.

Step 3

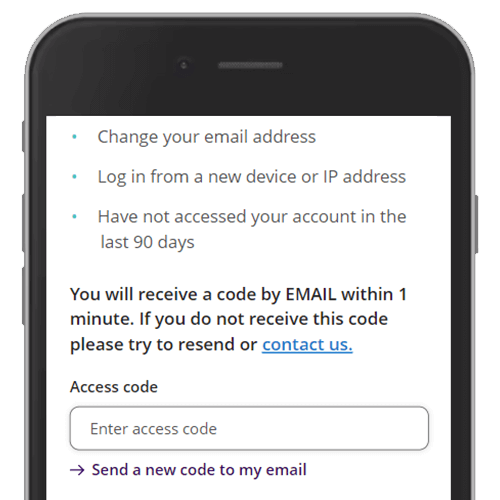

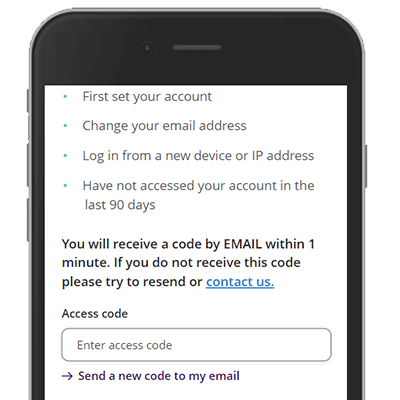

Verify your email address

In order to verify your account, you'll have to confirm your email address. You'll automatically receive a code sent to your email within one minute. Enter your code in the Access code field on the page and click Continue. If you did not receive the code, click Send a new code to my email.

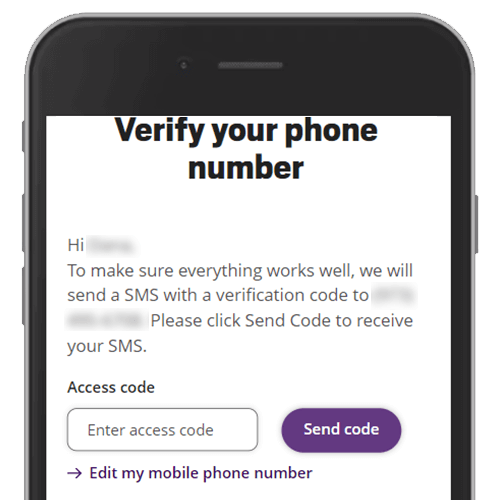

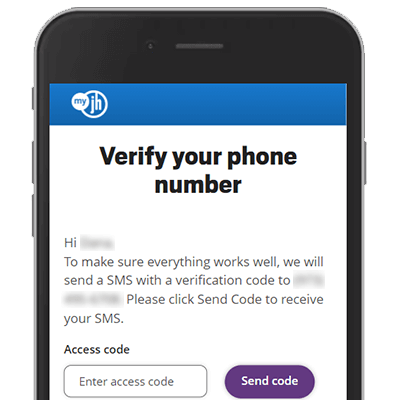

Step 4

Verify your phone number

When you're ready, click the Send code button to trigger your access code to be sent to your mobile phone. Enter your code in the Access code field on the page and click Submit. If you did not receive the code, click Edit my mobile phone number to re-enter your number in case you mistyped it.

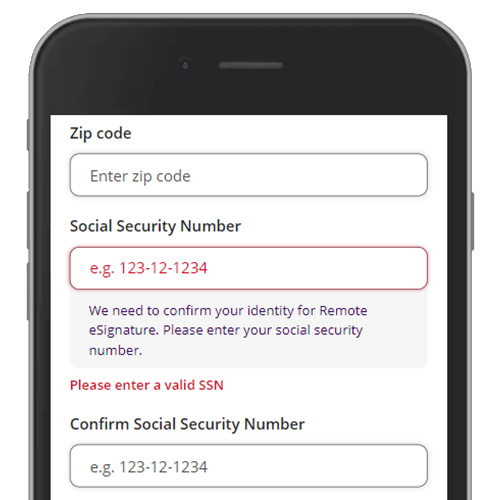

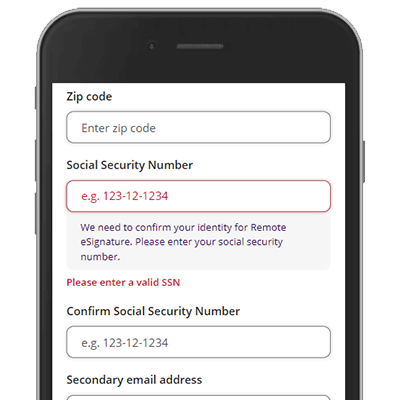

Step 5

Complete your account profile

Great news! Your account has been created. Next, you'll need to complete your account profile to enable features like remote eSign and reduce printing of documents in the office.

Click the Continue button on the prompt to fill in the Social Security Number (SSN) fields. While you're on your Account profile page, fill in the rest of your information so that your account is personalized and click Save.

