- Find an office

-

File Your Taxes

Find a Location

Find a Location -

Resolve Tax Issues

Resolve Tax Issues

Resolve Tax IssuesResolve Tax Issues

-

Tax Resources

See all Tax Help

See all Tax HelpTax Tools

Tax Tips & Resources

- Where's My Refund

- Refund Advance

- Hiring Local Jobs!

- Tax Services

- Promotions & Coupons

- Careers

- Search

- Contact Us

- Feedback

-

Log in | Sign up

Log in | Sign up

JH Accounts

|

|

Oh no! We may not fully support the browser or device software you are using ! To experience our site in the best way possible, please update your browser or device software, or move over to another browser. |

Working Hard for the Hardest Working®

For millions of Americans, Jackson Hewitt is the front door to the tax ecosystem. Every year, more than 13,000 Tax Pros at nearly 5,700 locations nationwide work one-on-one with millions of the hardest-working Americans to help them navigate the complexities of the tax code, to make sure that they get every credit, deduction, and dollar they deserve. Our 40 years of experience helping taxpayers navigate the tax ecosystem gives us keen insight into how to make it better.

WHO WE SERVE

Serving taxpayers and communities for over 40 years

Supporting taxpayers

We serve nearly 2 million taxpayers a year, and we stand behind the returns we file for each and every one. The following statistics represent the average Jackson Hewitt client in 2022:

- 78% earn less than $55,000

- 28% file as single parents

- 43% claim the Earned Income Tax Credit and 42% claim the Child Tax Credit

- 11% have unemployment income

- 86% of clients expected a refund

- We service thousands of clients every year in Spanish.

Supporting small businesses

Our franchisee model supports hard working small-business owners all over the country. The following statistics represent the average Jackson Hewitt franchisee in 2022:

- 486 franchisee partners

- 14 years average tenure

- 7+ average stores per franchisee

- Voted Top 500 Low-Cost Franchise by Entrepreneur magazine for three consecutive years

LEADING THE INDUSTRY

Our principles for improving the tax ecosystem

Establish tax preparer standards

- We have long supported legislation to establish national tax preparer standards. This will usher in a more effective, accountable, and taxpayer friendly system.

- Every Jackson Hewitt Tax Pro must complete hours of mandatory training and pass an annual test, which includes special courses on due diligence, compliance, and ethics, before completing tax returns for our clients. Our Tax Office Essentials training provides 35+ tax education courses, updated annually.

- The absence of minimum standards exposes millions of Americans to unethical tax return preparers, placing these taxpayers at a greater risk of inaccurate returns, as well as identity and return fraud.

Trusted partners with taxpayers and the IRS

- As Americans faced financial strain during the pandemic, programs like the Economic Impact Payments (EIP) and the expanded Child Tax Credit (CTC) became a key lifeline.

- These programs require tremendous collaboration between the IRS and the tax preparation industry to get the money in the hands of families as quickly as possible.

- Our ongoing cooperation and communication with the IRS and its banking partners are especially critical whenever Congress uses the tax code to deliver relief or any change that affects filers.

Modernize the IRS and address the tax gap

- Taxpayers deserve a responsive, professional, and efficient IRS, which is why we have long supported sustainable funding for the IRS.

- With proper funding, the IRS can modernize its technology, improve customer service, and begin the important work of closing the large and persistent tax gap.

- Better IRS data will help lawmakers fully study—and close—this gap.

- Jackson Hewitt supports efforts by Congress and the White House to elevate the tax gap issue and conduct better research into factors contributing to the widening gap, such as bad actors, like “ghost preparers,” who file inaccurate or fraudulent returns without consequence.

State of the union

What Americans Need to Know: 2022 Tax Industry Trends

The tax ecosystem continues to evolve in light of pandemic recovery and economic instability.

- Credits, stimulus payments, and form overhauls drove major refund volatility

- 1099-NEC volumes show ongoing growth in independent gig work

- Mobile trading apps continue to drive popularity of microinvesting, with complex tax reporting needs

WHO WE ARE

Jackson Hewitt at a glance

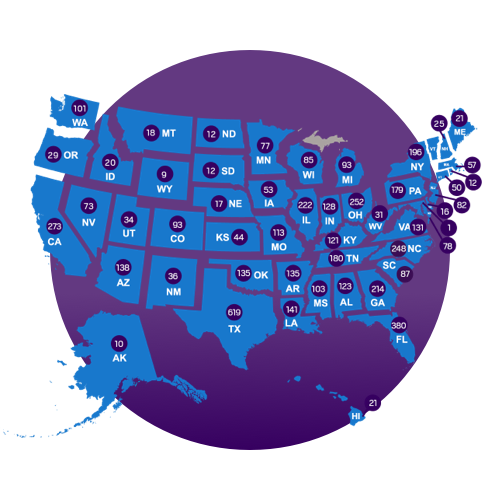

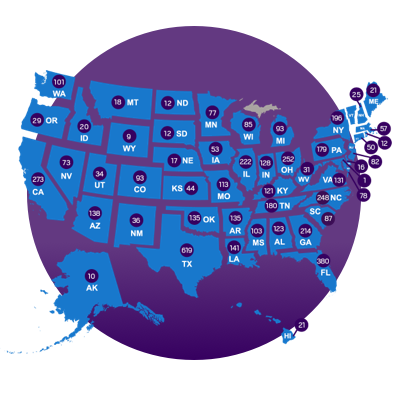

As the second-largest assisted tax prep company in the U.S., we have deep roots in communities across the country. Our Tax Pros take the time to connect with clients one on one.

- Nearly 2 million customers a year

- 5,639 locations with nearly 3,000 in Walmart stores

- An average of 107 locations and 339 employees per state

- 13,482 Tax Pros

- Our Tax Pros are required to pass yearly standards training, and they complete approximately 25 additional hours of tax education and training each year

HEAR IT FROM THE TOP

A word from our CEO

GET TO KNOW US