- Find an office

-

File Your Taxes

Find a Location

Find a Location -

Resolve Tax Issues

Resolve Tax Issues

Resolve Tax IssuesResolve Tax Issues

-

Tax Resources

See all Tax Help

See all Tax HelpTax Tools

Tax Tips & Resources

- Where's My Refund

- Refund Advance

- Now Hiring!

- Promotions & Coupons

- Careers

- Search

- Contact Us

- Feedback

-

Log in | Sign up

Log in | Sign up

JH Accounts

|

|

Oh no! We may not fully support the browser or device software you are using ! To experience our site in the best way possible, please update your browser or device software, or move over to another browser. |

Deductions

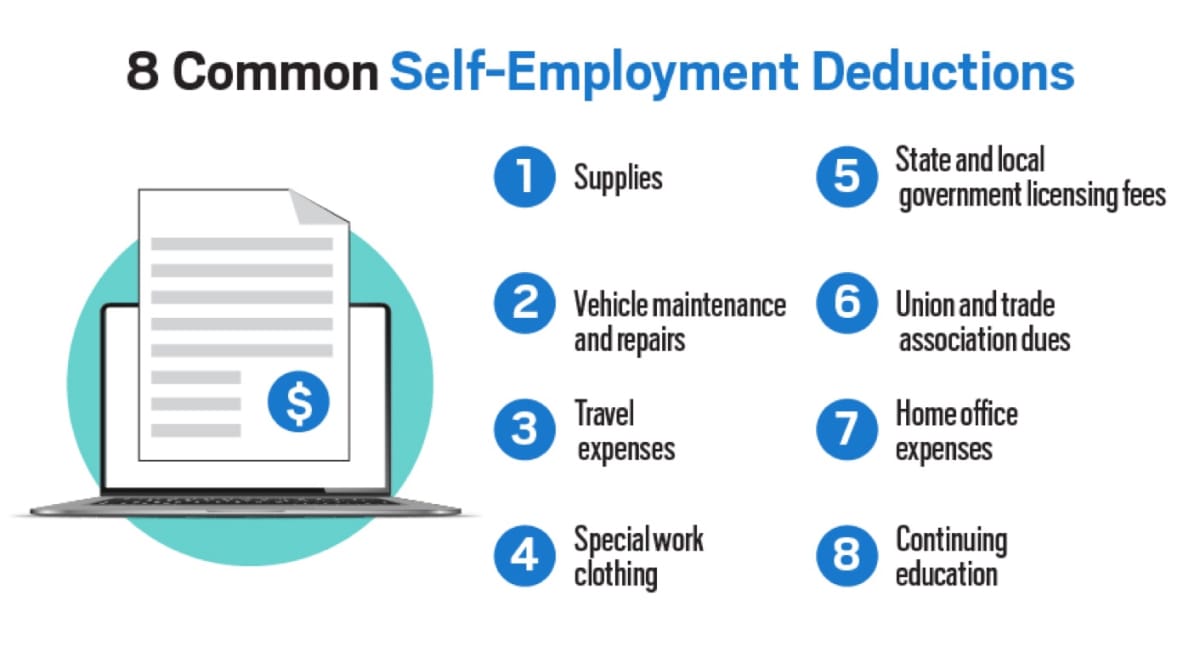

The Most Common Deductions for Self-Employed Workers

With more people than ever becoming entrepreneurs, joining the gig economy, or starting a small business, it could pay to know how self-employment can impact your taxes. Running your own business poses potential risks. There are certain IRS deductions that may help you keep more of your hard-earned money.

First things first

If a business paid you $600 or more for work you completed as a non-employee, you should receive Form 1099-NEC. If you’ve been paid at least $20,000, and had at least 200 transactions, through a third party, you can expect to get Form 1099-K. You must still report any income you received "under the table" or as direct payments and not reported on a 1099-NEC or 1099-K, and you’re still responsible for claiming the income and paying taxes on it.

Filing your taxes as a self-employed worker can be quite different from managing your taxes as a full-time employee at a single company. Whether you’re a gig economy worker, freelancer, contractor, small-business owner, or entrepreneur, you may be able to save money in the form of self-employment tax deductions.

The importance of qualified business income (QBI)

Self-employed workers and small-business owners might be eligible for a deduction of 20% of eligible income before taxes.

The QBI deduction is one of the most common tax write-offs for self-employed workers. For tax year 2023 (filed in 2024), this type of deduction will be available to taxpayers whose taxable income falls below $182,100 for individuals, or $364,200 for joint returns and certain taxpayers with higher business income.

QBI is income from a trade or business in the U.S., such as rideshare driving, consulting, e-commerce, or reselling income. The QBI deduction does not include wages earned as an employee and business-generated capital gains, interest, and dividend income.

What is considered deductible for self-employed workers?