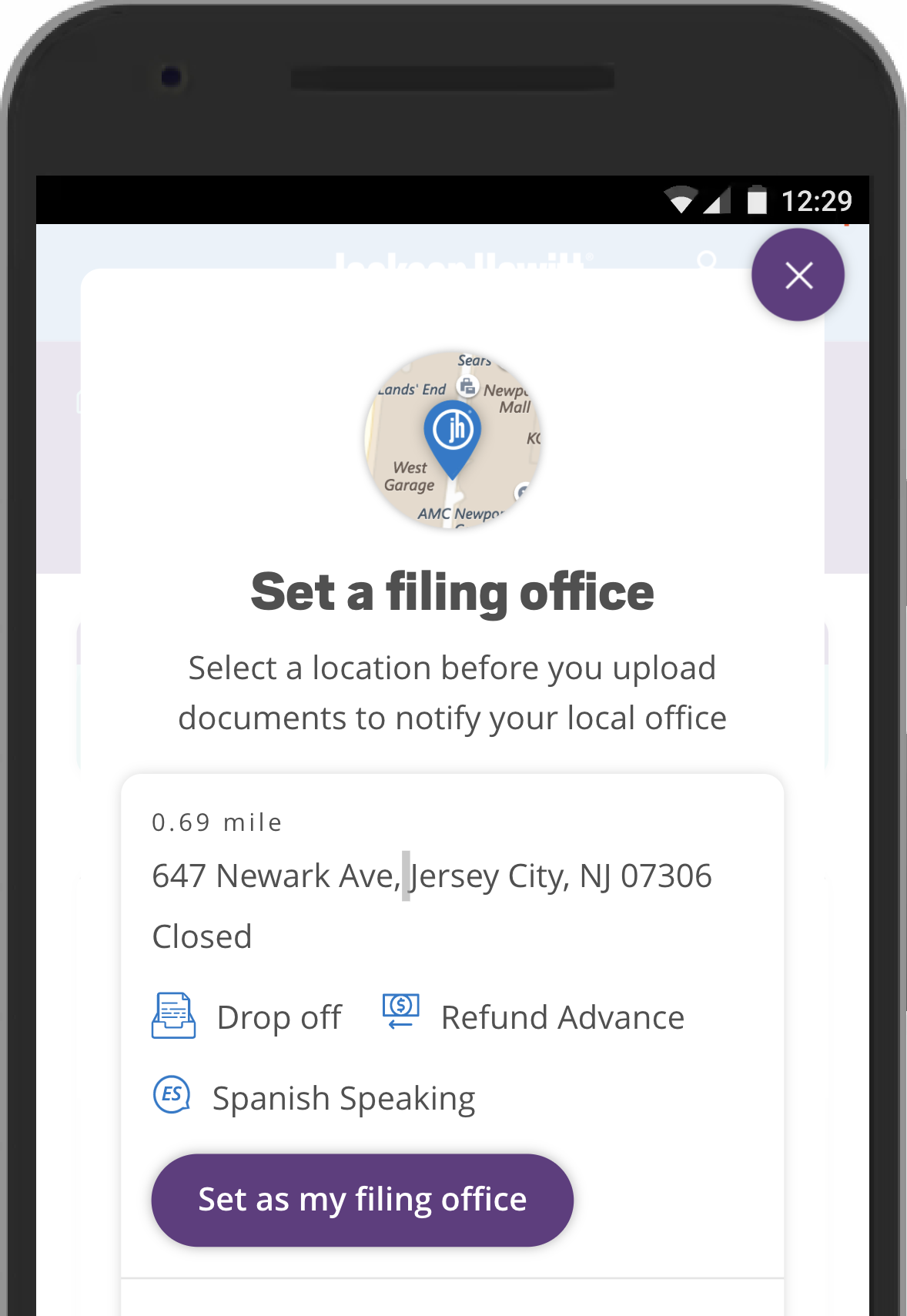

Step 6

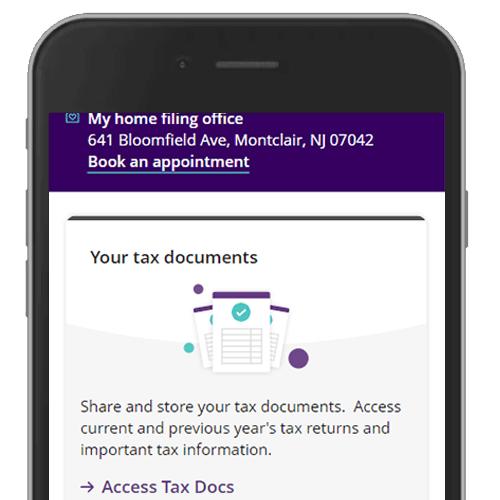

Select a filing office

If you haven't already done so, you'll want to set a home filing office.

- At the top of your account dashboard, click the Select a location link in the purple banner.

- Search for an office near you (or the office you want to share information with), choose an office, and click on the Set as my filing office button.

- To contact the office, click Book an appointment to set up a time or call the office using the phone number listed.

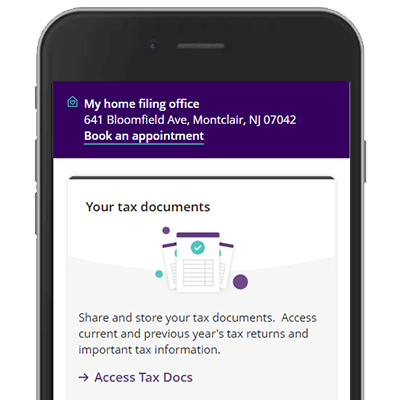

Step 7

You're all set!

To speed up your visit at the office, you can upload your tax docs ahead of time. Click on the first card on your Account Dashboard that says Access Tax Docs. Choose a file from your phone or computer, or snap a picture of your document to upload into your account.

Because trust, guarantees, convenience & money all matter

-

TRUSTED GUARANTEES.

Be 100% certain about your money & your taxes, year after year.

-

NATIONAL PRESENCE. LOCAL HEART.

We’re in your neighborhood & inside your favorite Walmart store.

-

40+ YEARS. 65+ MILLION RETURNS.

The kind of trusted expertise that comes with a lifetime of experience.