- Find an office

-

File Your Taxes

Find a Location

Find a Location -

Resolve Tax Issues

Resolve Tax Issues

Resolve Tax IssuesResolve Tax Issues

-

Tax Resources

See all Tax Help

See all Tax HelpTax Tools

Tax Tips & Resources

- Refund Advance

- Hiring Local Jobs!

- Tax Services

- Promotions & Coupons

- Where's My Refund

- Careers

- Search

- Contact Us

- Feedback

-

Log in | Sign up

Log in | Sign up

JH Accounts

|

|

Oh no! We may not fully support the browser or device software you are using ! To experience our site in the best way possible, please update your browser or device software, or move over to another browser. |

YOUR MONEY MATTERS

Upfront, affordable tax preparation from $49 - $149.

Jackson Hewitt offers affordable tax services near you! New clients can file federal taxes starting at $49 for simple returns and $149 OR LESS, for more complex taxes. Cheap tax services for any tax situation from a trusted expert, plus your biggest refund, guaranteed? It’s a win-win. Hurry in!

Who qualifies for our $49 tax filing price

Qualifiers include those filers who did not file 2024 taxes with Jackson Hewitt, who have no more than three W-2s, who have no dependents, and whose income does not require additional tax schedules. Talk to your local Tax Pro to know your cost of tax preparation and more.

How our $49 - $149 tax preparation pricing works

-

Simple filers file federal taxes for $49

Your local Tax Pro will look at your federal taxes to determine if you have simple returns or more complex.

-

Pay $149 OR LESS, for all other federal tax situations

Your Tax Pro can help you understand if your taxes require additional schedules when you file. No extra fees.

-

The free guarantees you need

You automatically get our Biggest Refund, Guaranteed and our Lifetime Accuracy Guarantee® to ensure your taxes are done RIGHT.

Discover which price fits your tax situation

We break down the qualifications for both affordable tax preparation costs, to help you understand which tax situation pertains to you.

| Tax situations | $49 simple filer offer | $149 OR LESS offer |

|---|---|---|

| Federal tax preparation price | $49 | $149 OR LESS |

| Eligible clients | New clients, or didn’t file with us last year | New clients, or didn’t file with us last year |

| Number of W-2s | Up to three W-2s | Unlimited |

| Dependents | No dependents | Unlimited |

| Credits & additional schedules | Saver’s Credit allowed, but no other credits or income that require extra tax schedules | Includes all credits, deductions, and income types that require additional tax schedules |

| State return | Priced separately | Priced separately |

| Ideal for | New clients with simple federal returns | New clients with more complex tax situations who still want an affordable price for expert federal tax prep, and no hidden fees. |

Convenient ways to file taxes & get your max refund

-

Your local Jackson Hewitt

We have over 5,100 national locations with local Tax Pros who are ready to help you.

-

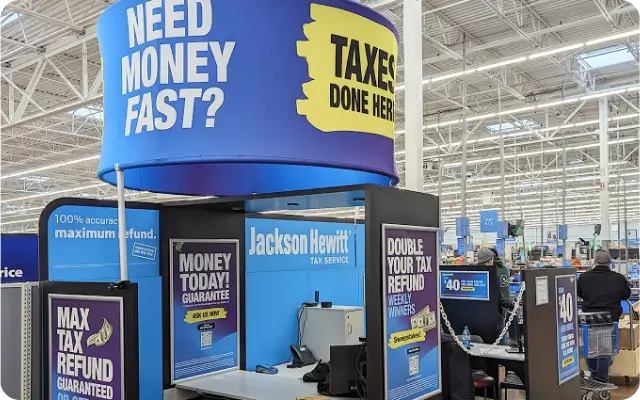

Your local Walmart store

Find a Jackson Hewitt kiosk inside more than 2,600 Walmart stores. Securely file with a Tax Pro during a daily errand!

-

Drop off & go

Too busy to sit with a Tax Pro? Simply leave your tax docs with a trusted expert to file for you.

Because trust, guarantees, convenience & money all matter

-

TRUSTED GUARANTEES.

Be 100% certain about your money & your taxes, year after year.

-

NATIONAL PRESENCE. LOCAL HEART.

We’re in your neighborhood & inside your favorite Walmart store.

-

40+ YEARS. 65+ MILLION RETURNS.

The kind of trusted expertise that comes with a lifetime of experience.

Federal Tax Returns Starting at $49

Limited-time offer. Available 1/5/26 - 4/4/26. Valid for new clients (did not file a 2024 tax return with Jackson Hewitt) at participating locations. For 2025 federal tax returns only. Not available for certain complex federal returns, including those claiming dependents, investment income, or marketplace health insurance. Additional fees apply for state & local tax returns, financial products & other services. Cannot be combined with any other promo or discount. Offer may be modified or discontinued at any time. Not available for Jackson Hewitt Online.

To qualify as a simple filer, the tax return must be a federal return, with a maximum of three W-2s. You must be a new client or a client who didn’t file taxes with us last year, you have no dependents, and no credits or types of income that require additional tax schedules. Taxpayers who qualify for the Saver’s Credit are eligible for this offer.

Limited-time offer. Available 2/23/26 - 4/4/26. Valid for new clients (did not file a 2024 tax return with Jackson Hewitt) at participating locations only for current-year federal tax prep fees & on no other product or service. Does not include state tax returns. Cannot be combined with any other promo or discount. Offer may be modified or discontinued at any time. Not available for Jackson Hewitt Online.

Biggest Refund Guarantee

FEDERAL RETURNS ONLY. If you are entitled to a refund larger than we initially determined, we’ll refund the tax preparation fees paid for that filed return (other product and service fees excluded) and give you an additional $100. You must submit a valid claim and file an amended return with Jackson Hewitt by the annual IRS deadline for the year of your tax return. Same tax facts must apply. Terms, restrictions, and conditions apply. Most offices are independently owned and operated.

Lifetime Accuracy Guarantee

If there is an error preparing your return resulting in an increased tax liability, the local office that prepared your return will reimburse you for penalties and interest (but not additional taxes) owed. You must notify us within 30 days of receiving initial notice from a taxing authority and provide necessary documents and/or assistance. Terms, restrictions, and conditions apply. Most offices are independently owned and operated.