According to the Internal Revenue Service (IRS), deductible business expenses for taxes must be both necessary and ordinary. That means the expense must be:

- Common and accepted in your business or trade

- Appropriate and helpful for your business or trade

Deductible business expenses may include the cost of goods sold, capital expenses, and other expenses. Keep the following potential business expenses for taxes in mind and save your receipts and records throughout the year in order to maximize your self-employment deductions.

1. Supplies

Most businesses have two types of supplies. There are office supplies such as pens, pencils, notepads, calendars, etc. and the work supplies that are specific to a job. A painter would have supplies such as paintbrushes, cleaner, tape, etc.

Keep track of your expenses for each job and for your office supplies. This will help you lower your income taxes and self-employment taxes when it comes time to do your tax return.

2. Vehicle maintenance and repairs

If you use your vehicle for your self-employed work, you may be able to deduct maintenance and repairs for vehicle upkeep and expenses—this may include expenses such as oil, registration fees, insurance, parking fees, tolls, and depreciation (if you own the car or truck), or leasing costs.

These deductible business expenses for taxes may include fees paid to a cab company for using its cars, or rental fees for a truck driver's trailer. Be sure to keep a log of all job-related vehicle expenses, including miles driven for business and your total mileage for the year.

3. Travel expenses

If you travel for work, you may be able to deduct travel expenses. This can include transportation and lodging, along with incidental expenses such as laundry, phones, maid service, and other expenses.

4. Special work clothing

For self-employed workers who require special work clothing, you may be able to deduct your clothing’s cost and maintenance. To qualify as a self-employed tax write-off, the clothing must be required for work and not suitable for everyday use. For example, qualifying clothing may include safety shoes for a building contractor.

5. State and local government licensing fees

Do you need to obtain licensing in order to perform your work? What about insurance? If you’re self-employed, you may be able to deduct state and local government licensing and regulatory fees, as well as liability insurance premiums.

6. Union and trade association dues

If you belong to professional organizations, you may be able to deduct your association fees for those organizations. Subscription fees for trade publications may also qualify as self-employment deductions.

7. Home office expenses

To be able to deduct home office costs, your space must be dedicated to work. For example, if you set up your laptop and work at the kitchen table where your family also eats dinner, that’s not deductible. A room that is designated solely for your work may be eligible for a self-employment tax deduction, though.

Within your home office, you may be able to deduct expenses such as the business percentage of electricity, mortgage interest, equipment, real estate taxes, and home maintenance. You’ll need to know how big the space is and how that compares to your whole home to calculate an accurate deduction.

8. Continuing education

Expenses associated with continuing education may be eligible for tax deductions. If you run a business, continuing education deductions may count for both you and any work-related education that you cover for your employees.

Other potential self-employment tax deductions

In addition to the common self-employment deductions listed above, you may also be able to deduct the following business expenses, if applicable:

- Advertising, branding, marketing, and promotional items

- Bank, credit card, and digital payment processor fees

- Business administrative expenses, such as business software, postage, and mail forwarding service

- Business gifts (limited to no more than $25 per recipient each year)

- Business insurance

- Business meals, up to 50% of meal cost

- Business real estate renting or leasing, including coworking space and office building rentals

- Employee wages and payroll

- Health insurance premiums paid for employees

- Interest paid on lines of credit, credit cards, and business loans

- Labor by subcontractors

- Professional services, such as accounting and legal services

- Supplies used in providing services or running your business

What paperwork do you need for self-employment deductions?

When you file your taxes as someone who’s self-employed, you’ll need the following paperwork in order to obtain the full value from your potential tax deductions. Keep these records throughout the year to reduce your stress come tax time.

- Accounting documents

- Allowances and returns

- Bank and credit card statements

- Checking and savings account interest

- Employee payments

- Gross receipts

- Inventory costs

- Partnership agreements, if applicable

- Payroll paperwork

- Previous year’s business tax return, if applicable

- Professional fees and contractor expenses

- Receipts for advertising and marketing

- Receipts for gifts, transportation, and travel

- Receipts for equipment, office supplies, and phone(s)

- Receipts for home office or office rental and expenses

- Sales records

If you’re not sure which documents do and do not apply to you, ask a tax professional for help. Jackson Hewitt’s Tax Pros can help you determine which deductions make sense for your specific work situation.

If you’re working in America’s rapidly expanding gig economy, knowing the tax deductions you might qualify for can help you prepare for tax season and encourage you to keep track of your job-related spending throughout the year. Stay informed and stay on top of your taxes by finding an office near you. Our Tax Pros are happy to answer any questions you may have on self-employment tax deductions.

Because trust, guarantees, convenience & money all matter

-

TRUSTED GUARANTEES.

Be 100% certain about your money & your taxes, year after year.

-

NATIONAL PRESENCE. LOCAL HEART.

We’re in your neighborhood & inside your favorite Walmart store.

-

40+ years. 60+ million returns.

The kind of trusted expertise that comes with a lifetime of experience.